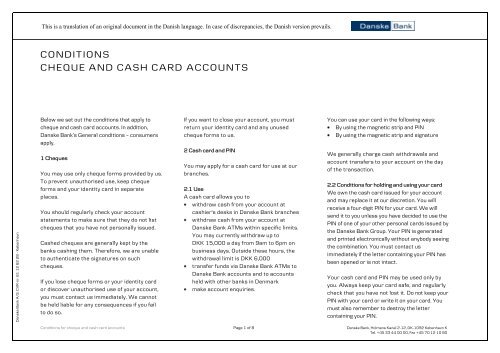

Conditions Cheque and Cash Card Accounts - Danske Bank

Conditions Cheque and Cash Card Accounts - Danske Bank

Conditions Cheque and Cash Card Accounts - Danske Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Danske</strong> <strong>Bank</strong> A/S. CVR-nr. 61 12 62 28 - København7 Register of persons having committedcheque or card fraudIf we close your account because of an excess inthe account, your CPR number may be entered inthe Danish banking sector’s register of personshaving committed cheque or card fraud for aperiod of two years beginning from the time ofregistration. During this period, you cannot opennew cheque or card accounts with Danish banks.A person who has fraudulently used acorporate account may also be registered ifthe person exercises financial control over thebusiness in question.8 <strong>Danske</strong> <strong>Bank</strong>’s liability<strong>Danske</strong> <strong>Bank</strong> is liable for the tardy or defectiveperformance of its contractual obligationsresulting from error or negligence. Even in areasof increased liability, <strong>Danske</strong> <strong>Bank</strong> is not liable forlosses arising frombreakdown of or lack of access to IT systemsor damage to data in these systems due toany of the factors listed below <strong>and</strong> regardlessof whether or not <strong>Danske</strong> <strong>Bank</strong> or a thirdpartysupplier is responsible for the operationof these systemspower failure or a breakdown of <strong>Danske</strong><strong>Bank</strong>’s telecommunications, legislative oradministrative intervention, acts of God, war,revolution, civil unrest, sabotage, terrorism orv<strong>and</strong>alism (including computer virus attacksor hacking)strikes, lockouts, boycotts or picketing,regardless of whether <strong>Danske</strong> <strong>Bank</strong> or itsorganisation is itself a party to or has startedsuch conflict <strong>and</strong> regardless of its cause (thisalso applies if the conflict affects only part of<strong>Danske</strong> <strong>Bank</strong>)other circumstances beyond <strong>Danske</strong> <strong>Bank</strong>’scontrol.<strong>Danske</strong> <strong>Bank</strong> is not exempt from liability if<strong>Danske</strong> <strong>Bank</strong> ought to have foreseen thecause of the loss when the agreement wasconcluded or ought to have avoided orovercome the cause of the lossunder Danish law, <strong>Danske</strong> <strong>Bank</strong> is liable forthe cause of the loss under anycircumstances.9 New copies of these conditionsIf you need a new copy of these conditions, pleasecontact your branch.10 ComplaintsYou should always contact your branch in case ofa disagreement on your business relationshipwith us to make sure that such disagreement isnot based on a misunderst<strong>and</strong>ing. Alternatively,you can call us on tel. +45 33 44 00 00 (openseven days a week).If you still disagree or are not satisfied with theoutcome of your complaint, you may contact<strong>Danske</strong> <strong>Bank</strong>’s Legal department, which is incharge of h<strong>and</strong>ling customer complaints. Theaddress is<strong>Danske</strong> <strong>Bank</strong>Legal departmentHolmens Kanal 2-12DK-1092 København K<strong>Conditions</strong> for cheque <strong>and</strong> cash card accounts Page 5 of 8 <strong>Danske</strong> <strong>Bank</strong>, Holmens Kanal 2-12, DK-1092 København KTel. +45 33 44 00 00, Fax +45 70 12 10 80

