e r 2 - Umgeni Water

e r 2 - Umgeni Water

e r 2 - Umgeni Water

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WF2WaFiv20atev01er fUve11forUe-Y1/r GmY/2rowmYe20wtmgea01th agear1aner2d SenB2 tSuniButostai WusoainWsi2nabWn20bleWane01e Dates15Devtess5/veloes P/2operP20pmerla01enan16ntn6

| Table of Contents ChapterTable of ContentsPageChapter 1. Foreword by the Chief Executive 3Chapter 2. Introduction and Strategy 5Chapter 3. Policy Statement 19Chapter 4. Directives by the Minister 21Chapter 5. Self-Appraisal 23Chapter 6. Participation in Companies 27Chapter 7. <strong>Water</strong> Resources 29Chapter 8. Bulk Potable <strong>Water</strong> Supply Plan 41Chapter 9. Bulk Wastewater Treatment and Disposal 57Chapter 10. Retail Supply 59Chapter 11. Other Activities (Section 30) 61Chapter 12. Human Resources Plan 65Chapter 13. Environmental Management Programmes and Plans 73Chapter 14. <strong>Water</strong> Conservation and Demand Management Plan 77Chapter 15. Financial Plan 79Chapter 16. Debt Management and Funding Requirements 122Chapter 17. Materiality and Significance Framework 132Chapter 18. Financial Ratios 135Chapter 19. Self-Evaluation Statement on Financial Viability 139Chapter 20. Bank Accounts 148Chapter 21. Analysis of Risk 149Chapter 22. Organisational Scorecard 153Chapter 23. Declaration 163<strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016 Page 1

Chapter| Table of ContentsPage 2 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

| Forewordby theChiefExecutiveChapterChapter 1.ForewordbytheChiefExecutiveThis Five-Year Businesss Plan,coveringg the period1 JulyJy 2011to 30 June2016,seeksto comply withh therequirementsof the<strong>Water</strong>ServicesActt (Act 108of 1997),PublicFinance ManagementActt (Act 1 of1999)), andassociatedregulationsandd prescribedguidelines issuedby theDepaDartment of <strong>Water</strong>Affairss andNationalTreasury.Underpinningthee businessplanare:• The February 2011State of o the NationAddress,• The February 2011National BudgetSpeech,• The State of <strong>Water</strong>Accesss andStrategicObjectives for <strong>Water</strong>in KwaZulu-Natal,ass per theKZNDepartmentof Co-operativeGovernanceandd Traditional Affairsoutcomess from its DecDember2010 <strong>Water</strong>Summit,and• OutcOcomesof Governmentand pertinentOutputs cascadingto theExecEcutiveThe Twelvee StrategicAuthorityy (the Minister of <strong>Water</strong> and Environmental Affairs,Edna Molewa), in which water isembeddedas a strategic catalystfor development, criticalto achievementt of government’’s economic growthpathobjectives.Insupportof this, , theBoardd of<strong>Umgeni</strong><strong>Water</strong>hass articulated thestrategiess to be achieved,withinn thecontextof<strong>Umgeni</strong><strong>Water</strong>’s mandate.This businesss plan seeks to respondd to thee organisation’s strategiesthrough targtgetingthe inputs,activities andd outputs to t progressively realise the t tenn organisational outcomesof:1. Productt (Bulkk <strong>Water</strong>r and Wastewater)Quality,2. Customer Satisfaction,3. Infrastructuree Stability,4. <strong>Water</strong> ResRourcesAdequacy,5. Stakeholder Understanding and a Support,6. Financial Viability,7. Community andEnvironmental Sustainability,8. Leadershipp and EmployeeDevelopment,9. Operational Resiliency,, and10. Operational Optimisation..Cognisantof customer water demandsin the context of a developmental state, thisbusinessplan identifies theplannedandfunded infrastructuree requiredd too supportt economic growthandenhancerurallivelihoods,committinga total of3.44 billionrand,whichwill bee spenton: :•Economic growth: R 1,524 million;•Enhancingrural livelihoods:: R 1,138 milliomon;•Upgradingandd rehabilitation of infrastructure:R528 million.Overall,theinfrastructuredevelopmentt programmee strives too ensure theorganisation’’s infrastructureis stableandprovidesreliable andsafe bulkbk potablewaterr supply to customersand vulnerablecommunities, whilstensuringwastewater discharges comcmplyy with environmental requirements.<strong>Umgeni</strong><strong>Water</strong>will continuee to provide on-going supportt to municipalities,such as, ass ann implementing agent forthe Greater Mbizanaa RegionalBulk <strong>Water</strong> SupplyScheme,providingoperations supportt forr the bulkdistributionsystemin King SabataDalindyeboLocalMunicipalityandd Nyandeni Local Municipality to t supportthe waterservicesturnaround strategy inORR Tambo DistrictMunicipality..<strong>Umgeni</strong> <strong>Water</strong> Five-YearBusinessPlan | 2011/20122 too 2015/2016Page3

