Trust Board papers - University Hospital Southampton NHS ...

Trust Board papers - University Hospital Southampton NHS ...

Trust Board papers - University Hospital Southampton NHS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

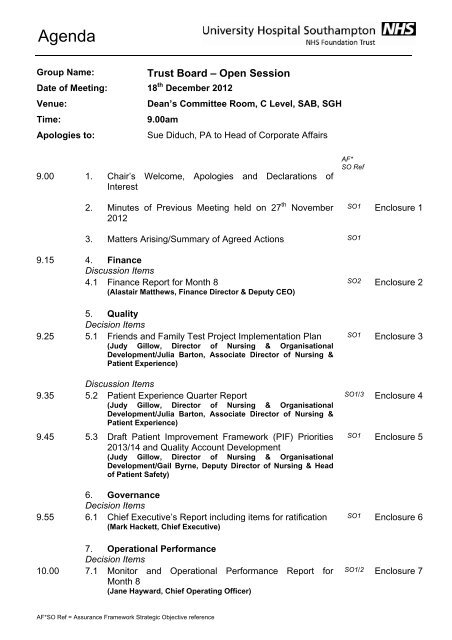

UHSFT – Directors’ Actions Summary for 18 th December 2012 <strong>Trust</strong> <strong>Board</strong> – Open sessionCONFIDENTIAL___________________________________________________________________________________________________________________________________________Action & Minute Reference By whom TargetDate<strong>Trust</strong> <strong>Board</strong> 28 th August 2012IM&T Strategy Refresh including Quarter Report (agenda item 6.1) MinuteRef 125/12 c)• An analysis of what can be done for both double and half theinfrastructure investment.• Links and collaboration with the <strong>University</strong> of <strong>Southampton</strong> beinvestigated and reinvigorated.• A discussion on the balance of capital priorities and the impact achievedto take place at a Study Session.<strong>Trust</strong> <strong>Board</strong> 29 th October 2012Patient Safety Quarter Report (agenda 5.1) Minute Ref 152/12 c)• The 24/7 indicators to be brought to A&AC for a deep dive review.• <strong>Board</strong> to be reminded of the infection control actions through the <strong>Board</strong>Information Pack.• An understanding of bed moves to be provided.AB/MHIC/AB/MHSA/AB/MHJG/MMJGJH18/12/1218/12/1218/12/12Current StatusIn hand for Q3 - Agenda TB 26/3/13Complete and will report in December.Agenda TBSS 15/1/1321/1/13 Agenda A&AC 21/1/13Complete – TB 27/11/12To be provided at TB 18/12/12 in Exec UpdatesAssurance Framework & Corporate Risk Register 2012/13 Quarter 2Report (agenda item 6.3) Minute Ref 156/12 c)A forecast on the risk position in the coming quarter to be included in thesummary.JG 21/1/13 Agenda A&AC 21/1/13<strong>Trust</strong> Key Performance Indicators for Month 6 (agenda item 7.2) Minute Ref159/12 c)A&AC to consider the issues around R&D. MM/SA 21/1/13 Agenda A&AC 21/1/131

Finance169/12 Finance Report for Month 7 (agenda item 4.1. Enclosure 2)a) AM presented the report which updates <strong>Board</strong> on the financial, activity and savingsperformance of the <strong>Trust</strong> for October 2012. AM noted that October was a highactivity month and an estimate had been made of expected income in the report;the actual income had been reported yesterday and the actual income is slightlyfavourable to the estimate such that the <strong>Trust</strong> is more on plan than reflected in thereport.Still working hard on CIPs. <strong>Trust</strong> liquidity quite tight. Raised concern about thelevel of activity in the hospital and amount of non-elective activity which is impactingupon elective activity with an impact upon income.169/12 b) A discussion followed covering: NM confirmed that Strategy and Finance Committee had scrutinised the reporton 26 November. Committee happy with the report but concerned about thelevel of activity which could impact upon the finances as the position is reallytight MH confirmed that the <strong>Trust</strong> is working hard to identify further savings to seek toremain on financial target.169/12 c) After discussion <strong>Trust</strong> <strong>Board</strong>: Noted that in October the <strong>Trust</strong> has delivered a pre-impairment surplus of£504k, £223k worse than Plan and the cumulative position is a surplus of£2,352k which is £203k worse than Plan Noted that Cost Improvement Programmes (CIPs) delivered were cumulatively£0.9m below Plan, which is phased based on a historic delivery profile. Thiswas a £0.1m deterioration in October. The target is fully identified at 31stOctober although a significant element remains classified as amber Noted that divisions and headquarters overspent against expenditure budgetsby £1.8m, this was exacerbated by a £0.4m overspending on reserves andcorporate budgets. This was largely offset by income being £1.8m above plan inthe month Noted the October position is based on a number of specific assumptions onIncome.170/12a)Reference Cost Index 2011-12 Full Publication (agenda item 4.2. Enclosure 3)AM stated that the report, which informs <strong>Board</strong> members of the <strong>Trust</strong>’s referencecost index for 2011-12, is for information. The data has just been released by theDH. UHS is lowest in the peer group of hospitals. The report includes a brief noteof future developments in costing the tariff.170/12 b) A discussion followed covering:Query on whether calculating costs/tariffs based on foundation trusts or tertiaryhospitals would impact upon the tariffs. Possible that there could be a shiftamong tariffs and a tariff more akin to costs in non-elective and tertiary work Will be sharing the result with the commissioners NM noted that Strategy and Finance Committee had discussed this andcongratulated execs on achieving lower costs than average and encouragedthat this is shared within the organisationMMu noted the information will be used in business case preparationClarification of how RCIs are included in strategic objectivesNeed to link to quality etc as having a low Reference Cost Index (RCI) is not anend in itself but part of the cost, quality and activity triangle.170/12 c) After discussion <strong>Trust</strong> <strong>Board</strong>: Noted the reportNoted that this secures a strategic objective set by <strong>Trust</strong> <strong>Board</strong> in 2012/13 tokeep RCI at or below the average of our peer group.2

172/12 b) A discussion followed covering: Query on key message. MD stated team is exceeding expectations on servicedelivery and that it should be a key concern for <strong>Board</strong> to ensure appropriatestaffing levels. Working hard to maintain appropriate staffing levels givenincreasing number of births. Discussing with the university to have two cohortsof midwives a year Number of midwives being trained will be driven by the LETB Consultant cover in labour ward. MD assured <strong>Board</strong> that cover is accessibleand believed to be sufficient New investment in obstetric theatre <strong>NHS</strong>LA level 3 work is ongoing. Financial reward of achieving this will be£0.5m and assessment will be in September 2013 Query about The Times article to reduce still births. MD stated the <strong>Trust</strong>’sstrategy is concentrated on ante-natal care and adherence to NICE guidance.MM noted that still births can be influenced by lifestyles Future requirement of obstetric and maternity services in the local healtheconomy and opportunity to influence service re-configuration.172/12 c) After discussion <strong>Trust</strong> <strong>Board</strong>: Congratulated the team on the achievements particularly around the Ghanaproject Agreed it would like to receive the dashboard as part of the performance report Noted and recognised that the service remains under pressure from increasedactivity and complexity, and that there is regular review and planning regardingstaffing and safety to ensure an effective and safe service Noted that the Maternity Service is working towards <strong>NHS</strong>LA accreditation atLevel 3, and that this will be assessed in 2013 Noted the current achievements, challenges and future developments of theMaternity Services.MD/JGMMu/MHGovernance173/12 Chief Executive’s Report (agenda item 6.1. Enclosure 6)a) MH stated that the report, which updates <strong>Board</strong> in accordance with StandingFinancial Instructions, is to note. There was a query on the purchase of a houseand MH replied that the <strong>Trust</strong>’s strategy is to purchase property bordering the siteto provide opportunity for site footprint expansion. Noted no consultantappointments to be ratified.173/12 b) Items for RatificationActions taken by the Chair as set in paragraphs 3.1.1 – 3.1.2 were ratified.174/12a)Infection Prevention & Control 2012/13 Quarter 2 Review and Matron Reportto include Health System Noro-Virus Action Plan (agenda item 6.2. Enclosure 7)JG introduced the paper which reports the 2012-13 Q2 infection preventionperformance within UHS, and quarter 2 Matron reports. Noted that Norovirusseason is starting. The <strong>Trust</strong> has been working hard with partners to have a robustplan to deal with the infection.4

174/12 b) A discussion followed covering: Matrons reports not included in the report. JG noted that these were discussedin TEC and could in future be circulated in the supporting paper informationpack Delivery of C.Diff against plan and the significant financial penalty of notachieving the target Work to address norovirus which includes decision not to convey by ambulanceservice, working with the port health authority and nursing home patients beingcared for there Anti-biotic prescribing. MM updated <strong>Board</strong> on prescribing patterns and actionstaken to address and the work in place to ensure appropriate prescribing. ICnoted that the <strong>University</strong> of <strong>Southampton</strong>’s Primary Care Group has had astrong track record in antibiotic prescribing, and JH noted the issue may beaddressed through e-prescribing MM noted benefit of e-prescribing which can flag anti-biotic use and initiate areview.174/12 c) After discussion <strong>Trust</strong> <strong>Board</strong>: Requested the Matron reports be circulated in the information pack Requested information on e-prescribing be circulated in the information pack Noted the key infection prevention priorities and quarter 2 performance Acknowledged the norovirus preparations for Winter 2012/13 Noted the care group accountability to <strong>Trust</strong> Delivery Group for compliance withUHS policy to ensure appropriate management of patients with MRSA and Cdifficile colonisation Noted the outlier high prevalence of antibiotic use in UHS relative to nationalaverage and actions being taken in relation to this.JGMM175/12a)Annual Emergency Planning & Business Continuity Report (agenda item 6.3.Enclosure 8)JH introduced the paper which provides an annual update to the <strong>Board</strong> on itscurrent state of Emergency Preparedness, and flags the impact of external factorson the <strong>Trust</strong>’s business and supply line. Seeking to ensure have the right amountof stock and plans to address. Thanked Salisbury and Portsmouth for their helpfollowing the New York floods and the <strong>Trust</strong>’s shortage of blood materials.175/12 b) A discussion followed covering:Partnership working which is identified as none in the paper. The front covershould reflect the informal arrangements as demonstrated in this paper Need to consider the unknown unknowns and ensure that as issues emergeplans are put in placeOutcomes of the Winchester hospital fire in the MRI unit are underconsideration.175/12 c) After discussion <strong>Trust</strong> <strong>Board</strong>: Noted the report.176/12a)Operational PerformanceMonitor and Operational Performance Report for Month 7 (agenda item 7.1. Enclosure9)JH introduced the report which provides a summary of the <strong>Trust</strong>’s performanceagainst the access times and operational performance targets as agreed by <strong>Trust</strong><strong>Board</strong>. JH flagged the good performance in Q2 and noted that for the first time the<strong>Trust</strong> had met some long waits targets which indicates that the back log is reducing.Biggest area of concern is performance in ED which is currently just achieving thetarget.5

