February 2011 - Gruppo Banca Carige

February 2011 - Gruppo Banca Carige

February 2011 - Gruppo Banca Carige

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

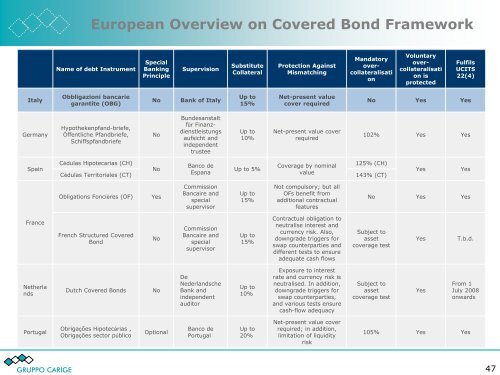

European Overview on Covered Bond FrameworkName of debt InstrumentSpecialBankingPrincipleSupervisionSubstituteCollateralProtection AgainstMismatchingMandatoryovercollateralisationVoluntaryovercollateralisation isprotectedFulfilsUCITS22(4)ItalyObbligazioni bancariegarantite (OBG)NoBank of ItalyUp to15%Net-present valuecover requiredNo Yes YesGermanyHypothekenpfand-briefe,Öffentliche Pfandbriefe,SchiffspfandbriefeNoBundesanstaltfür Finanzdienstleistungsaufsicht andindependenttrusteeUp to10%Net-present value coverrequired102% Yes YesSpainCédulas Hipotecarias (CH)Cédulas Territoriales (CT)NoBanco deEspanaUp to 5%Coverage by nominalvalue125% (CH)143% (CT)YesYesObligations Foncières (OF)YesCommission<strong>Banca</strong>ire andspecialsupervisorUp to15%Not compulsory; but allOFs benefit fromadditional contractualfeaturesNo Yes YesFranceFrench Structured CoveredBondNoCommission<strong>Banca</strong>ire andspecialsupervisorUp to15%Contractual obligation toneutralise interest andcurrency risk. Also,downgrade triggers forswap counterparties anddifferent tests to ensureadequate cash flowsSubject toassetcoverage testYesT.b.d.NetherlandsDutch Covered BondsNoDeNederlandscheBank andindependentauditorUp to10%Exposure to interestrate and currency risk isneutralised. In addition,downgrade triggers forswap counterparties,and various tests ensurecash-flow adequacySubject toassetcoverage testYesFrom 1July 2008onwardsPortugalObrigações Hipotecárias ,Obrigações sector públicoOptionalBanco dePortugalUp to20%Net-present value coverrequired; in addition,limitation of liquidityrisk105% Yes YesGRUPPO CARIGE 47