Chapter| Foreword by the ChiefExecutive<strong>Water</strong> resourcesassurancee and suppsply security iss paramount to <strong>Umgeni</strong> <strong>Water</strong> beingg able to t providesustainablebulkpotable water.In responseto thee developmentalstateagenda andto assuure supplyy securityto targetedCategory B municipalities,<strong>Umgeni</strong>WateWr iss developingthee Mhlabatshanedam,the SikoSoto Damandd theMvutshanee Dam.In addition, <strong>Umgeni</strong> <strong>Water</strong> will continue too collaboratewith the Department of <strong>Water</strong> AffaiAirs foradequate water resources to be timely plannedd and developedforeconomicc growth,notably, theconstructionofthe SpringGroveDamtoo supplementt thee Mgeni system,thee Smithfield Damm on thee Mkomazi Riverandthe raisingof the HazelmereDam on o the MdlotiRiver.<strong>Umgeni</strong><strong>Water</strong> will furthercontinueto manage its existingwaterresourcesupplies withh the utmostcare, whilstinvestigatingalternative sources, includingwastewater reusee fromits DarvillWastewater TreaTatmentWorkWks andsea-waterdesalinationin theeThekwini Metropolitan Munnicipality,to ensuresuitable future resource diversitytoo sustain the long-termwaterrequirementsoff thee region.Plans thatpromote watter conservationn and demand mannagementwill bee pursued,whilstt researchon climatechangerisks and developmentof adaptation strategies will continue.<strong>Umgeni</strong>will ensurethat it is compliantt with customerservice level agreements withh particular reference tosupply voluumes,pressure,servicee disruption intervals,andd metering.Furthermore,<strong>Umgeni</strong> <strong>Water</strong>will collaboratee with w localgovernment, provincialgovernmentt andnationalgovernment for better efficeciency in i respectof allocationof scarsrce resources,includingfunding resources.Bulkvolume growthfor 2010//2011 is expected to reduceby 2.6% as a resultoff the successfulwaterdemandmanagementinitiativess thathave beenn implementedby municipalities,in particulareThekwini MetropolitanMunicipality.In thiscontext, <strong>Umgeni</strong> <strong>Water</strong> will ensurefinancialsustainabilitythroughprovidingg a tariff thatisconstant in realtermss whileallowingforthe repayment of debtt and infrastructuree fundingrequirements,maintainingg optimaldebt levels, andad enhancing shareholder value.<strong>Umgeni</strong><strong>Water</strong>r will contributeto the t socialeconomy, throughleveraging its capital expenditure andoperationalexpenditure too createe jobs.Furthermore,<strong>Umgeni</strong> WatWter will investt ininitiatives inn supportof thee greeneconomy includingelectricity co-generationn investigations at itsDarvill Wastewater Works.investinginRetentionandd developmentof corece anddistinctive competenciess is of vital importanceto thee organisation’ssustainability andd will be ensuredd throughplans thatt deepenimplementationof thee human resources strategy,notablythroughlearnerships,graduatee developmentandd employeeandd leadershipdevelopmentplanss andthroughdeveloping strong partnerships withuniversities,, FET colleges, vocational institutions and SETAs.TheBoardof <strong>Umgeni</strong> WateWer will continue tostrengthen corpcporategovernanceandd risk managementand ensuremonitoringg in terms of the fraud prevpventionplan.MZIMKULUMSIWACHIEFEXECUTIVE30 APRIL2011Pagee 4<strong>Umgeni</strong> WateWer Five-Year Business Plann | 201121/2012to 2015/2016

Chapter| Introduction and Strategy2.2 Operating EnvironmentThe changes in the operating environment and specifically the expectations of the Executive Authority, theMinister of <strong>Water</strong> and Environmental Affairs, Edna Molewa, have informed <strong>Umgeni</strong> <strong>Water</strong>’s development of thisFive-Year Business Plan.The Executive Authority’s expectations are implicitly and explicitly reflected in the following pronouncements:2.2.1 The February 2011 State of the Nation Address, where President Jacob Zumareiterated:• Government’s continued commitment to building a developmental state for which the five keypriority areas are job creation, education, health, rural development and land reform, and fightingcrime.• Job creation through meaningful economic transformation and inclusive growth was particularlyemphasised. A New Growth Path has been introduced that will guide government’s work inachieving its goals. Every sector and business entity is urged to focus on job creation. Allgovernment departments will align their programmes with the job creation imperative.• Six priority areas have been identified for job creation: infrastructure development, agriculture,mining and beneficiation, manufacturing, the green economy and tourism.• Government has established a jobs fund of 9 billion rand over the next three years to finance new jobcreationinitiatives.• Progress made with service delivery includes provision of basic water supply access to an additional400,000 people in 2010.• This year government will spend 2,6 billion rand on water services. Among the priority areas are theprovinces of Limpopo, KwaZulu-Natal and the Eastern Cape where there are still large numbers ofpeople without safe drinking water.• Government will develop infrastructure that will boost the agricultural sector, including rehabilitationof water reservoirs. These projects will enhance food security and create work opportunities formany, especially women in rural areas.• The job creation drive will further enhance youth development.2.2.2 The February 2011 Budget, where Finance Minister Pravin Gordhan, indicated that:• The Budget sets out the financial framework for implementing government’s vision of creating jobs,reducing poverty, building infrastructure and expanding the country’s economy.• The New Growth Path outlines government’s approach to accelerating growth and employment,focusing on several key drivers: Continuing and broadening public investment in infrastructure;Targeting more labour-absorbing activities in the agricultural and mining value chains,manufacturing, construction and services; Promoting innovation through “green economy”initiatives; and Supporting rural development and regional integration.• Regarding economic growth and expectations, the domestic economy grew by 2.8 per cent in 2010.Real GDP growth is projected to reach 3.4 per cent in 2011, 4.1 per cent in 2012 and 4.4 per cent in2013.• Inflation is forecast to remain within the target range of 3 – 6 per cent, edging towards the upper endof the range in 2013 as the economy strengthens. Increasing food and oil prices represent risks to theinflation outlook.• Public sector investment remains the cornerstone of government’s strategy to support sustainableeconomic growth. Over 800 billion rand is projected to be spent over the MTEF period.Page 6 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

