Trust Board papers - University Hospital Southampton NHS ...

Trust Board papers - University Hospital Southampton NHS ...

Trust Board papers - University Hospital Southampton NHS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

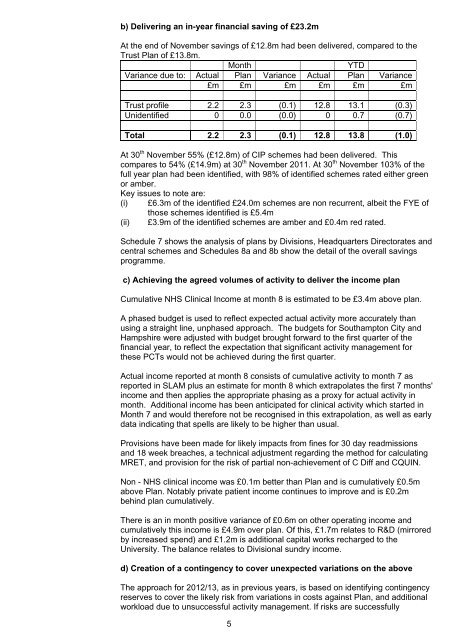

) Delivering an in-year financial saving of £23.2mAt the end of November savings of £12.8m had been delivered, compared to the<strong>Trust</strong> Plan of £13.8m.Month YTDVariance due to: Actual Plan Variance Actual Plan Variance£m £m £m £m £m £m<strong>Trust</strong> profile 2.2 2.3 (0.1) 12.8 13.1 (0.3)Unidentified 0 0.0 (0.0) 0 0.7 (0.7)Total 2.2 2.3 (0.1) 12.8 13.8 (1.0)At 30 th November 55% (£12.8m) of CIP schemes had been delivered. Thiscompares to 54% (£14.9m) at 30 th November 2011. At 30 th November 103% of thefull year plan had been identified, with 98% of identified schemes rated either greenor amber.Key issues to note are:(i) £6.3m of the identified £24.0m schemes are non recurrent, albeit the FYE ofthose schemes identified is £5.4m(ii) £3.9m of the identified schemes are amber and £0.4m red rated.Schedule 7 shows the analysis of plans by Divisions, Headquarters Directorates andcentral schemes and Schedules 8a and 8b show the detail of the overall savingsprogramme.c) Achieving the agreed volumes of activity to deliver the income planCumulative <strong>NHS</strong> Clinical Income at month 8 is estimated to be £3.4m above plan.A phased budget is used to reflect expected actual activity more accurately thanusing a straight line, unphased approach. The budgets for <strong>Southampton</strong> City andHampshire were adjusted with budget brought forward to the first quarter of thefinancial year, to reflect the expectation that significant activity management forthese PCTs would not be achieved during the first quarter.Actual income reported at month 8 consists of cumulative activity to month 7 asreported in SLAM plus an estimate for month 8 which extrapolates the first 7 months'income and then applies the appropriate phasing as a proxy for actual activity inmonth. Additional income has been anticipated for clinical activity which started inMonth 7 and would therefore not be recognised in this extrapolation, as well as earlydata indicating that spells are likely to be higher than usual.Provisions have been made for likely impacts from fines for 30 day readmissionsand 18 week breaches, a technical adjustment regarding the method for calculatingMRET, and provision for the risk of partial non-achievement of C Diff and CQUIN.Non - <strong>NHS</strong> clinical income was £0.1m better than Plan and is cumulatively £0.5mabove Plan. Notably private patient income continues to improve and is £0.2mbehind plan cumulatively.There is an in month positive variance of £0.6m on other operating income andcumulatively this income is £4.9m over plan. Of this, £1.7m relates to R&D (mirroredby increased spend) and £1.2m is additional capital works recharged to the<strong>University</strong>. The balance relates to Divisional sundry income.d) Creation of a contingency to cover unexpected variations on the aboveThe approach for 2012/13, as in previous years, is based on identifying contingencyreserves to cover the likely risk from variations in costs against Plan, and additionalworkload due to unsuccessful activity management. If risks are successfully5