176/12 b) A discussion followed covering: C.Diff target identified in Annual Plan as a risk in Q3. JH reported that the trustis still working hard to deliver within target No guarantee that will achieve ED target in Q3. Working as hard as possiblebut extremely challenging and finding it hard to gain support from partners torelease beds in the hospital Waits – JH stated that she is seeking to implement plans and reduce waits andis working with commissioners to achieve this. Aiming for an average of 14week wait. Plans to be considered by Strategy and Finance Committee Definition of re-attendance and whether this is appropriate. Noted that mainarea of re-attendance is in Eye Casualty.176/12 c) After discussion <strong>Trust</strong> <strong>Board</strong>: Noted this report, in particular 18 week incompletes future performance, Strokeperformance and Emergency Department performance Considered that there is appropriate assurance regarding current and futureperformance Noted performance risks across each quarter in 2012/13 Did not request any further plans to mitigate these risks Considered performance for Quarter 1 and Quarter 2 13/14 to support themonitor submission Requested that Strategy and Finance Committee consider plans to reducewaits.177/12a)Key Performance Indicators for Month 7(agenda item 7.2. Enclosure 10)JH noted that this is the second such report and includes new KPIs requested bythe October <strong>Board</strong>. The report provides a summary of the <strong>Trust</strong>’s performanceagainst a range of high level internal key performance indicators agreed by the<strong>Trust</strong> <strong>Board</strong>. JH noted that performance has improved and that a key concern isworkforce and staff experience re sickness and staff turnover.177/12 b) A discussion followed covering:JG noted the need to understand staff sickness and any potential actions by the<strong>Trust</strong> which could be undertaken to address. Will be considering exit interviewdata. To be scrutinised by Audit and Assurance CommitteeNumber of staff increasing which is reflective of issues discussed earlier in the<strong>Board</strong> and impact on patient safety R&D performance improved but recruitment to studies remains a concern.Some risk that will not achieve the year end targets. IC noted that some currentstudies require a smaller cohort therefore need to identify more studies tomaintain the number of participants. Will not impact upon application forAcademic Health Science NetworkEconomic situation and impact upon research funding and projects. MM notedthat charitably funded studies have dropped slightly but bio-medicine fundingremains relatively constant.177/12 c) After discussion <strong>Trust</strong> <strong>Board</strong>: Requested deep dive in Audit and Assurance Committee re staff sickness andturnover Noted the Key Performance Indicators Report Considered that there is appropriate assurance regarding current and futureperformance.JH/NMJG6

178/12178/12 a)Executive Updates (Oral Reports on emerging issues and ‘hot-spots’) (agendaitem 7.3)Operational PerformanceApprenticeships: The <strong>Trust</strong> has been named as one of top 100 companies by TheGuardian along with some big commercial companies.HSJ Awards: The <strong>Trust</strong> has won an award re research and its embedding in theculture of the organisation. Also significant recognition of how the <strong>Trust</strong> isdeveloping nursing research.RSH Ward for Medicine for Older People: Models for doctor led servicesuperseded due to lack of recruitment by a proposal for a nurse led orthopaedicrehab model. Failed to recruit and the <strong>Trust</strong> is now creating capacity on SGH siteand seeking a site where it could have rehab along with appropriate staffing.178/12 b) QualityPaul Grundy – clinical leader of the year: Awarded by HSJ. The <strong>Trust</strong> was alsoshortlisted for five further HSJ Awards. In addition the CommunicationsDepartment has been nominated for seven awards.AHSN: MH is discussing this and the application will be assessed early next year.178/12 c) Strategy<strong>NHS</strong> Global: This is DH support for trusts to develop international business. Theorganisation is having discussions with many governments and is seeking todevelop trade networks with commercial FTs and international business partners.Currently the focus is mainly around training and includes a thrust to developnetworks. <strong>Board</strong> noted the opportunities for links with the university.179/12179/12 a)Any Other BusinessThere were no items of any other business.179/12 b) The Chair asked whether there were any comments/questions from the public.There were none.180/12 Date and Time of Next MeetingTuesday, 18 th December 2012 commencing at 9.00am in the Dean’s CommitteeRoom, SAB, SGH7

UNIVERSITY HOSPITAL SOUTHAMPTON <strong>NHS</strong> FOUNDATION TRUSTFinance ReportReport to: <strong>Trust</strong> <strong>Board</strong> - 18 th December 2012Report from:SponsoringExecutive:Purpose of Report:Review History toDate:Andy Wood, Deputy Finance DirectorAlastair Matthews, Finance Director and Deputy CEOTo update <strong>Trust</strong> <strong>Board</strong> on the financial, activity and savings performance of the <strong>Trust</strong>for November 2012.The <strong>Trust</strong> <strong>Board</strong> has previously agreed the income and expenditure budgets for2012/2013 with a full year plan pre-impairment surplus of £6m.RecommendationThe <strong>Board</strong> are asked to note:(1) In November the <strong>Trust</strong> has delivered a pre-impairment surplus of £926k, £6kbetter than Plan although the cumulative position is a surplus of £3,278kwhich is £196k worse than Plan.(2) Cost Improvement Programmes (CIPs) delivered were cumulatively £1.0mbelow Plan, which is phased based on a historic delivery profile. Thisrepresents a £0.1m deterioration in November. The target is fully identified at30 th November although a significant element remains classified as amber.(3) Divisions and headquarters overspent against expenditure budgets by£1.8m, exacerbated by a £0.9m overspending on reserves and corporatebudgets. This was largely offset by activity above plan with income estimatedto be £2.5m above plan in the month.(4) The November position is based on a number of specific assumptions onincome.SummaryThe <strong>Trust</strong> delivered a pre-impairment surplus of £0.9m in November, which was inline with Plan. EBITDA was £3.3m compared to a Plan of £3.6m. Cumulativelypreimpairment surplus is below Plan by £0.2m.Cumulative <strong>NHS</strong> Clinical Income at month 8 is estimated to be £3.4m above plan.A phased budget is used to reflect expected actual activity more accurately thanusing a straight line, unphased approach. The budgets for <strong>Southampton</strong> City andHampshire were adjusted with budget brought forward to the first quarter of thefinancial year, to reflect the expectation that significant activity management forthese PCTs would not be achieved during the first quarter.Actual income reported at month 8 consists of cumulative activity to month 7 asreported in SLAM plus an estimate for month 8 which extrapolates the first 7 months'income and then applies the appropriate phasing as a proxy for actual activity inmonth. Additional income has been anticipated for clinical activity which started inMonth 7 and would therefore not be recognised in this extrapolation, as well as earlydata indicating that spells are likely to be higher than usual.Provisions have been made for likely impacts from fines for 30 day readmissionsand 18 week breaches, a technical adjustment regarding the method for calculatingMRET, and provisions for the risk of partial non-achievement of C Diff and CQUIN.1

Non - <strong>NHS</strong> clinical income was £0.1m better than Plan and is cumulatively £0.5mabove Plan. Notably private patient income continues to improve and is £0.2mbehind plan cumulatively.There is an in month positive variance of £0.6m on other operating income andcumulatively this income is £4.9m over plan. Of this, £1.7m relates to R&D (mirroredby increased spend) and £1.2m is additional capital works recharged to the<strong>University</strong>. The balance relates to Divisional sundry income.Divisions and <strong>Trust</strong> Headquarters were £12.0m overspent against expenditurebudgets cumulatively, offset by underspends on corporate and reserve budgets togive a £9.7m adverse variance overall. The former number includes £5m which isthe impact of adding back the positive variance on divisional income, to give a trueexpenditure variance.Savings required for the year (CIPs) total £23.2m. In November, savings of £2.2mwere delivered (£2.1m in October), leading to a cumulative adverse variance againstPlan of £1.0m.The period end cash balance at £16.3m was £6.9m below plan due mainly toincreased working capital balances(£4.1m) higher net capital expenditure (£2.2m)and lower cash generated from earnings (£0.9m) partly offset by lower financingcosts (£0.3m).Key Messages forNovember:The year end cash forecast at £15.7m is £4.7m lower than plan due mainly to highernon cash income within the <strong>Trust</strong> planned surplus and less external income tosupport the capital programme.Delivery of the <strong>Trust</strong>’s financial targets in 2012/2013 will principally be determined byperformance in four areas:a) Divisional and Headquarter Directorates controlling expenditure to within theirbudgetary targetsb) Delivery of in-year financial savings of at least £23.2m plus activitymanagement savings of a further £5.1m. Activity Management cost savings arephased into the corporate budget from 1 st July 2012.c) Delivery of activity levels in line with budgets and the Capacity Plan.d) Development of a contingency reserve to offset any unexpected variations onthe above, and to manage the risks associated with Activity Managementand other unforeseen risks emerging.This report provides an update on these four areas.a) Controlling of expenditure to within the agreed ‘runrate’ budget targetsIn overall terms the <strong>Trust</strong> was cumulatively above Plan on operating expenditure by£9.7m at the end of October. Divisions and <strong>Trust</strong> Headquarters were £12.0moverspent against expenditure budgets cumulatively, offset by underspends oncorporate and reserve budgets to give a £9.7m adverse variance overall. The formernumber includes £5m which is the impact of adding back the positive variance ondivisional income, to give a true expenditure variance. Total revenue at 31 stNovember was £8.8m above Plan, largely offsetting the £9.7m overspend onoperating expenditure.As previously noted a number of reserves are now phased in fixed twelfths. Thecumulative underspend on reserves at month 8 was £2.9m. The reserves that havebeen phased in twelfths include NESC, the capacity reserve, nonpay and druginflation, IT and consultant increments.2

Worked wtes rose by 105 in November to 7,654. Within this, agency usage rose by24 wte and overtime / excess hours increased by 14 wte. The hospital has beenunder significant capacity pressures for much of November and in addition to theimpact on performance targets, the agency spend was £2.0m in month, up £0.3m onthe year to date average and a cause for concern.Division ADivision A over spent by £0.2m in November which is also £0.2m greater thanforecast (£9.9m total expenditure for the month). Mid-month concerns with meetingthe Emergency Department (ED) access targets, led to Critical Care Unit nursingshifts being fully filled for the weekend with high cost agency, to ensure that patientswere not held up in ED. This meant the Critical Care Care Group missed its financialforecast by £120k. Agency spend in Critical Care doubled from last month to £0.3mfor November and because extra capacity was open clinical supplies expenditurewas also greater than forecast.Spend for the Division as a whole is £211k more than last month. An increase in runrate was not forecast for November and is largely attributable to the change inapproach in Critical Care.At the end of November Division A was £2.4m over spent largely due to the CancerCare Care Group (£2.2m) and specifically Drugs (£1.7m). Year to date slippageagainst the CIP target is £0.7m. On a positive note, debtors, which were £2.3m inMay and as such have been subject to much control action, have this month fallenbelow the £1m threshold for the first time.Division A has generated £60m of clinical income after the first 7 months of thisfinancial year (latest data available) and is above plan. Whilst Cancer Care isoverspending it is also over performing, in income terms, against its production plantarget (£1.5m over ytd).At the end of November the Division has identified 91% of its £4.1m CIP target. TheDivision has actioned 128 schemes so far this financial year with a total value of£2.7m, this represents 66% of the total CIP Target.The Division is currently forecasting to spend £115m in FY2012/13; this will bereviewed in light of the change in Critical Care capacity provision.Division BIn November Division B spent £6.9m which is £0.2m more than October and £0.1mmore than that forecast. The main reason for the adverse position is MSSEexpenditure within the respiratory centre on high cost ventilators, endoscopyconsumables and medical equipment maintenance.There is an in month overspend of £0.5m against the Divisional budget due to CIPshortfall of £0.1m, £0.2m agency nursing net of vacancies, £0.1m MSSE and £0.1mdrugs. The main concerns going forward are the agency use both in nursing anddoctors required to close the vacancy gap and cover winter pressures, plus theability to keep pace with the expected CIP delivery which increases to £0.7m permonth in Q4.At present the Division is continuing to focus on overseas recruitment and limiting itsturnover rate. Achievement against CIP depends on the length of stay scheme inEmergency Care which to month 7 is reporting activity over plan of £1.3m (4.5%). Intotal the Division is over-performing against production plan by some £2.1m (3.5%)which includes high cost drugs.3