| Introduction and Strategy Chapter2.2.3 State of <strong>Water</strong> Access in KZN (KZN CoGTA, December 2010)• 400,000 households in KZN do not have access to water, requiring a 400% increase in the rate ofwater services delivery to meet the 2014 targets.• Factors compounding the water backlog include cost escalations in operation and maintenance andthe effect of ageing infrastructure.• There is lack of cohesion among water sector stakeholders, which has resulted in fragmentedplanning, and contributes to lack of alignment between bulk water infrastructure planning andeconomic development goals of the province.• KZN does not have a single plan that enjoys ownership by all water sector stakeholders with cleardistinction of roles and functions, strategic objectives and implementation framework. <strong>Water</strong>provision is impeded by disintegrated planning, the absence of coordination, poor institutionalcapacity, financial/funding shortfalls and sustainability constraints.• The demand for an increased rate in water service delivery to 2014 requires strategic responses and aclear implementation plan which will be provincially coordinated in accordance with outcome 9.• In 2009, CoGTA developed four new municipal classification systems, based on indicators offunctionality, socio-economic profile and backlog status: class 1 - most vulnerable, class 2 - secondmost vulnerable, class 3 -second highest performing, and class 4 - highest performing.• In this regard: fifty-seven (57) municipalities were classified as vulnerable in South Africa, twenty-four(24) of which are in KZN, and nine (9) of which are in <strong>Umgeni</strong> <strong>Water</strong>’s supply area (Table 2.1).Table 2.1: Municipalities Classified as Vulnerable in <strong>Umgeni</strong> <strong>Water</strong> Supply Area.District MunicipalityLocal Municipalities Classified as VulnerableUgu DMuMgungundlovu DMiLembe DMSisonke DMVulamehlo LM, Umzumbe LM, uMuziwabantu LM, Ezinqolweni LMImpendle LMNdwedwe LM, Maphumulo LMIngwe LM, Umzimkhulu LM2.2.4 Strategic Objectives for <strong>Water</strong> in KZN (KZN CoGTA, January 2011)• Arising out of its December 2010 <strong>Water</strong> Summit, KZN CoGTA identified twelve (12) strategicobjectives for water in terms of its five priority areas of planning, capacity, sustainability, funding andinstitutional:• Priority Area 1: Planning, comprising the following four objectives: To develop a single water sector plan for the province of KZN (which includes establishment of aKZN <strong>Water</strong> and Energy Forum). To coordinate the planning activities of all water sector stakeholders. To align the policy environment with the requirement of a single provincial plan. To ensure that provision has been made to accommodate the impact of climate change in theplanning process.• Priority Area 2: Capacity, comprising the following three objectives To strengthen water sector institutions and to develop the institutional and technical capacities. To improve capacity of provincial water sector stakeholders and raise necessary funding (whichincludes development of comprehensive funding/financial model and funding plans aligned to theMunicipal Turn Around Strategies). To regulate capacity requirements and to ensure compliance.• Priority Area 3: Sustainability, comprising the following two objectives To maximise sustainability through catchment protection, water security and equity betweenenvironmental and livelihood production requirements. To ensure provision for FBWS has been made in sustainability programmes.<strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016 Page 7

Chapter| Introduction and Strategy• Priority Area 4: Funding, comprising the following objective To mobilise funding to address backlogs within the performance timeframe.• Priority Area 5: Institutional, comprising the following two objectives To produce a single provincial institutional framework for the water sector (i.e. to establish asingle provincial water board). To review the current institutional policy environment in order to establish institutions bestplaced to deliver on the performance targets (i.e. to review the current institutional frameworkpowers and functions).2.2.5 Government Outcomes and the Executive Authority, the Minister of <strong>Water</strong> andEnvironmental Affairs, Edna Molewa’s Response (December 2010)• Government has agreed on twelve (12) strategic outcomes to focus its work to 2014: Outcome 1 (Education) “Quality of our basic education” Outcome 2 (Health) “A long and healthy life for all South Africans” Outcome 3 (Security) “All people in South Africa are, and feel safe” Outcome 4 (Employment) “Decent employment through inclusive economic growth” Outcome 5 (Skills) “Skilled and capable workforce to support an inclusive growth plan” Outcome 6 (Infrastructure) “An efficient, competitive and responsive infrastructure network” Outcome 7 (Rural Development) “Vibrant, equitable, sustainable rural communities,contributing towards food security for all” Outcome 8 (Human Settlement) “Sustainable human settlements and improved quality ofhousehold life” Outcome 9 (Local Government) “Responsive, accountable, effective and efficient localgovernment system” Outcome 10 (Environment) “Protect and enhance our environmental assets and naturalresources” Outcome 11 (International) “Create a better South Africa, a better Africa and a better world” Outcome 12 (Public Service) “An efficient, effective and development oriented public serviceand an empowered, fair and inclusive citizenship”• Each outcome has a delivery agreement with the pertinent sphere of government, which whencombined; reflect government’s delivery and implementation plans for the country’s foremostpriorities to 2014.• In respect of this, the Executive Authority, the Minister of <strong>Water</strong> and Environmental Affairs, hasidentified ultimate responsibility to fulfil nine water related outputs of six identified outcomes asshown in Table 2.2.Table 2.2: Executive Authority’s response to the twelve government outcomes, showing six identified outcomesand nine water-related outputs.Selected Outcomes of GovernmentOutcome 10 (Environment) “Protect and enhance ourenvironmental assets and natural resources”Outcome 6 (Infrastructure ) “An efficient, competitiveand responsive infrastructure network”Outcome 7 (Rural Development) “Vibrant, equitable,sustainable rural communities, contributing towardsfood security for all”Page 8 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016Contribution by Executive Authority to Specific OutputsExecutive Authority will LeadOutput 1: Enhanced quantity and quality of our water resources.Executive Authority will LeadOutput 4: Maintenance and supply availability of our bulk waterinfrastructure.Executive Authority will Contribute toOutput 1: Sustainable agrarian reform andOutput 3: Access to rural services.

| Introduction and Strategy ChapterSelected Outcomes of GovernmentOutcome 9 (Local Government) “Responsive,accountable, effective and efficient local governmentsystem”Outcome 4 (Employment) “Decent employmentthrough inclusive economic growth”Outcome 8 (Human Settlement) “Sustainable HumanSettlements and improved quality of household life”Contribution by Executive Authority to Specific OutputsExecutive Authority will Contribute toOutput 1: Differentiated approach;Output 2: Access to basic water services; andOutput 7: Single window of coordination.Executive Authority will indirectly Contribute toOutput 7: Expansion of the Expanded Public Works Programme.Executive Authority will indirectly Contribute toOutput 2: Improve access to basic services.2.2.6 Executive Authority Programme for <strong>Water</strong> Sector Institutional Realignment(December 2010)In January 2011, DWA reported progress on the water sector institutional realignment project. Therealignment initiative is informed by the 2003 Strategic Framework for <strong>Water</strong> Services.The intended outcomes of the realignment process were identified as:• Creating nine to ten water boards in the country through a process of consolidation andestablishment of new boards.• Reduction of catchment management agencies from nineteen to about nine, without changing thenineteen water management areas.• Extending the role of water boards to maintain water resources infrastructure.<strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016 Page 9

