132World2000 Bank and investor anxietyBy cruelly juxtaposing the minimum 300 billion laid out for some seventy 3G licences and the deployment ofUMTS networks, along with the uncertain complementary revenues that these new services will generate,these difficulties brought analysts to pass increasingly harsh judgement on telecoms operators; within a matterof months, telecoms values had tumbled down, in the same manner as their Internet counterparts had: losingclose to half their value (some $500 billion) in 2000. Even though the average decrease was not quite sodramatic, it did represent over 50% for KPN (-74,3%), BT (-60,89%), and DT(-55%).The evolution and the downslide of share prices served to spotlight the level of debt being suffered byoperators and new entrants for whom the gushing capital is virtually dammed up, in both Europe and the US,as it is for the sector's leading players. The top three European operators' debts in late 2000 ranged from over46 billion euros for BT to 65 billion for DT, with France Telecom 60 billion in the red.In such a landscape, it was by no means surprising to see the spectacular escalation in the amounts ofsyndicated loans granted to telecoms firms during 2000, particularly in Europe (and at another level in Asia)Syndicated loans granted to telecom companiesArea 1998 1999 2000 (million $)W-Europe 32,114 113,324 238,179E-Europe 1,610 1,945 3,699N.America 116,631 128,082 145,095S.E.Asia 2,122 1,927 35,560WW. Total 167,255.06 264,470.63 438,829Source: Capital Data/La Lettre des TélécommunicationsNaturally, this situation attracted the attention of credit rating agencies, and it is likely that certain incumbentoperators with an insufficient debt:equity capital ratio will find their rating demoted to B. In addition to pullingout of non-strategic shareholdings, operators are reacting by launching an increasing number of IPOs for theirmobile and Internet subsidiaries. Telefonica went public with its Terra Nova Internet subsidiary, which hadtaken over Lycos, a leading American portal, while France Telecom, after having put Wanadoo onto theexchange, is getting ready to do the same with Orange, which is now its mobile subsidiary. DT (which was apioneer in this trend with the public offering of T-Online), is expected to follow suit with T-Mobile. While thesesales of shares represent only a fraction of the capital, and do not directly undermine headquarter operations,they do contribute — by isolating growth values — to underlining traditional telephony's gradually dwindlingrevenues. Here, the uncertainties which accompany BT's announced restructuring in the last quarter of 2000,gave rise to questions on the correlation with the latest break-up of AT&T…High-speed taking baby stepsWhile mobiles and all the issues surrounding UMTS licences dominate the debates in Europe, the issuesrelating to the conditions required for the progression of high-speed technologies were also present. At theend of 2000, however, the US took a lead in this field, particularly thanks to the advent of copper pairtechnologies, i.e. DSL (Digital Subscriber Loop). At the end of last year, there were over 2.1 million DSL lines,representing a significant increase given the fact that there were only 600,000 marketed lines at the end ofthe first half of the year. This growth took place after a two year period of stagnation, during which investmentswere made in operating centres and negotiations undertaken for the application of unbundling rules. In theUS, these rules were included in the 1996 Telecom Act, a fact which do not spare the country from a number© IDATE www.idate.fr

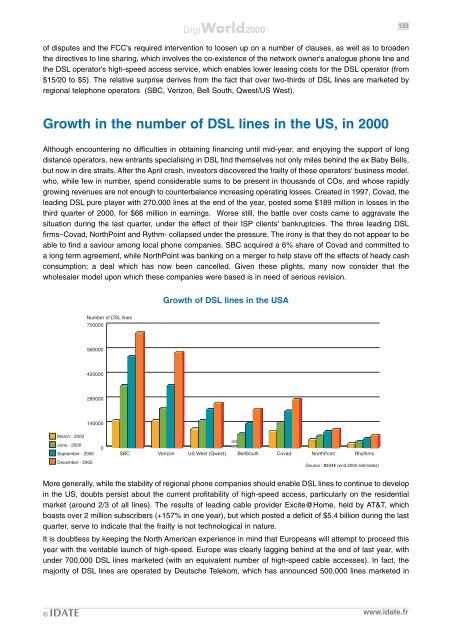

World2000 133of disputes and the FCC's required intervention to loosen up on a number of clauses, as well as to broadenthe directives to line sharing, which involves the co-existence of the network owner's analogue phone line andthe DSL operator's high-speed access service, which enables lower leasing costs for the DSL operator (from$15/20 to $5). The relative surprise derives from the fact that over two-thirds of DSL lines are marketed byregional telephone operators (SBC, Verizon, Bell South, Qwest/US West).Growth in the number of DSL lines in the US, in 2000Although encountering no difficulties in obtaining financing until mid-year, and enjoying the support of longdistance operators, new entrants specialising in DSL find themselves not only miles behind the ex Baby Bells,but now in dire straits. After the April crash, investors discovered the frailty of these operators' business model,who, while few in number, spend considerable sums to be present in thousands of COs, and whose rapidlygrowing revenues are not enough to counterbalance increasing operating losses. Created in 1997, Covad, theleading DSL pure player with 270,000 lines at the end of the year, posted some $189 million in losses in thethird quarter of 2000, for $66 million in earnings. Worse still, the battle over costs came to aggravate thesituation during the last quarter, under the effect of their ISP clients' bankruptcies. The three leading DSLfirms–Covad, NorthPoint and Rythm- collapsed under the pressure. The irony is that they do not appear to beable to find a saviour among local phone companies. SBC acquired a 6% share of Covad and committed toa long term agreement, while NorthPoint was banking on a merger to help stave off the effects of heady cashconsumption; a deal which has now been cancelled. Given these plights, many now consider that thewholesaler model upon which these companies were based is in need of serious revision.Growth of DSL lines in the USANumber of DSL lines700000560000420000280000140000March - 2000June - 2000September - 2000December - 20000SBCVerizonUS West (Qwest)ndBellSouthCovadNorthPointRhythmsSource : IDATE (end 2000 estimates)More generally, while the stability of regional phone companies should enable DSL lines to continue to developin the US, doubts persist about the current profitability of high-speed access, particularly on the residentialmarket (around 2/3 of all lines). The results of leading cable provider Excite@Home, held by AT&T, whichboasts over 2 million subscribers (+157% in one year), but which posted a deficit of $5.4 billion during the lastquarter, serve to indicate that the frailty is not technological in nature.It is doubtless by keeping the North American experience in mind that Europeans will attempt to proceed thisyear with the veritable launch of high-speed. Europe was clearly lagging behind at the end of last year, withunder 700,000 DSL lines marketed (with an equivalent number of high-speed cable accesses). In fact, themajority of DSL lines are operated by Deutsche Telekom, which has announced 500,000 lines marketed in© IDATE www.idate.fr