Download Now - Hyndburn Borough Council

Download Now - Hyndburn Borough Council

Download Now - Hyndburn Borough Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

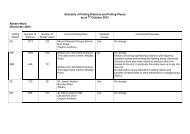

Winter 2012/13Private Rented SectorPrivate rented tenure stands at approximately 21% across <strong>Hyndburn</strong>,significantly higher than the national average of around 12-15%. Thispercentage has been on the rise over the last few years, especially soin <strong>Hyndburn</strong> where a reduction in house sales due to the economicdownturn and a low proportion of social housing has put extra pressureon the private rented sector to provide accommodation for those nolonger able to access owner occupation and for the more vulnerablehouseholds, especially those dependent on benefits.The rental market is highly segmented by price. This means there areoften different trends in different segments of the market. Across thecountry 25% of private tenants are on housing benefit, this isconsiderably higher in <strong>Hyndburn</strong> with around 44% with upto 50 – 60%in some areas. (Typically the bottom quartile is those in receipt of LocalHousing Allowance / housing benefit). Rental growth at this end of themarket will be influenced by the rent caps the government is putting inplace as part of its welfare reforms.Regulatory risk aside, Hometrack believe that affordability factors willcontinue to limit rental growth, despite the strong demand sidepressure. Hometrack expects rents to rise by 2-3% in 2012. Rentalyields have improved modestly since the top of the market and todayaverage 5.3% across the country, whilst slightly higher acrossSOCIAL, ECONOMIC & HOUSING INTELLIGENCE REPORTTable 6. Private Rented Households and those in receipt ofHousing BenefitWard(1)Number ofPrivateRented(2)PrivateRented(%)(3)NumberofHousingBenefit(4)HousingBenefit %proportionof PR(5)Percentageof HB of allstock(6)HouseholdsAltham 397 18.7% 167 42.1% 7.9% 2127Barnfield 511 25.7% 241 47.2% 12.1% 1991Baxenden 159 9.6% 37 23.3% 2.2% 1662Central 456 24.0% 221 48.5% 11.6% 1898Church 486 22.2% 249 51.2% 11.4% 2189CLM 448 22.5% 175 39.1% 8.8% 1990Huncoat 228 11.7% 83 36.4% 4.3% 1944Immanuel 317 16.0% 104 32.8% 5.2% 1985Milnshaw 312 16.6% 120 38.5% 6.4% 1881Netherton 636 31.8% 277 43.6% 13.9% 1999Overton 424 15.5% 135 31.8% 4.9% 2738Peel 800 37.5% 421 52.6% 19.7% 2133Rishton 723 24.2% 338 46.7% 11.3% 2988St.Andrews 457 22.7% 180 39.4% 8.9% 2017St Oswalds 276 10.6% 65 23.6% 2.5% 2602Spring Hill 577 28.1% 330 57.2% 16.0% 2057HYNDBURN 7207 21.1% 3146 43.6% 8.6% 34,201Source: <strong>Council</strong> Tax 2011(Key) The number of private rented stock by Ward, 2) Percentage of private rented stock perWard, 3) The number of households in receipt of Housing Benefits living in private rentedaccommodation, 4) The percentage of private rented households who are claiming HousingBenefits, 5) The percentage of all households claiming Housing Benefits whilst living in privaterented accommodation, 6) Total number of households by Ward)<strong>Hyndburn</strong> at levels in-between 6 to 7% with over 7% indicating morehigh risk low demand areas. Though better than low saving rates,investment in residential property is still motivated by expectation ofcapital growth. However, in <strong>Hyndburn</strong> with a high proportion on Local18