Chapter| Introduction andd Strategy2.3Responseto keyy Strategic<strong>Umgeni</strong>WatWerIssuesbyy thee Chairpersonoff thee Boardd ofThechangesin theoperatingenvironment andspecifically theexpectationsoff the Executive Authorityinformed <strong>Umgeni</strong>i <strong>Water</strong>’s development of thisFive-YearBusiness Plan.haveTheclear message that emanates fromm our Executivee Authority,thee Ministerr of <strong>Water</strong> and EnvironmentalAffairs(EdnaMolewa),is that instititutions of governmentmust convergearound thesameagenda.Thissymbioticrelationshipis reflected in thisbusinessplan, wheresix of thee twelve government outcomess thattheminister is responsiblee for togetether withh its relatedoutputs,have been firmly integratedd into<strong>Umgeni</strong><strong>Water</strong>’sbusinessplan throughlinkagess to organisational outcomess shownn inTablee 2.3.Furthermore, CoGTAhas identified the water sector challengess and munmnicipalitiesin South AfriAca andKZN whichare ‘stressed’.<strong>Umgeni</strong> WateWer will resprpondd tothesein practical / explicitt terms.Table 2.3:ExecutiveAuthority’s response tosix off government’s outcomes,andnineoutputs whicwh will be b linkedtoo <strong>Umgeni</strong><strong>Water</strong>’’s ten appraroved outcocomes.Government Outcomess and Outputs cascaded too<strong>Umgeni</strong><strong>Water</strong>r Outcomes thatwill bee specificallytheExecutivee Authorityycross-referencedto Government Outcomess andExecutive Authority OutOtputs.Outcome 10 (Environment)Executive Authority will lead:Output1: Enhanced quaantity and quality ofourwater resources.Outcome 6 (Infrastructure)Executive Authority will lead:Output4: Maintenance andd supplyy availability ofour bulkwater infrastructure.Outcome 7 (Rural Development)Executive Authority will contctributeto:Output1: Sustainableagrarianreformm andOutput3: Accessto rural services.Outcome 9 (Local Government)Executive Authority will contctributeto :Output1: Differentiatedapproach;Output2: Accessto basiic water services;; andOutput7: Single windoww of coordination.Outcome 4 (Employment)Executive Authority will indirectly contctribute to:Output7: Expansionof the t Expandedd PublicWorksProgramme.1. Product Quality(<strong>Water</strong> & Wastewater)2. Customer Satisfactionn3. OperationalResiliencyy4. OperationalOptimisationn5. Infrastructure Stabilityy6. Stakeholderr Understandingandd Support7. . FinancialViability8. <strong>Water</strong> Resources Adequacy9. CommunityandEnvironmentalSustainabilityy10. Leadershipp and EmployeeDevelopmenttOutcome 8 (HumanSettlement)Executive Authority will indirectly contctribute to:Output2: Improvee access too basicservices.Pagee 10<strong>Umgeni</strong> WateWer Five-Year Business Plann | 201121/2012to 2015/2016

| Introduction andd StrategyChapterIn this context,<strong>Umgeni</strong> <strong>Water</strong> will striveto:1.2.3.4.Aligntoo government outocomesandoutputs cascadingg too theexecutivee authoritywithinn thecontextof thee organisation’ss mandate.Workwith all stakeholders - customers,, national, provinciall and local government,organisedlabour,employees,investors,suppliers, civilcl societyand mediaa - toward coordinatedd andeffective bulkk waterservicess deliveryy in <strong>Umgeni</strong> <strong>Water</strong>’s supplyarea andd beyond.Continue totreatt bulkpotable waterandd bulkk wastewaterr too statutory standards.Planand fundd infrastructure to support economicgrowth andlivelihoods, whilstenhancingand maintainingthecondition of its infrastructure assets.5.Improvee the sequencingof bulkinfrastructureprojectsimplementation,municipalities’ reticulation infrastructure implementation.too better align to6.7.Collaborate withwh municipalities andthe KZNN province,to ensure sequential andreciprocalfundingstreamss betweenn theMunicipalInfrastructureGrantand<strong>Umgeni</strong><strong>Water</strong>’scapitalexpenditure progpgramme.Collaborate withwh theDepartment of <strong>Water</strong>Affairs toensurethatt the BulBlk InfrastructureGrant targetsvulnerablelocalmunmnicipalities andd leveragess <strong>Umgeni</strong><strong>Water</strong>’scapitalexpenditure progpgramme.8.Providea predictableand sustainabletarifff and anfinancial sustainabilityy off the organisation.optimallevelofdebt,whilst ensueuring9.Efficientlyusee and conservewaterr resources andd ensure theorganisation has h waterresourcesassuranceandd supply secsurity.10. Contributeto thee greenn economy.11.Contributeto ruraldevelopment,the social economyy and jobcreation, notablyy throughh theorganisation’ss capitalinfrastructuree programme, whilstpromotingthee objeoectivesoff broad-basedblackeconomic empepowerment..12. Ensure that theree isemployee andd leadership development at <strong>Umgeni</strong> <strong>Water</strong>.13.Furthermore,theBoardd willl continuegovernancefor <strong>Umgeni</strong> <strong>Water</strong>.toupholdthe higheststandardsofcorporateMRANDILEE MAHLALUTYECHAIRPERSONOFF THEBOARDD OF UMGENI WATERR<strong>Umgeni</strong> <strong>Water</strong> Five-YearBusinessPlan | 2011/20122 too 2015/201611Page 1

