February 2011 - Gruppo Banca Carige

February 2011 - Gruppo Banca Carige

February 2011 - Gruppo Banca Carige

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

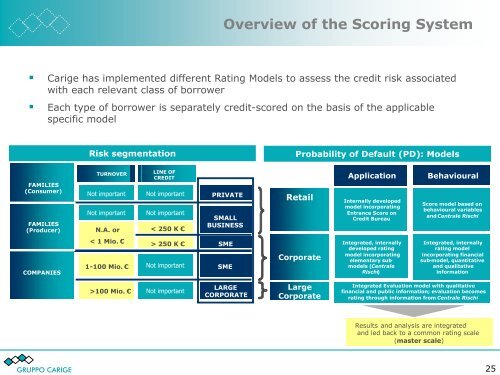

Overview of the Scoring System• <strong>Carige</strong> has implemented different Rating Models to assess the credit risk associatedwith each relevant class of borrower• Each type of borrower is separately credit-scored on the basis of the applicablespecific modelRisk segmentationProbability of Default (PD): ModelsFAMILIES(Consumer)FAMILIES(Producer)TURNOVERNot importantNot importantN.A. orLINE OFCREDITNot importantNot important< 250 K €PRIVATESMALLBUSINESSRetailApplicationInternally developedmodel incorporatingEntrance Score onCredit BureauBehaviouralScore model based onbehavioural variablesand Centrale RischiCOMPANIES< 1 Mio. €1-100 Mio. €> 250 K €Not importantSMESMECorporateIntegrated, internallydeveloped ratingmodel incorporatingelementary submodels(CentraleRischi)Integrated, internallyrating modelincorporating financialsub-model, quantitativeand qualitativeinformation>100 Mio. €Not importantLARGECORPORATELargeCorporateIntegrated Evaluation model with qualitativefinancial and public information; evaluation becomesrating through information from Centrale RischiResults and analysis are integratedand led back to a common rating scale(master scale)GRUPPO CARIGE 25