Division CDivision C was favourable in November by £97k (the cumulative position is £379kadverse) and spent £8.5m in month which was the same as October and as perforecast levels.CIP shortfalls, staffing pressures in Women & Newborn and pressures on staffing, xray film & clinical supplies within Neonates and Theatres were offset by supportservices underspends and lower non pay & higher income on car parking.The Divisional pay bill has increased since last month by £108k. This is due tovacancies being filled in Clinical Support and Non Clinical Support and higherDietetics agency covering vacancies. The total actual wte has increased by 41wte,30wte within Support Services on Therapies & Non Clinical support and the balancein Child Health.The main financial problem facing the Division is slippage against identified schemesplus unidentified CIPs with 10% (£571k) of the Divisional target still to identify.The latest activity figures show an over-performance of approx £1.2m (2.02%).Division DDivision D is £2.7m adverse at month 8, which is an adverse movement of £512k inthe month.The main issues in the month were unfound CIP in Cardiac, Medical staff spend inT&O, Nursing spend in T&O due to “specialing” of a patient , Stroke Unituncommissioned beds, Sub Contracting in T&O & Cardiac, high non pay costs forInterventional Radiology & CSI and low PP Income. This has in part been offset by ablood rebate.The Division spent £10,608k in November with agency expenditure at £447k.Headcount was 1,657 wte. (up 25 on the previous month). Latest activity figuresindicate the Division is £2m behind Plan, mostly in T&O due to combined Traumaand Winter related pressures.THQTHQ budgets overspent by £99k in November and are cumulatively £9k overspent.Clinical Governance (including training & development) overspent by £143k as theresult of returning budget for flexible SpRs to reserves following a reduction in NESCfunding in line with falling expenditure. CEO overspent by £101k including £73k inthe PSC. Estates overspent by £69k due to slippage on CIP delivery andengineering maintenance.Other Services underspent by £159k thanks to favourable movements on Thornburyagency bills, the EU emissions scheme and finance leases.Other THQ Directorates were close to break-even.4

) Delivering an in-year financial saving of £23.2mAt the end of November savings of £12.8m had been delivered, compared to the<strong>Trust</strong> Plan of £13.8m.Month YTDVariance due to: Actual Plan Variance Actual Plan Variance£m £m £m £m £m £m<strong>Trust</strong> profile 2.2 2.3 (0.1) 12.8 13.1 (0.3)Unidentified 0 0.0 (0.0) 0 0.7 (0.7)Total 2.2 2.3 (0.1) 12.8 13.8 (1.0)At 30 th November 55% (£12.8m) of CIP schemes had been delivered. Thiscompares to 54% (£14.9m) at 30 th November 2011. At 30 th November 103% of thefull year plan had been identified, with 98% of identified schemes rated either greenor amber.Key issues to note are:(i) £6.3m of the identified £24.0m schemes are non recurrent, albeit the FYE ofthose schemes identified is £5.4m(ii) £3.9m of the identified schemes are amber and £0.4m red rated.Schedule 7 shows the analysis of plans by Divisions, Headquarters Directorates andcentral schemes and Schedules 8a and 8b show the detail of the overall savingsprogramme.c) Achieving the agreed volumes of activity to deliver the income planCumulative <strong>NHS</strong> Clinical Income at month 8 is estimated to be £3.4m above plan.A phased budget is used to reflect expected actual activity more accurately thanusing a straight line, unphased approach. The budgets for <strong>Southampton</strong> City andHampshire were adjusted with budget brought forward to the first quarter of thefinancial year, to reflect the expectation that significant activity management forthese PCTs would not be achieved during the first quarter.Actual income reported at month 8 consists of cumulative activity to month 7 asreported in SLAM plus an estimate for month 8 which extrapolates the first 7 months'income and then applies the appropriate phasing as a proxy for actual activity inmonth. Additional income has been anticipated for clinical activity which started inMonth 7 and would therefore not be recognised in this extrapolation, as well as earlydata indicating that spells are likely to be higher than usual.Provisions have been made for likely impacts from fines for 30 day readmissionsand 18 week breaches, a technical adjustment regarding the method for calculatingMRET, and provision for the risk of partial non-achievement of C Diff and CQUIN.Non - <strong>NHS</strong> clinical income was £0.1m better than Plan and is cumulatively £0.5mabove Plan. Notably private patient income continues to improve and is £0.2mbehind plan cumulatively.There is an in month positive variance of £0.6m on other operating income andcumulatively this income is £4.9m over plan. Of this, £1.7m relates to R&D (mirroredby increased spend) and £1.2m is additional capital works recharged to the<strong>University</strong>. The balance relates to Divisional sundry income.d) Creation of a contingency to cover unexpected variations on the aboveThe approach for 2012/13, as in previous years, is based on identifying contingencyreserves to cover the likely risk from variations in costs against Plan, and additionalworkload due to unsuccessful activity management. If risks are successfully5

managed out, these reserves will become available to put into the central “bank” towhich bids for funding to improve services, quality and the hospital environment, canbe made.Cash & LiquidityThe period end cash balance at £16.3m was £6.9m below plan due mainly toincreased working capital balances(£4.1m) higher net capital expenditure (£2.2m)and lower cash generated from earnings (£0.9m) partly offset by lower financingcosts (£0.3m).The year end cash forecast at £15.7m is £4.7m lower than plan due mainly to highernon cash income within the <strong>Trust</strong> planned surplus and less external income tosupport the capital programme.With a working capital facility in place of £43m, the current financial position resultsin a liquidity rating of 3 and an overall Monitor risk rating of 3 (Schedule 1 and Annex5). This is forecast to remain a 3 at the year end.Schedule 1 also shows some key balance sheet indicators.Annex 4 shows cumulative capital expenditure compared to Plan. £12.7m has beenspent to date, £1.1m less than the updated Plan. £1.9m of new finance leases havebeen taken out in the first eight months of the year, compared to a Plan of £3.9m.ForecastA review of the year end Forecast was carried out in the light of October’s results.Whilst the forecast remains in line with Plan there was a level of control actionrequired to ensure the <strong>Trust</strong> delivers the planned surplus for the year. There will be afurther review of progress following the production of the November.RisksIdentifiedDescriptionPotentialValue £mLikelihoodWeightedvalue £mMitigationRisksOveralldemandlevelsThe <strong>Trust</strong> isanticipating incomein excess ofcontracted levels,based on capacityin place to deliveranticipated demandand experience ofdrug growth£15m L -10%£1.5m Ensure that paymentsfor overperformanceare secured. If activitydoes not occur ensurethat capacity andcosts are reducedaccordingly.CIPsNon-delivery ofCIPs£5m M –50%£2.5m Strong performancemanagementActivityManagementCost reductionrequired inresponse tosuccessful ActivityManagement.(NB: This risk andthe risks regarding“overall demandlevels” abovecannot becompounded).£5m L –10%£0.5m Ensure fullengagement in ActivityManagement; ensurecosts which can beremoved are removed.DivisionaloverspendingRisks ofoverspending dueto operationalpressures, capacityissues etc£10m M-50%£5.0m Strong performancemanagement.6

FINANCE REPORTSchedule 1 2012/13 Month: 8KEY METRICSCurrent Cumulative Year End ForecastPlan Actual Variance Plan Actual Variance Plan Forecast Variance£000's £000's £000's £000's £000's £000's £000's £000's £000's1) INCOME & EXPENDITURERevenue 46,625 49,129 (2,504) 369,166 377,955 (8,789) 554,441 574,056 (19,615)EBITDA (3,558) (3,337) 221 (23,124) (22,245) 879 (36,523) (36,030) 493Pre-impairment (surplus)/loss (919) (926) (6) (3,474) (3,278) 196 (6,000) (6,000) 02) STAFF COSTS and WTEEmployee benefits expenses 27,653 28,635 982 222,610 221,944 (666) 333,026 335,341 2,315Paybill (wte) 7,654Locum and agency spend 1,308 1,956 648 10,464 13,739 3,2753) CIPsCIP Delivered vs <strong>Trust</strong> Target 2,254 2,190 64 13,802 12,794 1,008 23,236 23,236 0% Identified 103%% Green rated 82%% Amber rated 16%% Red rated 2%4) CASHFLOWOpening Cash balance 21,511 20,680 831 29,540 29,540 0 29,540 29,540 0Income from operations 3,558 3,337 221 23,124 22,245 879 36,522 36,185 337Working Capital movement 15 (4,896) 4,911 (12,288) (16,412) 4,124 (14,574) (15,353) 779Capex (1,413) (2,580) 1,167 (13,154) (15,406) 2,252 (18,806) (23,005) 4,199Other (488) (261) (226) (4,039) (3,687) (352) (12,259) (11,665) (594)Closing Cash balance 23,183 16,280 6,903 23,183 16,280 6,903 20,423 15,702 4,7215) STATEMENT OF FINANCIAL POSITIONStock days 38 40 -2 36 36 0<strong>NHS</strong> trade debtor days 5 2 3 5 4 1Non <strong>NHS</strong> trade debtor days 11 11 0 10 9 1Trade creditor days 25 22 3 27 23 46) RISK RATING Plan Actual Plan ActualRiskRatingno. Plan ForecastRiskRatingno.EBITDA margin 7.4% 6.5% 6.0% 5.7% 3 6.3% 6.0% 3EBITDA % achieved 93.6% 98.0% 4 98.7% 4Return after financing 3.9% 3.9% 1.8% 1.7% 3 2.1% 2.1% 4I&E Surplus margin 2.0% 1.9% 0.9% 0.9% 2 1.1% 1.0% 3Liquid ratio 23 18.7 3 23 19.2 3Overall score 3 3