<strong>Danske</strong> <strong>Bank</strong> A/S. CVR-nr. 61 12 62 28 - KøbenhavnIf you are dissatisfied with the outcome, you maysubmit a complaint toThe Danish Complaint Board of <strong>Bank</strong>ing Services(Pengeinstitutankenævnet)Østerbrogade 62, 4. salDK-2100 København ØTel. +45 35 43 63 33www.pengeinstitutankenaevnet.dkThe Danish Data Protection Agency(Datatilsynet)Borgergade 28, 5. salDK-1300 København Kdt@datatilsynet.dk.Latest update: August 2009. Effective from 1November 2009.orThe Danish Consumer OmbudsmanThe National Consumer Agency of DenmarkAmagerfælledvej 56DK-2300 København SIf you wish to complain about <strong>Danske</strong> <strong>Bank</strong>’s useof your personal data, you must contact<strong>Danske</strong> <strong>Bank</strong>Legal departmentHolmens Kanal 2-12DK-1092 København Kor<strong>Conditions</strong> for cheque <strong>and</strong> cash card accounts Page 6 of 8 <strong>Danske</strong> <strong>Bank</strong>, Holmens Kanal 2-12, DK-1092 København KTel. +45 33 44 00 00, Fax +45 70 12 10 80

<strong>Danske</strong> <strong>Bank</strong> A/S. CVR-nr. 61 12 62 28 - København(7) Notwithst<strong>and</strong>ing the provisions of (2)–(6)hereof, the payer's provider is liable for anyunauthorised use after the provider was notifiedthat the payment instrument had been lost, thatthe personalised security feature had come tothe knowledge of an unauthorised person, or thatthe payer required the payment instrument to beblocked for any other reason.(8) Notwithst<strong>and</strong>ing the provisions of (2)–(6)hereof, the payer’s provider is liable for anyunauthorised use if the provider did not provideappropriate means, cf. section 60(1)(ii).(9) Moreover, notwithst<strong>and</strong>ing the provisionsof (2)–(6) hereof, the payer’s provider is liable ifthe payee knew or ought to know that the use ofthe payment instrument was unauthorised.(10) It may be agreed that (1)–(6) hereof shallnot apply to micro-payment instruments usedanonymously, or where the nature of the micropaymentinstrument makes the payer’s providerunable to prove that the payment transactionwas authorised. It may furthermore be agreedthat (7) <strong>and</strong> (8) hereof shall not apply to micropaymentinstruments where the nature of thepayment instrument makes it impossible to blockits use.(11) The provisions of (1)–(6) hereof apply toe-money except where the payer’s provider ofe-money is unable to block the payment accountor the payment instrument.63. Contestations concerning unauthorised orincorrectly executed payment transactions mustbe received by the provider as soon as possible<strong>and</strong> not later than 13 months after the debit dateof the relevant payment transaction.Contestations from the payee must be receivedwithin 13 months of the credit date. Where theprovider has not provided information or madeinformation available under Part 5, the deadlineis calculated from the date on which the providerprovided information or made informationavailable.64.–(1) The provider has the burden of proofwith respect to a payment transaction beingaccurately recorded <strong>and</strong> entered in the accounts<strong>and</strong> not affected by a technical breakdown orsome other deficiency. In connection with the useof a payment instrument, the providerfurthermore has to prove that the paymentinstrument’s personalised security feature wasused in connection with the payment transaction.The recorded use of a payment instrument is notin itself proof that the payer authorised thetransaction, that the payer acted fraudulently orfailed to fulfil his obligations, cf. section 59.(2) It may be agreed that (1) hereof shall notapply to micro-payment instruments usedanonymously, or where the nature of the paymentinstrument makes the provider unable to provethat the payment transaction was authorised.<strong>Conditions</strong> for cheque <strong>and</strong> cash card accounts Page 8 of 8 <strong>Danske</strong> <strong>Bank</strong>, Holmens Kanal 2-12, DK-1092 København KTel. +45 33 44 00 00, Fax +45 70 12 10 80