Trust Board papers - University Hospital Southampton NHS ...

Trust Board papers - University Hospital Southampton NHS ...

Trust Board papers - University Hospital Southampton NHS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

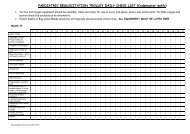

managed out, these reserves will become available to put into the central “bank” towhich bids for funding to improve services, quality and the hospital environment, canbe made.Cash & LiquidityThe period end cash balance at £16.3m was £6.9m below plan due mainly toincreased working capital balances(£4.1m) higher net capital expenditure (£2.2m)and lower cash generated from earnings (£0.9m) partly offset by lower financingcosts (£0.3m).The year end cash forecast at £15.7m is £4.7m lower than plan due mainly to highernon cash income within the <strong>Trust</strong> planned surplus and less external income tosupport the capital programme.With a working capital facility in place of £43m, the current financial position resultsin a liquidity rating of 3 and an overall Monitor risk rating of 3 (Schedule 1 and Annex5). This is forecast to remain a 3 at the year end.Schedule 1 also shows some key balance sheet indicators.Annex 4 shows cumulative capital expenditure compared to Plan. £12.7m has beenspent to date, £1.1m less than the updated Plan. £1.9m of new finance leases havebeen taken out in the first eight months of the year, compared to a Plan of £3.9m.ForecastA review of the year end Forecast was carried out in the light of October’s results.Whilst the forecast remains in line with Plan there was a level of control actionrequired to ensure the <strong>Trust</strong> delivers the planned surplus for the year. There will be afurther review of progress following the production of the November.RisksIdentifiedDescriptionPotentialValue £mLikelihoodWeightedvalue £mMitigationRisksOveralldemandlevelsThe <strong>Trust</strong> isanticipating incomein excess ofcontracted levels,based on capacityin place to deliveranticipated demandand experience ofdrug growth£15m L -10%£1.5m Ensure that paymentsfor overperformanceare secured. If activitydoes not occur ensurethat capacity andcosts are reducedaccordingly.CIPsNon-delivery ofCIPs£5m M –50%£2.5m Strong performancemanagementActivityManagementCost reductionrequired inresponse tosuccessful ActivityManagement.(NB: This risk andthe risks regarding“overall demandlevels” abovecannot becompounded).£5m L –10%£0.5m Ensure fullengagement in ActivityManagement; ensurecosts which can beremoved are removed.DivisionaloverspendingRisks ofoverspending dueto operationalpressures, capacityissues etc£10m M-50%£5.0m Strong performancemanagement.6