Schedule 2INCOME STATEMENT( ) Denotes Favourable Variance1st April 2012 to March 31st 2013 2012/13 Month: 8Annual Current Quarter CumulativeBudget Plan Actual Variance Plan Actual Variance Plan Actual Variance£000's £000's £000's £000's £000's £000's £000's £000's £000's £000'sIncome<strong>NHS</strong> Clinical Revenue 442,455 37,292 39,058 (1,765) 74,367 76,705 (2,338) 294,509 297,946 (3,437)Non <strong>NHS</strong> Clinical Revenue 7,651 638 737 (100) 1,275 1,607 (332) 5,101 5,590 (489)Other Operating Income 104,335 8,695 9,334 (639) 17,389 19,044 (1,656) 69,557 74,420 (4,863)Total Revenue 554,441 46,625 49,129 (2,504) 93,031 97,356 (4,326) 369,166 377,955 (8,789)Operating ExpensesEmployee Benefits Expense 333,026 27,653 28,635 982 55,305 56,931 1,626 222,610 221,944 (666)Drug Costs 41,543 3,442 4,322 880 6,884 8,538 1,655 27,803 32,128 4,325Clinical Supplies 56,905 4,779 5,365 585 9,558 10,459 901 37,869 40,201 2,331Non-Clinical Supplies 13,196 1,083 1,230 146 2,167 2,445 279 8,888 9,782 894Other Costs 73,249 6,110 6,241 131 12,220 12,638 418 48,872 51,655 2,783Total Operating Expenses 517,918 43,067 45,792 2,725 86,134 91,012 4,878 346,042 355,710 9,668(Profit)/Loss from Operations (EBITDA) (36,523) (3,558) (3,337) 221 (6,896) (6,345) 552 (23,124) (22,245) 879Non Operating Income (70) (5) (11) (6) (11) (23) (12) (44) (74) (29)Non Operating Expenditure 30,593 2,644 2,422 (222) 5,262 4,939 (323) 19,694 19,041 (653)(Net Surplus) / Deficit excl Impairments (6,000) (919) (926) (6) (1,646) (1,429) 217 (3,474) (3,278) 196Impairments 2,400 0 34 34 0 21 21 0 225 225(Net Surplus) / Deficit post Impairments (3,600) (919) (891) 28 (1,646) (1,408) 238 (3,474) (3,052) 422

Schedule 2bINCOME & EXPENDITURE FORECAST1st April 2012 to March 31st 2013 2012/13 8Current forecastPlan Forecast Variance£000's £000's £000'sOperating Income<strong>NHS</strong> Clinical Revenue 442,455 452,467 (10,012)Non <strong>NHS</strong> Clinical Revenue 7,651 8,460 (809)Other Operating Income 104,335 113,129 (8,794)Total Revenue 554,441 574,056 (19,615)Operating ExpensesEmployee Benefits Expense 333,026 335,341 2,315Drug Costs 41,543 48,076 6,533Clinical Supplies 56,905 59,241 2,336Non-Clinical Supplies 13,196 14,617 1,421Other Costs 73,249 80,751 7,502Total Operating Expenses 517,918 538,026 20,108Profit /Loss from Operations (36,523) (36,030) 493Non-Operating income (70) (86) (16)Non-Operating Expenditure 30,593 30,116 (477)(Net Surplus) / Deficit excl Impairments (6,000) (6,000) (0)Impairments 2,400 5,640 3,240(Net Surplus) / Deficit post Impairments (3,600) (360) 3,240

LTFM PlanActual1234567891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071727374757677A B C D E F G H I J K L M N O P Q R S2000150010005000-500-1000-1500Schedule 3GRAPHS 2012/13 Month: 87700760075007400730072007100700025000200001500010000500001.Pre-impairment Income and ExpenditureIn Month - surplus (deficit)A M J J A S O N D J F M3.Workforce WTEA M J J A S O N D J F MApr-12Excludes Agency, overtime and excess hoursActualProfile as per <strong>Trust</strong>PlanMay-125.Cost Improvement ProgrammesProfiled Savings Programme 2012/2013Jun-12Jul-12Aug-12Sep-12Oct-12Nov-12Dec-12Jan-13ActualFeb-13ActualLTFM PlanMar-1370006000500040003000200010000-1000-200035030025020015010050350003000025000200001500010000500002.Pre-impairment Income and ExpenditureCumulative - surplus (deficit)A M J J A S O N D J F M4.Agency and Overtime WTE( overtime Includes excess hours )M A M J J A S O N D J F MNew graph - cash vs forecast 6.CashflowM A M J J A S O N D J F MActualLTFMPlanagency Actualovertime Actual

Schedule 4Central and Divisional Revenue PerformanceApril 1st 2012 to March 31st 20132012/13 Month: 8Current Quarter CumulativeAnnual Current Current Current Quarter Quarter Quarter Budget Actual VarianceBudget Month Month Month To Date To Date To DateBudget Actual Variance Budget Actual Variance<strong>NHS</strong> Clinical Revenue £000's £000's £000's £000's £000's £000's £000's £000's £000's £000's<strong>NHS</strong> Hampshire (134,468) (11,263) (12,069) (806) (22,460) (23,440) (980) (89,791) (93,088) (3,297)<strong>NHS</strong> <strong>Southampton</strong> City (117,481) (9,841) (10,900) (1,059) (19,622) (20,897) (1,275) (78,448) (82,765) (4,317)Isle of Wight PCT (7,071) (599) (572) 27 (1,194) (1,097) 97 (4,695) (4,969) (274)Portsmouth PCT (3,186) (270) (307) (37) (559) (545) 14 (2,115) (2,308) (193)South Central Specialised (99,678) (8,379) (9,473) (1,094) (16,708) (17,363) (655) (66,441) (66,931) (490)Thames Valley Specialised (4,552) (386) (302) 84 (769) (528) 241 (3,023) (2,581) 442Other (299) (25) 21 46 (51) (27) 24 (199) (304) (105)Total South Central SLAs (366,735) (30,762) (33,602) (2,840) (61,362) (63,897) (2,535) (244,712) (252,946) (8,234)<strong>NHS</strong> Dorset (4,392) (372) (163) 209 (742) (652) 90 (2,916) (3,057) (141)<strong>NHS</strong> Bournemouth & Poole (1,687) (143) (16) 127 (285) (97) 188 (1,120) (1,451) (331)<strong>NHS</strong> Wiltshire (5,407) (458) (454) 4 (999) (1,049) (50) (3,590) (4,360) (770)Other. (29,217) (2,475) (3,282) (807) (4,849) (5,604) (755) (19,400) (20,846) (1,446)Total South West SLAs (40,703) (3,448) (3,915) (467) (6,875) (7,402) (527) (27,026) (29,714) (2,688)SACS & Surrey (3,270) (277) (205) 72 (552) (475) 77 (2,172) (2,276) (104)Channel Islands (8,743) (741) (950) (209) (1,477) (1,434) 43 (5,805) (6,378) (573)London Specialised Commissioning (BMT) (399) (34) (50) (16) (67) (44) 23 (265) (167) 98South East Specialised Commissioning (9,404) (797) (756) 41 (1,588) (1,493) 95 (6,244) (5,445) 799Milton Keynes Specialised Commissioning (72) (6) 83 89 (12) 43 55 (48) (122) (74)Total other SLAs (21,888) (1,854) (1,878) (24) (3,697) (3,403) 294 (14,534) (14,388) 146TOTAL CONTRACTED INCOME (429,326) (36,064) (39,395) (3,331) (71,934) (74,702) (2,768) (286,272) (297,048) (10,776)Non Contracted Activity (NCAs) (5,342) (452) (752) (300) (902) (1,015) (113) (3,547) (4,375) (828)Phasing and other adjustments 1,004 26 75 49 893 (1,123) (2,016) 894 3,687 2,793Total SLA & NCA Income (433,664) (36,490) (40,072) (3,582) (71,943) (76,840) (4,897) (288,925) (297,736) (8,811)Anticipated & Additional Clinical / Off Tariff Income (10,152) (802) 1,014 1,816 (2,424) 135 2,559 (6,944) (1,038) 5,906Old Year Transactions 1,361 0 0 0 0 (0) (0) 1,361 828 (533)Total Misc Commission Income (8,791) (802) 1,014 1,816 (2,424) 135 2,559 (5,583) (210) 5,373TOTAL <strong>NHS</strong> CLINICAL REVENUE (442,455) (37,292) (39,058) (1,765) (74,367) (76,705) (2,338) (294,509) (297,946) (3,437)Non <strong>NHS</strong> Clinical RevenuePrivate Patients (5,104) (425) (520) (95) (851) (1,003) (152) (3,403) (3,218) 185CRU (2,547) (212) (217) (5) (425) (604) (180) (1,698) (2,372) (674)0 0TOTAL NON <strong>NHS</strong> CLINICAL REVENUE (7,651) (638) (737) (100) (1,275) (1,607) (332) (5,101) (5,590) (489)Other Operating IncomeOverseas Visitors (285) (24) (29) (5) (48) (84) (36) (190) (270) (80)Research & Development. (26,347) (2,196) (2,275) (79) (4,391) (4,976) (585) (17,565) (19,248) (1,683)Education Income (40,704) (3,392) (3,303) 89 (6,784) (6,663) 120 (27,136) (26,347) 789Clinical Excellence Awards (3,821) (324) (318) 5 (647) (637) 11 (2,526) (2,547) (21)Misc. Other Operating Income (see annex 2) (33,178) (2,760) (3,408) (649) (5,519) (6,685) (1,166) (22,140) (26,008) (3,868)TOTAL OTHER OPERATING INCOME (104,335) (8,695) (9,334) (639) (17,389) (19,044) (1,656) (69,557) (74,420) (4,863)TOTAL REVENUE (554,441) (46,625) (49,129) (2,504) (93,031) (97,356) (4,326) (369,166) (377,955) (8,789)

