QuickBooks® - Intuit

QuickBooks® - Intuit

QuickBooks® - Intuit

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

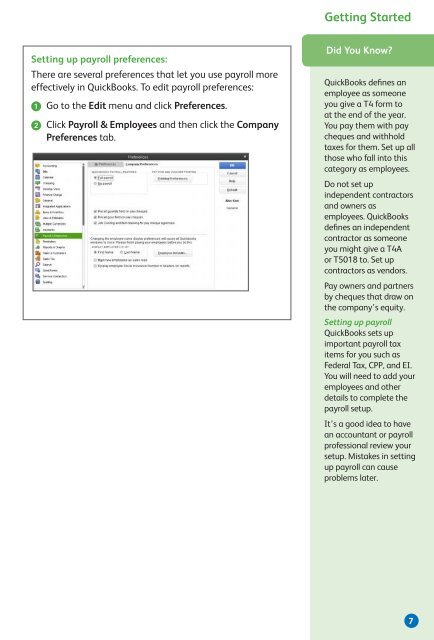

Getting StartedSetting up payroll preferences:There are several preferences that let you use payroll moreeffectively in QuickBooks. To edit payroll preferences:➊ Go to the Edit menu and click Preferences.➋ Click Payroll & Employees and then click the CompanyPreferences tab.Did You Know?QuickBooks defines anemployee as someoneyou give a T4 form toat the end of the year.You pay them with paycheques and withholdtaxes for them. Set up allthose who fall into thiscategory as employees.Do not set upindependent contractorsand owners asemployees. QuickBooksdefines an independentcontractor as someoneyou might give a T4Aor T5018 to. Set upcontractors as vendors.Pay owners and partnersby cheques that draw onthe company’s equity.Setting up payrollQuickBooks sets upimportant payroll taxitems for you such asFederal Tax, CPP, and EI.You will need to add youremployees and otherdetails to complete thepayroll setup.It’s a good idea to havean accountant or payrollprofessional review yoursetup. Mistakes in settingup payroll can causeproblems later.7