February 2011 - Gruppo Banca Carige

February 2011 - Gruppo Banca Carige

February 2011 - Gruppo Banca Carige

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

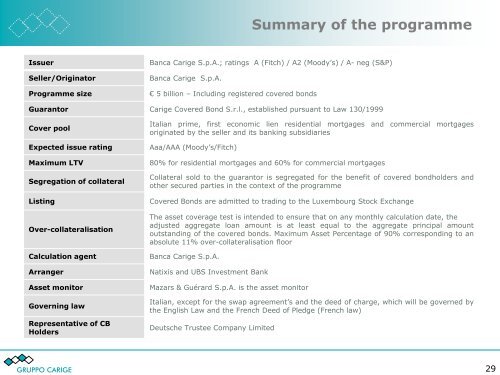

Summary of the programmeIssuerSeller/OriginatorProgramme size<strong>Banca</strong> <strong>Carige</strong> S.p.A.; ratings A (Fitch) / A2 (Moody’s) / A- neg (S&P)<strong>Banca</strong> <strong>Carige</strong> S.p.A.€ 5 billion – Including registered covered bondsGuarantor <strong>Carige</strong> Covered Bond S.r.l., established pursuant to Law 130/1999Cover poolExpected issue ratingMaximum LTVSegregation of collateralListingOver-collateralisationCalculation agentArrangerAsset monitorGoverning lawRepresentative of CBHoldersItalian prime, first economic lien residential mortgages and commercial mortgagesoriginated by the seller and its banking subsidiariesAaa/AAA (Moody’s/Fitch)80% for residential mortgages and 60% for commercial mortgagesCollateral sold to the guarantor is segregated for the benefit of covered bondholders andother secured parties in the context of the programmeCovered Bonds are admitted to trading to the Luxembourg Stock ExchangeThe asset coverage test is intended to ensure that on any monthly calculation date, theadjusted aggregate loan amount is at least equal to the aggregate principal amountoutstanding of the covered bonds. Maximum Asset Percentage of 90% corresponding to anabsolute 11% over-collateralisation floor<strong>Banca</strong> <strong>Carige</strong> S.p.A.Natixis and UBS Investment BankMazars & Guérard S.p.A. is the asset monitorItalian, except for the swap agreement’s and the deed of charge, which will be governed bythe English Law and the French Deed of Pledge (French law)Deutsche Trustee Company LimitedGRUPPO CARIGE 29