Schedule 5OPERATING EXPENSES2012/13 Month: 8Current Quarter CumulativeAnnual DESCRIPTION Month Month Month Budget Actual Variance Budget Actual VarianceBudget Budget Actual Variance To Date To Date To Date£000's £000's £000's £000's £000's £000's £000's £000's £000's £000'sEMPLOYEE BENEFITS EXPENSE109,736 Medical and dental. 8,461 9,100 639 17,190 18,193 1,004 71,382 70,993 (389)41,766 Administration 3,722 3,516 (206) 7,020 7,065 44 27,746 27,785 402,096 Estates 177 183 6 354 327 (27) 1,388 1,268 (120)28,717 Healthcare assistants and other support staff. 2,411 2,193 (218) 4,797 4,454 (344) 19,196 17,402 (1,793)105,618 Nursing, midwifery and health visiting staff. 9,660 8,958 (701) 17,654 17,763 109 70,122 69,828 (294)0 Nursing, midwifery and health visiting learners. 0 (0) 0 (0) 0 1 143,225 Scientific, therapeutic and technical staff. 3,792 3,401 (392) 7,090 6,716 (374) 28,742 26,306 (2,437)116 Non-Executive Directors. 10 10 1 16 20 5 78 77 (0)4,000 Locum Medical costs / Agency Medics 333 402 69 667 853 186 2,667 3,389 7238,696 Agency Nursing 725 1,184 459 1,449 2,159 709 5,797 7,493 1,6953,000 Agency Other 250 371 121 500 754 254 2,000 2,857 857<strong>NHS</strong> Professionals Spend Included within Agency 462 716 2,838(2,719) Vacancy Factor. (266) 266 (500) 500 (1,860) 1,860(3,433) Pay Savings. (71) 71 (382) 382 (1,223) 1,223(5,524) Staff Recharges. (1,578) (683) 895 (600) (1,372) (772) (3,676) (5,457) (1,781)81 Activity Management. 9 (9) 19 (19) 67 (67)(2,349) Other Employee Benefits Expense 17 (17) 32 0 (31) 185 2 (183)333,026 TOTAL EMPLOYEE BENEFITS EXPENSE 27,653 28,635 982 55,305 56,931 1,626 222,610 221,944 (666)NON-PAY EXPENDITURERaw Materials and consumables used41,543 Drug Costs. 3,442 4,322 880 6,884 8,538 1,655 27,803 32,128 4,32556,905 Clinical Supplies 4,779 5,365 585 9,558 10,459 901 37,869 40,201 2,331Decrease (increase) in inventories of finished goods & WI13,196 Non-Clinical Supplies 1,083 1,230 146 2,167 2,445 279 8,888 9,782 894111,644 Total Raw Materials and consumables used 9,304 10,916 1,612 18,608 21,443 2,834 74,560 82,110 7,5511,444 Cost of Secondary Commissioning of mandatory services 167 328 161 272 485 213 886 1,846 96013,976 Research & development expense (915) 1,099 2,014 628 2,569 1,942 9,318 9,565 2471,160 Training and Development expense 93 187 94 181 246 65 788 924 135(25) Activity Management (3) 3 (6) 6 (13) 1356,694 Misc. Other Operating expenses (see below) 6,769 4,627 (2,142) 11,146 9,338 (1,808) 37,892 39,321 1,428PFI Operating Expenses184,892 TOTAL NON-PAY EXPENDITURE 15,414 17,157 1,743 30,829 34,081 3,252 123,432 133,766 10,334517,918 TOTAL OPERATING EXPENSES 43,067 45,792 2,725 86,134 91,012 4,878 346,042 355,710 9,6686,017 Services from other <strong>NHS</strong> <strong>Trust</strong>s. 544 586 41 1,059 1,167 107 4,045 4,291 2476,980 Services from other <strong>NHS</strong> Bodies. 582 98 (484) 1,175 542 (633) 4,653 4,010 (643)1,915 Services from Foundation <strong>Trust</strong>s. 149 469 320 313 708 395 1,284 2,029 7453,521 Establishment. 274 316 41 607 698 91 2,367 2,581 2141,584 Transport. 89 104 15 172 194 22 1,226 1,403 17823,410 Premises. 2,075 1,418 (656) 3,887 2,780 (1,107) 15,153 12,179 (2,974)275 Bad debts. 23 32 9 46 95 49 183 315 132226 Audit fees & other auditors renumeration. 19 48 29 38 34 (4) 151 117 (34)9,082 Clinical negligence. 757 757 1,514 1,514 6,055 6,055 0(2,463) Non Pay Savings (331) 331 (267) 267 (508) 508Non Po Accrual (3) (3) (7) (7) 63 6337 General Reserves 3 2 (1) 8 3 (4) 26 10 (17)432 Consultancy 27 32 4 34 65 31 274 170 (104)5,679 Other Operating Expenses 2,558 770 (1,788) 2,561 1,546 (1,015) 2,984 6,098 3,11356,694 TOTAL MISC. OTHER OPERATING EXPENSES 6,769 4,627 (2,142) 11,146 9,338 (1,808) 37,892 39,321 1,428The premises line above includes a share of the reserves budget totalling £488k Fav in month and £3050k Fav to date which is materially effecting the reported underspends.

Schedule 6DIVISIONAL/HEADQUARTERS PERFORMANCE 2012/13 Month: 8Net Expenditure PerformanceForecastWorkforceOpening Issues From Current CumulativeDivisional Forecast Forecast ForecastAnnual Reserves Annual Period Plan Actual Variance Income Budget Actual Variance Total Memo:Plan & Virements Budget Variance £000's £000's £000's position on Worked Agency Excess & Actual Last£000's £000's £000's £000's Adv. O Drive £000's £000's £000's WTE WTE OT WTE WTE MonthAdv. (Fav.) Variance ytd ActualDivisions (Fav.) wteSurgery 22,762 1,717 24,479 113 16,126 16,723 597 1,132 24,854 25,624 770 372 37 2 410 408Cancer Care 30,633 1,315 31,948 280 21,122 23,346 2,223 (1,501) 31,739 35,062 3,323 353 14 5 371 365Critical Care 49,294 2,594 51,888 234 34,544 34,879 335 (125) 52,408 53,034 626 847 33 25 906 894Division A Management 1,122 (36) 1,086 (425) 1,299 587 (711) 1,086 931 (155) 24 1 25 22Sub Total Division A 103,811 5,590 109,401 203 73,091 75,534 2,443 (493) 110,087 114,651 4,564 1,595 84 33 1,712 1,689Specialist Medicine 36,053 (111) 35,942 269 24,344 24,895 551 (774) 35,718 37,392 1,674 387 8 3 399 397Emergency Care 34,912 2,476 37,388 235 25,094 26,075 981 (1,331) 37,851 39,788 1,937 723 104 11 839 831Division B Management 1,024 150 1,174 (24) 864 776 (88) 1,157 1,157 22 22 22Sub Total Division B 71,989 2,515 74,504 480 50,302 51,746 1,444 (2,105) 74,726 78,337 3,611 1,133 112 15 1,259 1,249Women and Newborn 31,050 1,096 32,146 172 21,549 22,585 1,035 78 32,129 33,891 1,762 632 5 29 666 662Child Health 32,222 2,703 34,925 70 23,551 23,653 101 (749) 34,870 35,697 827 533 11 7 551 543Clinical Support 15,190 2,100 17,290 (141) 11,623 10,835 (788) (543) 17,511 16,620 (891) 484 32 516 498Non Clinical Support 16,522 (1,375) 15,147 (52) 10,252 10,314 62 15,192 15,203 11 180 27 207 197Division C Management 590 (146) 444 (146) 365 333 (32) 444 504 60 7 7 6Sub Total Division C 95,574 4,378 99,952 (97) 67,340 67,719 379 (1,214) 100,146 101,915 1,769 1,834 17 96 1,947 1,906Trauma & Orthopaedics 18,139 1,824 19,963 146 13,604 13,575 (29) 1,727 20,820 20,919 99 234 27 3 265 250Cardiothoracic 34,322 639 34,961 364 23,507 25,585 2,078 81 35,011 39,459 4,448 486 21 3 510 507Neurosciences 22,198 1,171 23,369 (11) 15,782 15,925 143 71 23,363 23,876 513 301 23 3 327 323Pathology 15,626 641 16,267 19 10,904 11,237 334 (18) 16,311 17,118 807 231 4 235 233Radiology 20,177 1,737 21,914 55 14,439 14,717 278 142 22,327 22,967 640 299 1 6 306 307Division D Management 1,030 431 1,461 (61) 989 924 (65) 1,453 1,232 (221) 13 1 14 12Sub Total Division D 111,492 6,444 117,936 512 79,224 81,963 2,739 2,003 119,285 125,571 6,286 1,565 72 20 1,657 1,632Miscellaneous AdjustmentsAct Man and Fin adjs not yet allocated to Divisions (3,093)TOTAL DIVISIONS 382,866 18,927 401,793 1,098 269,957 276,963 7,006 (4,902) 404,244 420,474 16,230 6,127 285 164 6,575 6,476HeadquartersStrategy (564) 2,086 1,522 15 1,001 809 (192) 1,579 1,329 (250) 24 24 25Finance 4,634 282 4,916 9 3,269 3,256 (13) 4,928 4,865 (63) 76 76 74Estates 14,926 885 15,811 69 10,553 10,317 (235) 15,811 15,362 (449) 108 6 3 117 114Clinical Governance 2,177 233 2,410 (65) 1,566 1,582 15 7,212 6,875 (337) 39 4 43 42Medical Director 509 (4) 505 1 340 360 20 515 544 29 6 6 6Training and Development 3,636 239 3,875 208 2,789 2,757 (32) within clinical governance 67 67 70Chief Executive Office 3,027 2,456 5,483 101 3,631 3,731 99 5,547 5,435 (112) 145 4 149 146Research & Development (4,287) (14) (4,301) (0) (2,867) (2,867) 0 (4,046) (4,046) 215 1 215 216Human Resources 2,991 106 3,097 4 2,092 1,959 (133) 3,133 2,985 (148) 110 5 116 111IM&T 5,187 223 5,410 (58) 3,660 3,646 (13) 5,410 5,488 78 147 5 152 153Other Services (6,988) (6,988) (159) (4,898) (4,263) 634 (6,985) (10,142) (3,157)CLRN (0) (0) (0) (0) 12 12 12SWPHO 0 (0) (0) 0 66 0 66 67OPA's 286 286 (24) 191 (0) (191) 286 4 (282)Clinical Neg/Employer Liab. 9,849 193 10,042 (2) 6,695 6,744 49 10,042 10,149 107 2 2 2Headquarters Total 35,383 6,685 42,068 99 28,021 28,031 9 43,432 38,848 (4,584) 1,018 6 22 1,045 1,040Division/Headquarters Income Removal as per annex 2 67,353 3,470 70,822 632 44,967 49,961 4,995Division/Headquarters Total 485,602 29,081 514,683 1,829 342,945 354,955 12,010 (4,902) 447,676 459,322 11,646 7,144 290 186 7,620 7,516Balance Sheet. (0) (1) (1)Capital Programme 885 (67) 818 (208) 563 (334) (896) 32 1 34 33Central Reserves 31,155 (24,728) 6,427 836 2,898 (2,898) 1,645 1,344 (301)Corporate Costs 168 (1,004) (836) 67 (576) (65) 511 33,873 35,691 1,818Corporate Income Removal 109 (3,284) (3,174) 201 212 1,154 942 (486,794) (496,717) (9,923)Total Operating Expenses 517,919 (1) 517,918 2,725 346,042 355,710 9,668 (4,902) (3,600) (360) 3,240 7,177 290 187 7,654 7,549