Chapter| Introduction and Strategy2.4 <strong>Umgeni</strong> <strong>Water</strong> Mission, Strategic Intent, Vision, Strategic Perspectives,Objectives and Outcomes2.4.1 Mission“To provide effective and affordable bulk water, bulk sanitation and related solutions to local government inaccelerating the water sector’s national developmental agenda”As articulated in its mission, <strong>Umgeni</strong> <strong>Water</strong>’s business is provision of water and sanitation services to localgovernment.2.4.2 Strategic Intent“A key partner in enabling local government to deliver effective water services”<strong>Umgeni</strong> <strong>Water</strong> continues to strive to be a strategic and sustainable partner of municipalities, creating distinctshareholder value through providing bulk water and sanitation services as a catalyst for local economicdevelopment and supporting government’s developmental agenda.2.4.3 Vision“To be The Number One <strong>Water</strong> Utility in the Developing World”The organisation’s long term aspiration is to become the first-choice water utility in the developing world and toleave a positive legacy in the areas it serves.2.4.4 <strong>Umgeni</strong> <strong>Water</strong>’s Service Area<strong>Umgeni</strong> <strong>Water</strong> will pursue its strategy in the following strategic markets:1. <strong>Umgeni</strong> <strong>Water</strong>’s gazetted area of supply: water services and other related activities.2. Rest of KwaZulu-Natal: water services and other related activities.3. Rest of South Africa: water services and other related activities on demand.4. Rest of Africa: knowledge management, networking and responding to bi-lateral agreements betweenSouth Africa and other countries.2.4.5 Four Strategic Perspectives<strong>Umgeni</strong> <strong>Water</strong>’s strategy comprises four perspectives, Customer and Growth, Financial, Developmental andEnvironmental and Organisational Learning and Growth.2.4.6 Eleven Strategic ObjectivesThese four perspectives are expounded through eleven strategic objectives:1. Exceed customer expectations.2. Grow / increase customer base.3. Manage stakeholder relations.4. Contribute to an affordable tariff.5. Maintain an optimal debt level.6. Enhance shareholder value.7. Contribute to developmental agenda and the social economy.8. Contribute to the green economy.9. Maintain strategic effectiveness.10. Ensure functional excellence.11. Ensure operational competence.When mapped together through its four perspectives, these eleven strategic objectives would enable theorganisation to achieve its mission in a balanced and sustainable manner (Figure 2.1).Page 12 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

| Introduction andd StrategyChapterFigure2.1: <strong>Umgeni</strong> <strong>Water</strong>’s Strategyy Mapshowing eleven strategic objectives,embedded infoursustainabilityperspectivesthat collectivelyy contribute too the organisation’smission.Mission:Toprovide effective and affordablebulkwater, bulksanitation and related solutions to localgovernmentt in acceaeleratingthewater sectoor's nationaldevelopmentalagendaCustomer andGrowthhTo create valuee forour custoomersExceedCustomerExpectationsGrow/ Increase CustomerBaseManageStakeholderRelationsWhilst mainntainingsoundfinancialhealtthContribute to anAffordablee TariffFinancialMaintainn an OptimalDebtLevelEnhanceShareholderValueTocontributetosustainabledevelopment and alivelihoodsDevDvelopmental andEnvironmentalContribute too developmentalagendaContribute too the green economyand the socialeconomyWe will enableour peopleeOrgaOanisationalLearningandGrowthMaintain StrategicEnsure FunctionalEnsureOperationalEffectivenessExcellenceCompetencee2.4. .7TenOutcomesThestrategyfurther targetstenn outcomes,shown in FiguFure 2.2Targetingthesee outcomes enabless theorganisation to followa path of contctinuousimprovement thattt wouldd ultimately leadto a highhhly performingg andsustainablee waterr utility.Figure 2.2: <strong>Umgeni</strong> Wateer’ss Ten OutcOcomes4<strong>Water</strong>Resources2AdequacyCustomerSatisSsfaction51StakeholderProduct Quality3Understandingand SupportInfrastructureStability6FinancialViability7Community andEnvironmentalSustainability8Leadership andEmployeeDevelopment9OperationalResiliency10OperationalOptimisation<strong>Umgeni</strong> <strong>Water</strong> Five-YearBusinessPlan | 2011/20122 too 2015/201613Page 1

Chapter| Introduction and Strategy2.5 Strategic Objectives, Outcomes and Key Performance Indicators (KPIs)The organisation has eighteen key performance indicators that respond to its eleven strategic objectivesand ten outcomes, as shown in Table 2.4. The business plan chapters that follow responds to these KPIs, andtargets pertaining to these are contained in the scorecard at the end of this business plan.Table 2.4: Strategic objectives, outcomes and key performance indicators with cross-reference to GovernmentOutcomes and Executive Authority Outputs*StrategicObjective<strong>Umgeni</strong> <strong>Water</strong>OutcomeExplanation ofOutcomeKey PerformanceIndicatorReference to GovernmentOutcome and ExecutiveAuthority (EA) OutputCustomer and Growth Perspective1. Exceedcustomerexpectations2. Growth /Increasecustomer baseProduct qualityCustomerSatisfactionInfrastructureStabilityProduct Quality (<strong>Water</strong>and Wastewater) isachieved when <strong>Umgeni</strong><strong>Water</strong> produces potablewater and wastewater incompliance with statutoryrequirements andconsistent with customer,public health, andenvironmental needs.1. Per cent statutorycompliance for bulkpotable water and bulkwastewater.*Customer Satisfaction is 2. Per cent compliance withachieved when <strong>Umgeni</strong> service level agreements<strong>Water</strong> provides reliable, with particular referenceresponsive, and affordable to supply volumes,services in line withpressure, serviceexplicit, customer-agreed disruption intervals, andservice levels and receives metering. *timely customer feedbackto maintain responsivenessto customer needs andemergencies.<strong>Umgeni</strong> <strong>Water</strong> hasInfrastructure Stabilitywhen it understands thecondition and costsassociated with criticalinfrastructure assets andmaintains and enhancesthe condition of all assetsover the long-term. This isdone at the lowest possiblelife-cycle cost andacceptable risk levels, isconsistent with customerand statutory-supportedservice levels, andconsistent with anticipatedgrowth and systemreliability goals.3. The extent to which thereis planned and fundedinfrastructure to supporteconomic growth andlivelihoods, and assetcondition is enhanced andmaintained.*Outcome 10 EnvironmentEA will Lead Output 1: Enhancedquantity and quality of waterresources.(Sub-output: Regulation of waterquality – water works andwastewater works compliance)Outcome 6: InfrastructureLead Output 4 Maintenance andsupply availability of bulk waterinfrastructure(Sub-outputs: New augmentationschemes; Regional bulk waterinfrastructure (RBIG) systems;Existing water resourcesinfrastructure maintained)Outcome 9 Local GovernmentEA Contributes to Output 2:Improved access to basicservices.(Sub-outputs: Support the deliveryof bulk and reticulationinfrastructure following adifferentiated approach. Bulkinfrastructure fund)<strong>Water</strong>ResourcesAdequacy<strong>Umgeni</strong> <strong>Water</strong> has <strong>Water</strong>Resources Adequacy,when it assesses thescarcity of freshwaterresources, investigatessustainable alternatives,manages water4. The extent to which thereis water resourcesassurance / supplysecurity.*Page 14 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016Outcome 7: Rural DevelopmentContribute to Outcome 3 Accessto rural services (Sub-outputs:improved access to services)Outcome 6: InfrastructureLead Output 4 Maintenance andsupply availability of bulk waterinfrastructure(Sub-outputs: New augmentationschemes; Regional bulk waterinfrastructure (RBIG) systems;

