MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

MICROBANKING BULLETIN - Microfinance Information Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

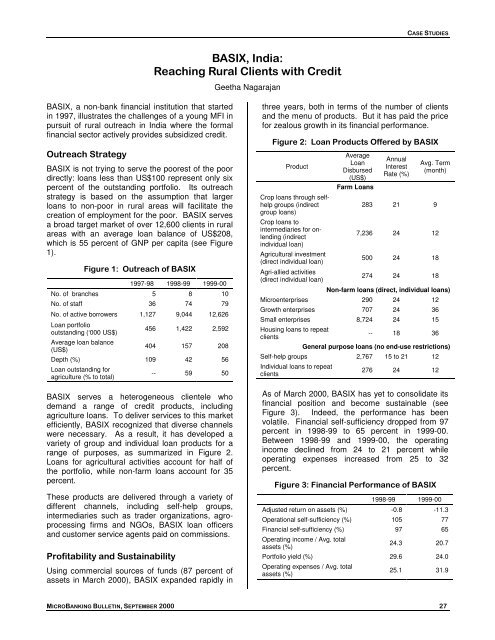

CASE STUDIESBASIX, India:Reaching Rural Clients with CreditGeetha NagarajanBASIX, a non-bank financial institution that startedin 1997, illustrates the challenges of a young MFI inpursuit of rural outreach in India where the formalfinancial sector actively provides subsidized credit.Outreach StrategyBASIX is not trying to serve the poorest of the poordirectly: loans less than US$100 represent only sixpercent of the outstanding portfolio. Its outreachstrategy is based on the assumption that largerloans to non-poor in rural areas will facilitate thecreation of employment for the poor. BASIX servesa broad target market of over 12,600 clients in ruralareas with an average loan balance of US$208,which is 55 percent of GNP per capita (see Figure1).Figure 1: Outreach of BASIX1997-98 1998-99 1999-00No. of branches 5 8 10No. of staff 36 74 79No. of active borrowers 1,127 9,044 12,626Loan portfoliooutstanding (‘000 US$)Average loan balance(US$)456 1,422 2,592404 157 208Depth (%) 109 42 56Loan outstanding foragriculture (% to total)-- 59 50BASIX serves a heterogeneous clientele whodemand a range of credit products, includingagriculture loans. To deliver services to this marketefficiently, BASIX recognized that diverse channelswere necessary. As a result, it has developed avariety of group and individual loan products for arange of purposes, as summarized in Figure 2.Loans for agricultural activities account for half ofthe portfolio, while non-farm loans account for 35percent.These products are delivered through a variety ofdifferent channels, including self-help groups,intermediaries such as trader organizations, agroprocessingfirms and NGOs, BASIX loan officersand customer service agents paid on commissions.Profitability and SustainabilityUsing commercial sources of funds (87 percent ofassets in March 2000), BASIX expanded rapidly inthree years, both in terms of the number of clientsand the menu of products. But it has paid the pricefor zealous growth in its financial performance.Figure 2: Loan Products Offered by BASIXProductCrop loans through selfhelpgroups (indirectgroup loans)Crop loans tointermediaries for onlending(indirectindividual loan)Agricultural investment(direct individual loan)Agri-allied activities(direct individual loan)AverageLoanDisbursed(US$)Farm LoansAnnualInterestRate (%)Avg. Term(month)283 21 97,236 24 12500 24 18274 24 18Non-farm loans (direct, individual loans)Microenterprises 290 24 12Growth enterprises 707 24 36Small enterprises 8,724 24 15Housing loans to repeatclients-- 18 36General purpose loans (no end-use restrictions)Self-help groups 2,767 15 to 21 12Individual loans to repeatclients276 24 12As of March 2000, BASIX has yet to consolidate itsfinancial position and become sustainable (seeFigure 3). Indeed, the performance has beenvolatile. Financial self-sufficiency dropped from 97percent in 1998-99 to 65 percent in 1999-00.Between 1998-99 and 1999-00, the operatingincome declined from 24 to 21 percent whileoperating expenses increased from 25 to 32percent.Figure 3: Financial Performance of BASIX1998-99 1999-00Adjusted return on assets (%) -0.8 -11.3Operational self-sufficiency (%) 105 77Financial self-sufficiency (%) 97 65Operating income / Avg. totalassets (%)24.3 20.7Portfolio yield (%) 29.6 24.0Operating expenses / Avg. totalassets (%)25.1 31.9<strong>MICROBANKING</strong> <strong>BULLETIN</strong>, SEPTEMBER 2000 27