Schedule 7CIPS BEING WORKED ON 2012/13 Month: 8Identified CIP SplitScheme StatusPay Non-Pay Income Total CIP Variance Variance Pay % Non Pay % Income % Green Amber Red Unmarked ToCIP's CIP's CIP's CIP Target (Fav) / Adv%DivisionCare Group / Directorate ` No. £'000 No. £'000 No. £'000 No. £'000 No.Division ASurgery 766 229 64 1,059 1,039 (20) 102% 72% 22% 6% 48 894 7 165 55Cancer Care 537 225 407 1,169 1,342 173 87% 46% 19% 35% 41 950 9 197 2 22 52Critical Care & Theatres 993 299 167 1,459 1,684 225 87% 68% 20% 11% 52 1,102 15 357 67Division A Total 2,296 753 638 3,687 4,065 378 91% 62% 20% 17% 141 2,946 31 719 2 22 174Division BEmergency Care 1,365 455 4 1,824 1,968 144 93% 75% 25% 0% 13 483 5 1,341 18Specialist Med & Ophthalmology 530 279 998 1,807 1,993 186 91% 29% 15% 55% 28 1,529 18 246 2 32 48Pathology 207 540 364 1,111 1,092 (19) 102% 19% 49% 33% 34 1,054 4 27 1 30 39Radiology 340 617 156 1,113 1,341 228 83% 31% 55% 14% 24 1,002 11 110 1 1 36Division B Total 2,442 1,891 1,522 5,855 6,394 539 92% 42% 32% 26% 99 4,068 38 1,724 4 63 141Division CWomen & Newborn 656 327 477 1,460 1,897 437 77% 45% 22% 33% 49 1,136 18 224 6 100 73Child Health 948 186 376 1,510 1,779 269 85% 63% 12% 25% 59 1,431 5 48 2 31 66Clinical Support 869 101 458 1,428 1,155 (273) 124% 61% 7% 32% 54 1,264 7 104 2 60 63Non Clinical Support 171 276 376 823 961 138 86% 21% 34% 46% 25 687 4 74 2 62 31Division C Total 2,644 890 1,687 5,221 5,792 571 90% 51% 17% 32% 187 4,518 34 450 12 253 233Division DCardiothoracic 787 497 445 1,729 2,306 577 75% 46% 29% 26% 28 1,640 2 51 2 38 32Trauma & Orthopaedics 326 516 842 908 66 93% 39% 61% 15 833 1 9 16Neurosciences 460 316 826 1,602 1,445 (157) 111% 29% 20% 52% 17 1,540 2 61 1 1 20Division D Total 1,573 1,329 1,271 4,173 4,659 486 90% 38% 32% 30% 60 4,013 5 121 3 39 68Total Clinical Services 8,955 4,863 5,118 18,936 20,910 1,974 91% 47% 26% 27% 487 15,545 108 3,014 21 377 616<strong>Trust</strong> HeadquartersFinance 61 294 10 365 342 (23) 107% 17% 81% 3% 9 136 5 229 14Estates 735 175 910 753 (157) 121% 81% 19% 9 787 2 123 11Medical Director 100%Chief Operating Officer 128 15 13 156 156 100% 82% 10% 8% 8 155 1 1 9Human Resources 260 8 39 307 209 (98) 147% 85% 3% 13% 10 234 3 73 13IM&T 295 161 1 457 370 (87) 124% 65% 35% 0% 11 346 6 111 17Strategy 23 76 230 329 89 (240) 370% 7% 23% 70% 13 329 13Clinical Governance 79 235 25 339 339 100% 23% 69% 7% 13 279 2 60 15Chief Executive 45 9 54 68 14 79% 83% 17% 2 54 2<strong>Trust</strong> HQ Total 891 1,533 493 2,917 2,326 (591) 125% 31% 53% 17% 75 2,320 19 597 94Central Schemes 261 261 (261) 100% 100% 2 261 2A Other 1,899 1,899 (1,899) 100% 100% 7 1,899 7THQ Restructure 100%Total Other 2,160 2,160 (2,160) 100% 100% 7 1,899 2 261 9U.H.S. <strong>Trust</strong> Total 9,846 8,556 5,611 24,013 23,236 (777) 103% 41% 36% 23% 569 19,764 129 3,872 21 377 719=100%2% =100%

Schedule 7CIPS BEING WORKED OotalDivisionCare Group / DirectorateDivision ASurgeryCancer CareCritical Care & TheatresDivision A TotalDivision BEmergency CareSpecialist Med & OphthalmologyPathologyRadiologyDivision B TotalDivision CWomen & NewbornChild HealthClinical SupportNon Clinical SupportDivision C TotalDivision DCardiothoracicTrauma & OrthopaedicsNeurosciencesDivision D TotalTotal Clinical Services<strong>Trust</strong> HeadquartersFinanceEstatesMedical DirectorChief Operating OfficerHuman ResourcesIM&TStrategyClinical GovernanceChief Executive<strong>Trust</strong> HQ TotalCentral SchemesOtherTHQ RestructureTotal OtherU.H.S. <strong>Trust</strong> Total£'0001,0591,1691,4593,6871,8241,8071,1111,1135,8551,4601,5101,4288235,2211,7298421,6024,17318,936365910156307457329339542,9172611,8992,16024,013

Schedule 8a 2012/13 Month: 8<strong>University</strong> <strong>Hospital</strong> <strong>Southampton</strong> <strong>NHS</strong> FT Savings Programme 2012/13CIP Delivery - Scheme Analysis2012/13 AWL Year to Date Split by: Full Year RollClosed Target Identified Identified Actual Variance Profile Actual Variance Rec Non Rec Total Effect ForwardAs at Period 08 - November Beds £'000 £'000 WTEs WTEs WTEs £'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000IncIncCare Pathways 44 3,716 2,762 77.02 14.30 62.72 2,207 714 1,493 2,724 38 2,762 394 3,118IncInformation Technology 0 462 234 6.84 0.00 6.84 274 116 158 146 88 234 191 337IncWorkforce 0 5,346 6,563 133.48 54.46 79.02 3,176 4,235 (1,060) 3,807 2,756 6,563 736 4,543IncCarryforward 0 73 73 0.00 0.00 0.00 43 49 (5) 73 0 73 0 73Inc<strong>NHS</strong> Patient Income 0 2,751 3,150 0.00 0.00 0.00 1,634 1,336 298 2,610 540 3,150 1,552 4,162IncNon-<strong>NHS</strong> Patient Income 0 1,744 1,499 0.00 0.00 0.00 1,036 882 154 940 559 1,499 162 1,102IncNon Patient Income 0 642 814 0.00 0.00 0.00 381 505 (124) 457 357 814 45 502IncProcurement - Drugs 0 765 508 0.00 0.00 0.00 454 141 313 508 0 508 2 510IncProcurement - Other 0 2,851 2,971 0.00 0.00 0.00 1,693 1,397 296 2,414 557 2,971 715 3,129IncInnovation Bids 11 1,058 720 10.40 0.00 10.40 628 75 553 698 22 720 424 1,122IncMiscellaneous 0 1,632 2,328 0.00 0.00 0.00 969 1,881 (912) 1,185 1,143 2,328 513 1,698IncLocal Non Pay 0 988 2,390 0.00 0.00 0.00 587 1,463 (876) 2,126 249 2,375 687 2,813Spare 3 0 0 0.00 0.00 0.00 0 0 0 0 0 0 0 0Spare 4 0 0 0.00 0.00 0.00 0 0 0 0 0 0 0 0Spare 5 0 0 0.00 0.00 0.00 0 0 0 0 0 0 0 0Spare 6 0 0 0.00 0.00 0.00 0 0 0 0 0 0 0 0Spare 7 0 0 0.00 0.00 0.00 0 0 0 0 0 0 0 0IncUnidentified 1,208 718 718IncTotal U.H.S. 55 23,236 24,012 227.74 68.76 158.98 13,802 12,794 1,008 17,688 6,309 23,997 5,420 23,108IncIncSchemes split by:Acute A&E 0 0 0 0.00 0.00 0.00 0 0 0 0 0 0 0 0Acute Day Case 0 0 13 0.00 0.00 0.00 0 13 (13) 0 13 13 0 0Acute Elective 0 1,100 0.00 0.00 0.00 0 426 (426) 950 150 1,100 302 1,252Acute Non-Elective 0 0 0.00 0.00 0.00 0 0 0 0 0 0 0 0Acute Other <strong>NHS</strong> 0 127 0.00 0.00 0.00 0 61 (61) 127 0 127 106 233Acute Outpatient 0 50 0.00 0.00 0.00 0 0 0 50 0 50 150 200Other Revenue 0 3,671 0.00 0.00 0.00 0 1,950 (1,950) 2,373 1,298 3,671 1,102 3,475IncTotal Income 0 4,961 0.00 0.00 0.00 0 2,449 (2,449) 3,500 1,461 4,961 1,660 5,160Medical Consultant 0 991 5.90 4.80 1.10 0 676 (676) 585 406 991 113 698Medical Other 0 329 1.95 0.95 1.00 0 239 (239) 145 184 329 28 173Nursing Trained 50 4,814 127.26 30.50 96.76 0 1,782 (1,782) 4,198 616 4,814 851 5,049Nursing Untrained 0 156 0.92 0.00 0.92 0 108 (108) 140 16 156 4 144Science, Prof & Technical 0 1,428 8.68 7.48 1.20 0 933 (933) 501 927 1,428 85 586Admin 9+ 0 62 0.00 0.00 0.00 0 21 (21) 52 10 62 26 78Admin Band 1-5 0 1,194 72.33 17.43 54.90 0 623 (623) 1,050 144 1,194 355 1,405Admin Band 6-8 0 462 4.76 2.50 2.26 0 361 (361) 154 308 462 6 160Other 5 375 5.10 5.10 0.00 0 241 (241) 103 272 375 39 142IncTotal Pay 55 11,556 9,811 226.90 68.76 158.14 6,864 4,984 1,880 6,928 2,883 9,811 1,506 8,434IncDrugs 0 1,374 894 0.00 0.00 0.00 816 306 510 894 0 894 205 1,099IncClinical Supplies 0 4,578 2,111 0.00 0.00 0.00 2,719 1,019 1,701 2,052 59 2,111 561 2,613IncNon Clin Supplies 0 1,367 785 0.00 0.00 0.00 812 603 209 775 10 785 149 924IncOther Non Pay 0 4,360 5,450 0.84 0.00 0.84 2,590 3,433 (843) 3,539 1,896 5,435 1,340 4,879IncTotal Non Pay 0 11,679 9,240 0.84 0.00 0.84 6,937 5,361 1,576 7,260 1,965 9,225 2,254 9,514IncIncTotal U.H.S. 55 23,235 24,012 227.74 68.76 158.98 13,802 12,794 1,007 17,688 6,309 23,997 5,420 23,108