| Introduction and Strategy ChapterStrategicObjective<strong>Umgeni</strong> <strong>Water</strong>OutcomeExplanation ofOutcomeabstractions assiduouslyand has access to stableraw water resources tomeet current and futurecustomer needs.Key PerformanceIndicatorReference to GovernmentOutcome and ExecutiveAuthority (EA) OutputExisting water resourcesinfrastructure maintained)Outcome 10: EnvironmentLead Output 1 Enhanced qualityand quantity of water resources(Sub-output: <strong>Water</strong> demandmanagement)3. ManageStakeholderRelationsStakeholderUnderstandingand SupportStakeholderUnderstandingand SupportFinancial Perspective4. Contribute to anaffordable tariff5. Maintain anoptimal debtlevel6. EnhanceshareholdervalueFinancialviabilityFinancialviabilityFinancialviabilityStakeholder5. Per cent alignment toUnderstanding andprovincial water plan.*Support, is attained when<strong>Umgeni</strong> <strong>Water</strong> engendersunderstanding and supportfrom statutory, contractedand non-contracted bodiesfor service levels, tariffstructures, operatingbudgets, capitalimprovement programmes,risk managementdecisions, and waterresources adequacyamongst others.StakeholderUnderstanding andSupport6. The extent to which thereis engagement ofstatutory, contracted andnon-contractedstakeholders and responseto queries regarding theorganisation’sdevelopments andperformance.<strong>Umgeni</strong> <strong>Water</strong> is7. The extent to which thereFinancially Viable when it is a tariff that is constantunderstands thein real terms whileorganisational life-cycle allowing for thecosts and maintains a repayment of debt andbalance between debt and infrastructure fundingassets while managing requirements.*operating expendituresand increasing revenues. Inaddition, the organisationaims at a sustainable tariffthat is consistent withcustomer expectations,recovers costs andprovides for futureexpansion.Financially Viable 8. The extent to which thereis an optimal debt level.*Financially Viable9. The extent to which thereis ability to raiseaffordable funding.10. The extent to which thereis Improvement inaccumulated reserves.Outcome 6: InfrastructureLead Output 4 Maintenance andsupply availability of bulk waterinfrastructure(Sub-outputs: New augmentationschemes; Regional bulk waterinfrastructure (RBIG) systems;Existing water resourcesinfrastructure maintained)Outcome 6: InfrastructureLead Output 4 Maintenance andsupply availability of bulk waterinfrastructure(Sub-outputs: Raw water pricingstrategy and funding modelreviewed).<strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016 Page 15

Chapter| Introduction and StrategyStrategicObjective<strong>Umgeni</strong> <strong>Water</strong>OutcomeExplanation ofOutcomeDevelopmental and Environmental Perspective7. Contribute todevelopmentalagenda and thesocial economy8. Contribute tothe greeneconomyCommunityandEnvironmentalSustainabilityCommunityandEnvironmentalSustainability<strong>Umgeni</strong> <strong>Water</strong> achievesCommunity andEnvironmentalSustainability when it isexplicitly cognisant of andattentive to the impacts ithas on current and futurecommunity sustainability,supports socio-economicdevelopment, andmanages its operations,infrastructure, andinvestments to protect,restore, and enhance thenatural environment,whilst using energy andother natural resourcesefficiently.Community andEnvironmentalSustainabilityOrganisational Learning and Growth Perspective9. MaintainStrategicEffectiveness10. EnsureFunctionalExcellence11. EnsureOperationalCompetenceLeadership andEmployeeDevelopmentLeadership andEmployeeDevelopmentOperationalResiliencyKey PerformanceIndicator11. Number of jobs createdthrough infrastructureand other programmes*12. The extent to which thereis use of preferentiallyprocured suppliers,cooperatives, NGOs orcharities.*13. The extent to whichsupport is provided tovulnerablemunicipalities.*14. Number ofenvironmentalsustainability initiatives.*Leadership and Employee 15. The extent to which theDevelopment is achieved organisation provideswhen <strong>Umgeni</strong> <strong>Water</strong> is a leadership and influencesparticipatory, collaborative the water sector.organisation dedicated tocontinual learning andimprovement, recruits andretains a workforce that iscompetent, motivated,adaptive and works safely,ensures institutionalknowledge is retained andimproved; providesopportunities forprofessional andleadership development,and creates an integratedand well-coordinatedsenior leadership team.Leadership and EmployeeDevelopment<strong>Umgeni</strong> <strong>Water</strong> hasOperational Resiliency,when it’s leadership andstaff work together toanticipate and avoidproblems and proactively16. Per cent retention anddevelopment of core anddistinctive competencies.17. Number of systems andprocesses that enableimplementation ofstrategy.Page 16 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016Reference to GovernmentOutcome and ExecutiveAuthority (EA) OutputOutcome 4: EmploymentIndirectly Contribute to Output 7Expansion of the extendedpublic works programmeOutcome 9 Local GovernmentEA Contributes to Output 2:Improved access to basicservices.(Sub-outputs: Support the deliveryof bulk and reticulationinfrastructure following adifferentiated approach. Bulkinfrastructure fund)Outcome 7: Rural DevelopmentContribute to Outcome 3 Accessto rural services (Sub-outputs:improved access to services)Outcome 10: EnvironmentLead Output 2 Reducedgreenhouse gas emissions,climate change and improved airquality.(Sub-outputs: Energy efficiency,adapting to the impacts of climatechange, reduction of carbonemissions, renewable energy)Outcome 10: EnvironmentLead Output 1 Enhanced qualityand quantity of water resources(Sub-output: <strong>Water</strong> demandmanagement)

