Download Now - Hyndburn Borough Council

Download Now - Hyndburn Borough Council

Download Now - Hyndburn Borough Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

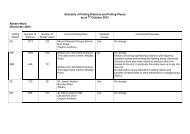

PercentageWinter 2012/13SOCIAL, ECONOMIC & HOUSING INTELLIGENCE REPORTThere is a particular need to balance local housing markets byincreasing the variety of stock, in terms of house type, within the<strong>Borough</strong>‟s townships in accordance with the Strategic Housing MarketAssessment and Housing Needs Study. The housing offer has a largeproportion of small 2/3 bedroom terraced dwellings which account forover half the overall housing stock. Most of the properties also fallwithin <strong>Council</strong> Tax categories „A‟ and „B‟ with fewer housing within high„E‟ banding than the north-west and national average.On developments of 15 or more houses the developer will be requiredto make provision for 20% of the houses to be affordable. In meetingthis target consideration will be given to the availability of financialgrants and evidence on the economic viability of individualdevelopments.Repossession Hot SpotIn the last edition back-in 2011, we highlighted the research carried outby Shelter that identified areas where the highest proportion ofhomeowners who have been issued with a possession order for theirhome, and are therefore at serious risk of repossession. Experts werepredicting repossessions to rise with a threat of rises in interest rates, achallenging economy causing affordability difficulties.The research carried out by Shelter placed <strong>Hyndburn</strong> in a higher ratecategory with the area sitting 61 st out of 324 local authorities with 125possession orders over the previous twelve months. A year on theeconomy is still struggling, whilst interest rates have remained at thesame base rate.Figure 13. Mortgage possession claims leading to ordersMortgage possession claims leading to orders made per 1,000 households9876543210200220032004200520062007200820092010BurnleyBw DEngland & Wales<strong>Hyndburn</strong>LancashireNorth WestSource: PO rates Ministry of Justice statistics August 2012The previous year showed <strong>Hyndburn</strong> had 4 (3.94) per 1,000households with mortgage claims leading to possession orders. Thisfigure has now risen to 5 (4.85) per 1,000 households rising aboveBlackburn and Pendle levels to the same rate achieved in Burnley.Whilst these figures are significantly above the national average theyare considerably lower than the rates from 2008 a few years back.Pendle201126