Schedule 8b 2012/13 Month: 8<strong>University</strong> <strong>Hospital</strong> <strong>Southampton</strong> <strong>NHS</strong> FT Savings Programme 2012/13CIP Delivery - Divisional Analysis2012/13 AWL Year to Date Split by: Full Year RollClosed Target Identified Identified Actual Variance UHS Prfl Actual Variance Rec Non Rec Total Effect ForwardAs at Period 08 - November Beds £'000 £'000 WTEs WTEs WTEs £'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000DivisionDivision A 14 4,065 3,687 71.51 19.76 51.75 2,415 1,613 802 3,132 555 3,687 1,321 4,453Division B 31 6,394 5,855 68.27 24.98 43.29 3,798 2,662 1,136 4,798 1,057 5,855 882 5,680Division C 0 5,792 5,224 42.58 13.52 29.06 3,440 2,809 631 3,511 1,713 5,224 1,641 5,152Division D 10 4,659 4,169 43.68 8.80 34.88 2,767 2,269 498 3,558 611 4,169 807 4,365THQ 0 2,326 2,917 1.70 1.70 0.00 1,382 1,910 (528) 1,989 913 2,902 329 2,318Other 0 2,160 0.00 0.00 0.00 0 1,532 (1,532) 700 1,460 2,160 440 1,140UHS Total 55 23,236 24,012 227.74 68.76 158.98 13,802 12,794 1,008 17,688 6,309 23,997 5,420 23,108Schemes split by:Acute A&E 0 0 0 0.00 0.00 0.00 0 0 0 0 0 0 0 0Acute Day Case 0 0 13 0.00 0.00 0.00 0 13 (13) 0 13 13 0 0Acute Elective 0 1,100 0.00 0.00 0.00 0 426 (426) 950 150 1,100 302 1,252Acute Non-Elective 0 0 0.00 0.00 0.00 0 0 0 0 0 0 0 0Acute Other <strong>NHS</strong> 0 127 0.00 0.00 0.00 0 61 (61) 127 0 127 106 233Acute Outpatient 0 50 0.00 0.00 0.00 0 0 0 50 0 50 150 200Other Revenue 0 615 3,671 0.00 0.00 0.00 365 1,950 (1,585) 2,373 1,298 3,671 1,102 3,475IncTotal Income 0 615 4,961 0.00 0.00 0.00 365 2,449 (2,084) 3,500 1,461 4,961 1,660 5,160Medical Consultant 0 991 5.90 4.80 1.10 0 676 (676) 585 406 991 113 698Medical Other 0 329 1.95 0.95 1.00 0 239 (239) 145 184 329 28 173Nursing Trained 50 4,814 127.26 30.50 96.76 0 1,782 (1,782) 4,198 616 4,814 851 5,049Nursing Untrained 0 156 0.92 0.00 0.92 0 108 (108) 140 16 156 4 144Science, Prof & Technical 0 1,428 8.68 7.48 1.20 0 933 (933) 501 927 1,428 85 586Admin 9+ 0 62 0.00 0.00 0.00 0 21 (21) 52 10 62 26 78Admin Band 1-5 0 1,194 72.33 17.43 54.90 0 623 (623) 1,050 144 1,194 355 1,405Admin Band 6-8 0 462 4.76 2.50 2.26 0 361 (361) 154 308 462 6 160Other 5 375 5.10 5.10 0.00 0 241 (241) 103 272 375 39 142IncTotal Pay 55 11,437 9,811 226.90 68.76 158.14 6,794 4,984 1,810 6,928 2,883 9,811 1,506 8,434IncDrugs 0 1,374 894 0.00 0.00 0.00 816 306 510 894 0 894 205 1,099IncClinical Supplies 0 4,609 2,111 0.00 0.00 0.00 2,738 1,019 1,719 2,052 59 2,111 561 2,613IncNon Clin Supplies 0 1,367 785 0.00 0.00 0.00 812 603 209 775 10 785 149 924IncOther Non Pay 0 3,834 5,450 0.84 0.00 0.84 2,277 3,433 (1,156) 3,539 1,896 5,435 1,340 4,879Total Non Pay 0 11,184 9,240 0.84 0.00 0.84 6,643 5,361 1,282 7,260 1,965 9,225 2,254 9,514IncTotal U.H.S. 55 23,236 24,012 227.74 68.76 158.98 13,802 12,794 1,008 17,688 6,309 23,997 5,420 23,108

Schedule 9 2013/142012/13 Month: 8 Actual Actual Actual Actual Forecast Forecast Forecast Forecast ForecastOriginalAnnual PlanForecastOutturn YTD Plan YTD Actual Quarter 1 Quarter 2 October November December Quarter 3 Quarter 4 Quarter 1 Quarter 2CASHFLOW £000s £000s £000s £000s £000s £000s £000s £000s £000s £000s £000s £000s £000sSurplus (deficit) after tax 3,606 360 3,474 3,052 1,030 615 517 891 504 1,912 (3,196) 955 547Finance income / charges 1,536 1,620 716 716 277 284 71 83 226 381 678 738 747Depreciation and amortisation, total 21,640 21,640 14,040 13,610 5,029 4,987 1,845 1,749 2,007 5,601 6,023 6,111 6,111Impairment losses / (reversals) 2,400 5,556 0 225 (16) 220 (13) 34 0 21 5,331 0 0Gain / (loss) on disposal of property plant and equipment 0 9 0 9 0 0 9 0 0 9 0 0 0PDC Dividend expense 7,341 7,000 4,894 4,633 1,735 1,740 579 579 587 1,745 1,780 1,836 1,836EBITDA 36,522 36,185 23,124 22,245 8,056 7,845 3,008 3,337 3,324 9,669 10,616 9,640 9,241Other Non Cash movements with profit/(loss) from operations 0 0 0 0 0 0 0 0 0 0 0 0 0Operating cash flows before movements in working capital 36,522 36,185 23,124 22,245 8,056 7,845 3,008 3,337 3,324 9,669 10,616 9,640 9,241Increase / (decrease) in working capital:(Increase)/decrease in Inventories 1,607 1,607 1,107 (780) (397) 460 (1,219) 376 2,087 1,244 300 0 0(Increase)/decrease in <strong>NHS</strong> Trade Receivables 1,603 (129) 1,603 3,101 1,865 1,092 268 (124) (2,230) (2,086) (1,000) (579) 0(Increase)/decrease in Non <strong>NHS</strong> Trade Receivables 165 3,964 (21) 1,615 1,137 648 (1,188) 1,017 2,204 2,033 145 (156) 0(Increase)/decrease in other Receivables (485) (1,730) (485) (818) (2,236) 1,774 96 (453) (912) (1,268) 0 (500) 0(Increase)/decrease in accrued income 0 0 0 0 0 0 0 0 0 0 0(Increase)/decrease in Other financial assets (323) (2,426) 277 (13,399) (3,036) (2,360) (2,970) (5,032) 4,652 (3,350) 6,321 500 0(Increase)/decrease in Prepayments (3) (3) (3) (1,968) (2,938) 364 324 282 665 1,271 1,300 (1,800) 0(Increase)/decrease in Other assets (non-charitable) 0 0 0 0 0 0 0 0 0 0 0 0 0Increase/(decrease) in Deferred Income (5,915) (4,454) (2,515) 1,753 (1,778) 1,059 1,863 608 (2,729) (257) (3,478) 78 0Increase/(decrease) in Provisions (29) 0 (29) 0 0 0 0 0 0 0 0 0 0Increase/(decrease) in post employment benefit obligations 0 0 0 0 0 0 0 0 0 0 0 0 0Increase/(decrease) in Trade Creditors - <strong>NHS</strong> 0 (580) 0 36 241 (1,655) 1,280 170 (706) 744 90 407 0Increase/(decrease) in Trade Creditors - Non-<strong>NHS</strong> (7,905) (8,144) (8,933) (9,436) (8,407) 18 452 (1,499) (2,876) (3,923) 4,168 (578) 178Increase/(decrease) in Other Creditors (728) (728) (728) 322 328 286 (398) 107 (1,050) (1,342) 0 0 0Increase/(decrease) in PDC Dividend Creditor 0 0 0 0 0 0 0 0 0 0 0Increase/(decrease) in accruals (2,551) (2,653) (2,551) 3,160 1,041 3,835 (1,366) (349) (5,313) (7,028) (500) 0 0Increase/(decrease) in other financial liabilities (10) 0 (10) 0 0 0 0 0 0 0 0 0 0Increase/(decrease) in Other liabilities (non-charitable) 0 (79) 0 0 0 0 0 0 (79) (79) 0 0 0Increase/(decrease) in Other liabilities (charitable) 0 0 0 0 0 0 0 0 0 0 0 0 0Movements in working capital (14,574) (15,353) (12,288) (16,412) (14,180) 5,522 (2,859) (4,896) (6,287) (14,042) 7,346 (2,628) 178NET CASHFLOW FROM OPERATING ACTIVITIES 21,949 20,832 10,836 5,833 (6,124) 13,367 149 (1,559) (2,963) (4,373) 17,962 7,012 9,419Cash flow from investing activitiesProperty, plant and equipment - maintenance (16,956) (21,154) (11,304) (13,044) (3,595) (5,991) (2,044) (1,414) (2,027) (5,485) (6,083) (3,840) (5,401)Property, plant and equipment - replacements 0 0 0 0 0 0 0 0 0 0 0Property, plant and equipment - new builds and enhancements 0 0 0 0 0 0 0 0 0 0 0Proceeds on disposal of property, plant and equipment 0 0 0 0 0 0 0 0 0 0 0Purchase of intangible assets 0 0 0 0 0 0 0 0 0 0 0Proceeds on disposal of intangible assets 0 0 0 0 0 0 0 0 0 0 0Increase / (decrease) in capital creditors (1,850) (1,851) (1,850) (2,362) (2,275) (297) 1,376 (1,166) 511 721 0 0 0Government grants received 0 0 0 0 0 0 0 0 0 0 0Purchase of current asset investments 0 0 0 0 0 0 0 0 0 0 0Proceeds on disposal of current asset investments 0 0 0 0 0 0 0 0 0 0 0Other Cashflows from investing activities 0 0 0 0 0 0 0 0 0 0 0NET CASH INFLOW (OUTFLOW) FROM INVESTING ACTIVITIES (18,806) (23,005) (13,154) (15,406) (5,870) (6,288) (668) (2,580) (1,516) (4,763) (6,083) (3,840) (5,401)NET CASH INFLOW / (OUTFLOW) BEFORE FINANCING 3,143 (2,173) (2,318) (9,573) (11,994) 7,079 (519) (4,139) (4,479) (9,137) 11,879 3,172 4,018Cash flow from financing activitiesPublic Dividend Capital received 0 0 0 0 0 0 0 0 0 0 0 0 0Public Dividend Capital repaid (0) 0 (0) 0 0 0 0 0 0 0 0 0 0Dividends paid (7,341) (6,649) (3,670) (3,129) 0 (3,129) 0 0 0 0 (3,520) 0 (3,670)Interest (paid) on non-commercial loans (1,597) (863) (625) (439) 0 (439) 0 0 0 0 (424) 0 (437)Interest (paid) on bank overdrafts 0 0 0 0 0 0 0 0 0 0 0Interest element of finance lease rental payments 0 (862) 0 (214) (83) (80) (26) (26) (162) (213) (486) (543) (543)Capital element of finance lease rental payments 0 (4,016) 0 (2,169) (952) (755) (317) (145) (469) (931) (1,378) (1,326) (1,335)Interest received on Cash and Cash equivalents 63 94 41 74 23 27 13 11 5 29 15 15 15Movement in other grants / capital recceived 0 0 0 0 0 0 0 0 0 6 15Drawdown / (repayment) of overdraft 0 0 0 0 0 0 0 0 0 0 0 0 0Drawdown / (repayment of working capital facility 0 0 0 0 0 0 0 0 0 0 0 0 0Drawdown of non-commercial loans 5,000 5,000 5,000 5,000 0 5,000 0 0 0 0 0 0 0Repayment of non-commercial loans (8,385) (3,381) (4,786) (1,696) (5) (1,688) (2) (1) 0 (3) (1,685) 0 (1,935)(Increase) / decrease in non-current receivables 0 (751) 0 (879) (120) (499) (190) (69) 128 (131) 0 0 0Increase / (decrease) in non-current payables 0 (238) 0 (236) (26) (190) 11 (31) (2) (22) 0 116 (12)Other cash flows from financing activities 1 0 1 0 0 0 0 0 0 0 0 0 0NET CASH INFLOW (OUTFLOW) FROM FINANCING (12,259) (11,665) (4,039) (3,687) (1,162) (1,753) (511) (261) (500) (1,272) (7,478) (1,732) (7,902)NET INCREASE / (DECREASE) IN CASH AND CASH EQUIVALENTS (9,117) (13,838) (6,357) (13,260) (13,156) 5,326 (1,029) (4,400) (4,979) (10,408) 4,401 1,440 (3,884)Opening Cash and Cash Equivalents 29,540 29,540 29,540 29,540 29,540 16,384 21,710 20,680 16,280 21,710 11,301 15,702 17,142Closing Cash and Cash Equivalents 20,423 15,702 23,183 16,280 16,384 21,710 20,680 16,280 11,301 11,301 15,702 17,142 13,258