| Introduction andd StrategyChapterStrategicObjective<strong>Umgeni</strong> <strong>Water</strong>OutcomeOperationalOptimisationExplanation ofKey PerformanceOutcomeIndicatoridentify,assess,andestablishtolerance levelsfor, and proactivelyand deffectively managesa fullrange ofbusiness risks,consistent with industryytrends and systemreliabilitygoals.Operational18. Per centincrease inOptimisation, has beennutilisation ofachievedwhen <strong>Umgeni</strong>organisational resources<strong>Water</strong> has on-going,(more balanceduse).timely, cost-effectiveandsustainableeperformanceimprovements inall facetsof itsoperations, minimisesresourceuse, loss, andimpactsfromday-to-dayyoperations and maintainsawareness of informationand operationaltechnology deveelopmentsto anticipateandsupporttimely adoption ofreliable,improvements.Reference too GovernmentOutcome and ExecutiveAuthority(EA)Output<strong>Umgeni</strong> <strong>Water</strong> Five-YearBusinessPlan | 2011/20122 too 2015/201617Page 1

Chapter| Introduction and StrategyPage 18 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

| Policy StatementChapterChapter 3.PolicyStatement<strong>Umgeni</strong><strong>Water</strong>’soveralll policyhas not changedsince the t previousyear andthee organisation willcontinuetoimplementits business planin accordance with this.The information containedin the ‘Introductionand Strategy’ chapterof thiss businessplan, notanablyy the long-termandapproach and is supportedbya conttinuouslyimprovedsuite of policiess withinthe organisation thatt covers theentire scope ofthe organisation’sbusiness.strategic objectives and a outcomesoftheorganisation, further contextualises the organisation’ss overall policyy <strong>Umgeni</strong> <strong>Water</strong> Five-YearBusinessPlan | 2011/20122 too 2015/201619Page 1

Chapter| Policy StatementPage 20 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

| Directivesby thee MiniisterChapterChapter 4.DirectivesbytheMinisterIn2009/2010,thee Ministerr ofWateWer andEnvironmentalAffairsrequested <strong>Umgeni</strong> <strong>Water</strong> to assist withh theturnaroundstrategyfor the waterservices function inn the ORTamboo DistrictMunicipality,in Eastern Cape.Following completion of o therequiredinterventionin 200209/2010, UmgUgenii <strong>Water</strong> wasrequestedd toundertakefurtherwork to supportt thee OR TamTmbo District Municipality inn 2010//2011.Progressas at 313Decemberr 2010,issummarised beloww and furtherdetailss are providedd in Chapter 11 (Other Activities) of thisbusiness plan.1.The GreaaterMbizanaRegionalBulk <strong>Water</strong> Supply Developmentt•Construction work onn the raw water pump stationandrisingmain is progressingg well.•Construction work onn the LudekaDamm has comcmmenced.•Construction work off thee first phase of the Nommlacu <strong>Water</strong> TreatmentWorkss has begun.•Detaileddesign workk onn phase1 of the bulktreated water supply system is complete.2.Mthathaa Bulk WatWter Intervention•Work wascompleted andthe operationmunicipality.andd maintenancemanual handedovertothee district3.4.Quakeni(Ingquza Hill) Regional Bulk <strong>Water</strong>Supplyy Scheme•The proposedZalu Damis under discussion..Refurbishmentof <strong>Water</strong>Treatment Works’•Refurbishmentt ofthee four works’- Mbizana, Libode,Ngqeleni,andPort St Johns - is underway.Oneworks wasrefurbished andhanded overto the District MunMicipality and theotherss aree scheduled forcompletionn in 2011.<strong>Umgeni</strong> <strong>Water</strong> Five-YearBusinessPlan | 2011/20122 too 2015/201621Page 2

Chapter| Directives by the MinisterPage 22 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

For thee strategicobjective ‘excceedcustomer expectations’ targetingg theoutcome ofcustomer satisfaction:| Self-AppraisalChapterChapter 5.Self-AppraisalThe business achievementsandunder achievements as at 311 December 20100 areprovidedd below. (Alsorefer to thebaselinee informationprovidedin the organisational scorecard inn Chapter 22 of this business plan)):5.15.1.115.1.25.1.35.1.4Performancee inrelationtoo theCustomer andad GrowthPerspectiveFor thee strategicobjective ‘excceedcustomer expectations’ targetingg theoutcome ofproductt quality (water and wastewaterr quality):•The organisationis meetmtingg statutoryy requirements for potablewatersupply.•The organisationis currently not meetingg itss permit requirements for treatedd wastewaterdischarge.The challenges that are a constrainingthee achievement off the target are:stormwater ingressinto themunicipalsewersystem, resulting in highh infloww volumes too theDarvillWastewaterTreatmentWorks,whichare difficult too manage,as well as, illegal industrial dischargesintoo the municipal sewernetwork, whicwh impact on the worrks influent quality.To mitigate this, UmgUgeni<strong>Water</strong> intendss too augment thecapacityof thee DarvDvill WastewaterTreatmentWorksforr whichh it hasbudgetedan amount of o R 1688 million too bee implemented withiwin theFive-Year infrastructureexpenditure programme.•<strong>Umgeni</strong>i <strong>Water</strong>r has met m all customerrequirementss in accordance withh supplyy agreementsin termsofwater quantity/volume demand, pressure, meteering and permissible service disruptionintervals.• Infrastructureimprovements continue to be b in linewith municipality water servsvices developmentplans.•All major customers werwre consulted andsupportedd the proposed bulksupplyy tariff.•Of significancee is thee critical intervention madde in response too the drought situationn and loww damwater levels in theSouthh Coast, for whichh the BoarBrd approved an emergencyy pipeline project.•The lowlight inn respect of thisoutcomeis still s the non-concludedbulk watewer supply agreementt withThe MsunduziLocal MunMnicipality.The municipalityy is currentlyawaiting a responsee from DWA.Forthee straategicobjectiveinfrastructuree stability:‘grow/increasee customerr base’ targetingg theoutcome of•The organisationhadd stratifieditss capital infrastructureprogrammeintoo the following major areas:Supportforr rural livelihoodss (35%); Economic growth(32%);Upgrade andd refurbishment ( 25% %).•Projectsin these portfolioswere inn various phaspses of implementation as at 311 st DeceDember2010.o Supportingrurallivelihoods:Six projectsin constructionphase;; twoprojects inn tenderphasee or entering tenderphase;; threeprojects in design phase; andd two projectsin planningphase.o Supportingeconomicgrowth:: Threee projectsin construction phase;andd threee projectsintender phase orr enteringtenderr phase.o Infrastructure upgradesandrefurbishment: Five projectsin designn phase.•The lowlight inn respect of thisoutcomeis projepect snagsattributable to variousreasons andresultinginbehind schedule implementation of infrastructure programme.For thee strategic objectivee ‘grow/increasecustomer base’ targetingg theoutcomee waterresources adeequacy:•Construction of the SpriSng Grove Damm (by TCTATA) iss scheduled too commencein 201121.• Investigationsof alternativesources areunderway, namely,, the desalinationinvestigationwitheThekwini,as well as, the Darvill wastewater reclamationn investigation.•Modelling work assessing the impactss off climate changeon water resources hasbeen undertaken.<strong>Umgeni</strong> <strong>Water</strong> Five-YearBusinessPlan | 2011/20122 too 2015/201623Page 2

