MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

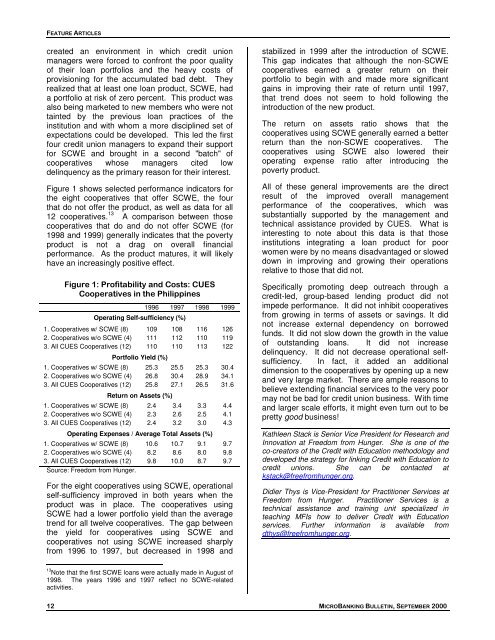

FEATURE ARTICLEScreated an environment in which credit unionmanagers were forced to confront the poor qualityof their loan portfolios and the heavy costs ofprovisioning for the accumulated bad debt. Theyrealized that at least one loan product, SCWE, hada portfolio at risk of zero percent. This product wasalso being marketed to new members who were nottainted by the previous loan practices of theinstitution and with whom a more disciplined set ofexpectations could be developed. This led the firstfour credit union managers to expand their supportfor SCWE and brought in a second "batch" ofcooperatives whose managers cited lowdelinquency as the primary reason for their interest.Figure 1 shows selected performance indicators forthe eight cooperatives that offer SCWE, the fourthat do not offer the product, as well as data for all12 cooperatives. 13 A comparison between thosecooperatives that do and do not offer SCWE (for1998 and 1999) generally indicates that the povertyproduct is not a drag on overall financialperformance. As the product matures, it will likelyhave an increasingly positive effect.Figure 1: Profitability and Costs: CUESCooperatives in the PhilippinesOperating Self-sufficiency (%)1996 1997 1998 19991. Cooperatives w/ SCWE (8) 109 108 116 1262. Cooperatives w/o SCWE (4) 111 112 110 1193. All CUES Cooperatives (12) 110 110 113 122Portfolio Yield (%)1. Cooperatives w/ SCWE (8) 25.3 25.5 25.3 30.42. Cooperatives w/o SCWE (4) 26.8 30.4 28.9 34.13. All CUES Cooperatives (12) 25.8 27.1 26.5 31.6Return on Assets (%)1. Cooperatives w/ SCWE (8) 2.4 3.4 3.3 4.42. Cooperatives w/o SCWE (4) 2.3 2.6 2.5 4.13. All CUES Cooperatives (12) 2.4 3.2 3.0 4.3Operating Expenses / Average Total Assets (%)1. Cooperatives w/ SCWE (8) 10.6 10.7 9.1 9.72. Cooperatives w/o SCWE (4) 8.2 8.6 8.0 9.83. All CUES Cooperatives (12) 9.8 10.0 8.7 9.7Source: Freedom from Hunger.For the eight cooperatives using SCWE, operationalself-sufficiency improved in both years when theproduct was in place. The cooperatives usingSCWE had a lower portfolio yield than the averagetrend for all twelve cooperatives. The gap betweenthe yield for cooperatives using SCWE andcooperatives not using SCWE increased sharplyfrom 1996 to 1997, but decreased in 1998 andstabilized in 1999 after the introduction of SCWE.This gap indicates that although the non-SCWEcooperatives earned a greater return on theirportfolio to begin with and made more significantgains in improving their rate of return until 1997,that trend does not seem to hold following theintroduction of the new product.The return on assets ratio shows that thecooperatives using SCWE generally earned a betterreturn than the non-SCWE cooperatives. Thecooperatives using SCWE also lowered theiroperating expense ratio after introducing thepoverty product.All of these general improvements are the directresult of the improved overall managementperformance of the cooperatives, which wassubstantially supported by the management andtechnical assistance provided by CUES. What isinteresting to note about this data is that thoseinstitutions integrating a loan product for poorwomen were by no means disadvantaged or sloweddown in improving and growing their operationsrelative to those that did not.Specifically promoting deep outreach through acredit-led, group-based lending product did notimpede performance. It did not inhibit cooperativesfrom growing in terms of assets or savings. It didnot increase external dependency on borrowedfunds. It did not slow down the growth in the valueof outstanding loans. It did not increasedelinquency. It did not decrease operational selfsufficiency.In fact, it added an additionaldimension to the cooperatives by opening up a newand very large market. There are ample reasons tobelieve extending financial services to the very poormay not be bad for credit union business. With timeand larger scale efforts, it might even turn out to bepretty good business!Kathleen Stack is Senior Vice President for Research andInnovation at Freedom from Hunger. She is one of theco-creators of the Credit with Education methodology anddeveloped the strategy for linking Credit with Education tocredit unions. She can be contacted atkstack@freefromhunger.org.Didier Thys is Vice-President for Practitioner Services atFreedom from Hunger. Practitioner Services is atechnical assistance and training unit specialized inteaching MFIs how to deliver Credit with Educationservices. Further information is available fromdthys@freefromhunger.org.13 Note that the first SCWE loans were actually made in August of1998. The years 1996 and 1997 reflect no SCWE-relatedactivities.12 <strong>MICROBANKING</strong> <strong>BULLETIN</strong>, SEPTEMBER 2000