Schedule 10Finance Risk Indicators:Y/N1 Unplanned decrease in (quarterly) EBITDA margin in two consecutive quarters N2 Self-certification by trust that the Quarterly FRR may be less than 3 in the next 12 months N3 FRR 2 (or less) for any one quarter N4 Working capital facility (WCF) agreement includes default clause N5 Debtors > 90 days past due account for more than 5% of total debtor balances N6 Creditors > 90 days past due account for more than 5% of total creditor balances N7 Two or more changes in Finance Director in a twelve month period N8 Interim Finance Director in place over more than one quarter end N9 Quarter end cash balance 125% of plan for the year to date NTo be reported by exception only:1 Unplanned significant reductions in income or significant increases in costs N2 Requirements for additional working capital facilities beyond those incorporated in the Prudential NBorrowing Limit (PBL)3 Failure to comply with the <strong>NHS</strong> Foundation <strong>Trust</strong> Annual Reporting Manual N4 Discussions with external auditors which may lead to a qualified audit report N5 Transactions potentially affecting the risk rating and/or resulting in an "investment adjustment" N6 Proposed disposals of protected assets or removal of protected status N

Annex 1Non-Operating Income and Expenditure 2012/13 Month: 8Annual DESCRIPTION Current Quarter CumulativeBUDGET Plan Actual Variance Plan Actual Variance Plan Actual Variance£000's £000's £000's £000's £000's £000's £000's £000's £000's £000'sNon-Operating IncomeFinance Income(70) Interest Income (5) (11) (6) (11) (23) (12) (44) (74) (29)Other Non-Operating Income0 Gain/ (Loss) from Investments 0 0 0 0 0 0 0 0 00 Proft (Loss) on asset disposals 0 0 0 0 0 0 0 0 00 Other Non-Operating Income 0 0 0 0 0 0 0 0 0(70) Total Non-Operating Income (5) (11) (6) (11) (23) (12) (44) (74) (29)Non-Operating ExpensesFinance Costs0 Interest Expense on Overdrafts and Working Capital Facilities 0 0 0 0 0 0 0 0 0493 Interest Expense on Non-Commercial Borrowings 42 69 27 58 126 68 297 574 277985 Interest Expense on Finance Leases 89 16 (73) 178 32 (146) 375 132 (243)132 Interest Expense on PFI leases and liabilities 11 10 (1) 22 20 (2) 88 83 (5)Depreciation and Amortisation21,642 Depreciation and Amortisation 1,890 1,749 (141) 3,780 3,594 (186) 14,040 13,610 (430)0 Depreciation and Amortisation - finance leases 0 0 0 0 0 0 0 0 00 Profit (Loss) on Asset Disposals 0 0 0 0 9 9 0 9 97,341 PDC Dividend Expense 612 579 (33) 1,224 1,158 (65) 4,894 4,633 (261)0 Expenditure of <strong>NHS</strong> Charitable Funds 0 0 0 0 0 0 0 0 00 Other Non-Operating Expenses 0 0 0 0 0 0 0 0 030,593 Total Non-Operating Expenses 2,644 2,422 (222) 5,262 4,939 (323) 19,694 19,041 (653)

Annex 2DIVISIONAL/HEADQUARTERS INCOME 2012/13 Month 8Annual Current Current Current Budget Actual Variance Budget Actual VarianceBudget Month Month Month Quarter Quarter To Date To Date To Date To DateBudget Actual Variance£000's £000's £000's £000's £000's £000's £000's £000's £000's £000'sAdv. Adv. Adv.Divisions (Fav.) (Fav.) (Fav.)Surgery (466) (39) (16) 23 (78) (43) 35 (311) (247) 63Cancer Care (6,902) (577) (608) (31) (1,266) (1,332) (66) (4,761) (4,925) (164)Critical Care (824) (66) (103) (37) (69) (172) (103) (562) (519) 42Division A Management 1,612 133 (133) 316 2 (314) 1,247 2 (1,244)Sub Total Division A (6,580) (548) (727) (178) (1,097) (1,545) (448) (4,387) (5,689) (1,303)Specialist Medicine (1,526) (126) (119) 6 (251) (262) (10) (1,053) (1,047) 6Emergency Care (87) (2) (6) (4) (4) (24) (20) (78) (121) (43)Division B Management 260 178 (178) 160 (0) (160) 341 (0) (341)Sub Total Division B (1,352) 50 (125) (175) (95) (286) (190) (790) (1,168) (378)Women and Newborn (1,605) (138) (145) (7) (273) (288) (16) (1,065) (965) 100Child Health (647) (55) (68) (13) (109) (121) (11) (428) (436) (8)Clinical Support (2,631) (218) (267) (49) (432) (494) (62) (1,761) (1,876) (115)Non Clinical Support (4,059) (333) (362) (28) (639) (748) (109) (2,739) (3,021) (281)Division C Management 818 67 (67) 99 (99) 577 (577)Sub Total Division C (8,124) (677) (841) (164) (1,354) (1,651) (297) (5,416) (6,297) (881)Trauma & Orthopaedics (25) (2) (0) 2 (4) (0) 4 (17) (28) (11)Cardiothoracic (438) (37) (27) 9 (73) (73) (0) (292) (254) 38Neurosciences (359) (30) (17) 12 (60) (63) (3) (239) (264) (24)Pathology (4,629) (386) (383) 3 (772) (770) 2 (3,085) (3,007) 78Radiology (3,577) (469) (407) 61 (743) (759) (17) (2,454) (2,461) (8)Division D Management (147) (12) (1) 12 (25) (1) 24 (97) (10) 87Sub Total Division D (9,175) (936) (835) 100 (1,676) (1,666) 10 (6,184) (6,024) 159Divisions Total (25,231) (2,111) (2,528) (417) (4,222) (5,147) (925) (16,776) (19,179) (2,403)HeadquartersStrategy (992) (84) (87) (3) (168) (170) (2) (657) (696) (40)Finance (50) (4) (13) (9) (8) (16) (8) (33) (43) (10)Estates (1,914) (160) (173) (14) (319) (372) (53) (1,276) (1,409) (133)Clinical Governance (118) (7) (27) (20) (17) (8) 9 (96) (62) 34Medical Director (1) (1) (1) (1) (2) (2)Training and Development (181) (15) (106) (91) (30) (76) (46) (120) (436) (316)Chief Executive Office (521) (55) (97) (42) (124) (155) (31) (349) (407) (58)Research & Development (18,388) (89) (1,516) (1,427) (2,100) (3,170) (1,071) (12,259) (12,058) 201Human Resources (1,690) (142) (164) (21) (271) (304) (33) (1,120) (1,159) (39)IM&T (911) (76) (57) 18 (173) (129) 44 (608) (592) 16Other Services (4,028) (1,480) (366) 1,114 (1,015) (952) 62 (473) (3,397) (2,924)CLRN (9,816) (818) (710) 108 (1,636) (1,663) (27) (6,544) (6,625) (81)SWPHO (6,956) (580) (402) 178 (1,159) (876) 283 (4,637) (3,841) 796OPA's (0) (0) (0) (0)Clinical Neg/Employer Liab. (27) (2) (7) (5) (5) (8) (3) (18) (54) (36)Headquarters Total (45,591) (3,512) (3,727) (214) (7,024) (7,900) (876) (28,191) (30,783) (2,592)Division/Headquarters Total (70,822) (5,623) (6,255) (632) (11,246) (13,047) (1,801) (44,967) (49,961) (4,995)Balance sheet. (0) (0) (0) (0) (1) (1)Capital Programme (194) (194) (304) (304) (1,153) (1,153)Central Reserves 3,360 7 (7) 14 (14) (27) 27Corporate Costs 0 (0) (2) 2Total Divisional Income (67,462) (5,616) (6,449) (833) (11,233) (13,352) (2,119) (44,995) (51,115) (6,120)MEMORANDUMDIVISIONAL INCOME BY SUBJECTIVEPrivate Patients (5,104) (425) (520) (95) (851) (1,003) (152) (3,403) (3,218) 185Overseas Visitors (285) (24) (29) (5) (48) (84) (36) (190) (270) (80)CRU (2,547) (212) (217) (5) (425) (604) (180) (1,698) (2,372) (674)Research & development. (26,347) (2,196) (2,275) (79) (4,391) (4,976) (585) (17,565) (19,248) (1,683)Patient Income (50) (4) (3) 1 (8) (8) (0) (33) (25) 8Nursery Fees (1,416) (118) (74) 44 (236) (159) 77 (944) (760) 184Non-Patient Care Services to other Bodies (12,030) (1,011) (1,095) (84) (2,012) (2,279) (267) (7,974) (9,130) (1,156)Car Parking (3,221) (271) (299) (28) (542) (604) (62) (2,136) (2,256) (120)Staff accommodation rentals (70) (6) (3) 3 (12) (7) 4 (47) (32) 15Cancer Drugs Fund (4,814) (361) (453) (92) (882) (949) (67) (3,369) (3,659) (289)Donated Income (1,556) (130) (129) 1 (259) (307) (48) (1,037) (598) 440Charitable and Other Contributions to Expenditure (724) (60) (58) 2 (121) (118) 2 (483) (748) (265)Hosted Services Income (6,956) (580) (402) 178 (1,159) (876) 283 (4,637) (3,841) 796Other Income (2,341) (218) (891) (673) (287) (1,375) (1,088) (1,479) (4,960) (3,481)Total Divisional Income by Subjective (67,461) (5,616) (6,449) (833) (11,233) (13,352) (2,119) (44,995) (51,115) (6,120)Being Other Operating Income (74,420) see schedule 4plus Non <strong>NHS</strong> Clinical Revenue (5,590)less Education Income 26,347Clinical Excellence Awards 2,547(51,115)