Chapter| Self-Appraisal5.1.5 For the strategic objective ‘manage stakeholder relations’ targeting the outcome ofstakeholder understanding and support:• <strong>Umgeni</strong> <strong>Water</strong> has made progress towards engendering understanding and support from statutory,contracted and non-contracted institutions in respect of: business planning, capital improvementprogrammes, operating budgets and tariff structures, performance with plans, and service delivery,amongst others.Highlights include:• Engagement with DWA at its strategy planning session in December 2010, where the twelvegovernment outcomes were presented and the six outcomes that were relevant to the ExecutiveAuthority and DWA clearly articulated.• Collaboration with KZN CoGTA in organising and participating in the KZN <strong>Water</strong> Summit inDecember 2010, where participation and input into the key issues affecting the water sector weremade.• Participation in the KZN Cabinet Lekgotla session.• Appointment of the Chief Executive to the KZN Planning Commission.• Arising from the Minister’s Directive to assist OR Tambo, the organisation concluded an agreementto operate a total of 70,500 cubic metres per day water treatment works and associatedinfrastructure for OR Tambo DM (further details of which are provided in chapter 11 of this businessplan).5.2 Performance in relation to the Financial Perspective5.2.1 For the strategic objectives ‘contribute to an affordable tariff,’ ‘maintain an optimal debtlevel,’ ‘improve return on asset,’ and ‘enhance shareholder value,’ which are targeting theoutcome of financial viability:• The medium-term trend shows slowing in revenue growth due to slowing in volume growth.• The organisation has, at least in the past five years, provided a tariff consistent with customerexpectations, cost recovery and enabled reasonable provision for infrastructure expansion. Themedium-term trend is however a slightly higher (above inflation rate) tariff that will enable costrecovery for water resources developments to assure future raw water supplies.• Regional Bulk Infrastructure Grants were allocated for the Mhlabatshane Bulk <strong>Water</strong> Supply and theGreater Eston <strong>Water</strong> Scheme.• The financial self-evaluation chapter that follows the financial plan of this business plan providesmore details on the achievement of this outcome.5.3 Performance in relation to the Developmental and EnvironmentalPerspective5.3.1 For the strategic objective ‘contribute to the national developmental agenda and reductionof backlogs’ targeting the outcome of community and environmental sustainability:• As part of ensuring assurance and security of bulk water supply to category B municipalities,<strong>Umgeni</strong> <strong>Water</strong> is developing the following water resource dams:o The Mhlabatshane Dam, which is under construction.o The Sikoto Dam and the Mvutshane Dam, for which the designs have significantly advanced.• As part of its contribution to the social economy:o <strong>Umgeni</strong> <strong>Water</strong> approved a cooperatives policy in September 2010, following which, fouropportunities for cooperatives have been identified in the areas of: Pipeline Maintenance;Reservoir and General Maintenance; Security; and Cleaning Services.o In addition, one cooperative was established as part of the Adopt a River project for which<strong>Umgeni</strong> <strong>Water</strong> is the implementing agent for DWA.• Job Creation: significant jobs have been created during implementation of projects:Page 24 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

| Self-Appraisal Chaptero The projects that are in construction stage during the past six months created 292 jobs.o The Greater Mbizana Regional Bulk <strong>Water</strong> Supply project where <strong>Umgeni</strong> <strong>Water</strong> is theImplementing Agent on behalf of OR Tambo DM has created 96 jobs.o 1,217 jobs were created during implementation of the Working-for-<strong>Water</strong> programme forwhich <strong>Umgeni</strong> <strong>Water</strong> is the implementing agent.o 100 women are employed in the iSipingo Adopt a River project where <strong>Umgeni</strong> <strong>Water</strong> is theImplementing Agent on behalf of DWA.• As part of its contribution to the green economy:o <strong>Umgeni</strong> <strong>Water</strong> is continuing to investigate the feasibility of electricity co-generation at itsDarvill Wastewater Works.5.4 Performance in relation to the Organisational Learning and GrowthPerspective5.4.1 For the strategic objectives ‘maintain strategic effectiveness,’ ‘ensure functionalexcellence,’ and ‘ensure operational competence’ targeting the outcomes of Leadershipand Employee Development, Operational Resiliency, and Operational Optimisation.• The organisation continues to keep abreast of its operating environment contributing to key watersector debates, and importantly has noted its Executive Authority expectations as well as the state ofthe water sector and municipality environment in KZN. This, amongst others, will ensure theorganisation continues to have a responsive strategy and develops an aligned business plan.• As an indication of the esteem in which the organisation is regarded in the water sector, <strong>Umgeni</strong><strong>Water</strong> has received several invitations and delegations from some of the SADC water utilities,notably:o A visit by the Botswana <strong>Water</strong> Utility Corporation to understand the business model of<strong>Umgeni</strong> <strong>Water</strong> in the context of the restructuring that they are undertaking in Botswana.o An invitation to visit the <strong>Water</strong> and Sanitation Department of Benguela and Lobito, which isthe result of the twinning arrangement between the province of KwaZulu-Natal and theprovince of Benguela, Angola, in which <strong>Umgeni</strong> <strong>Water</strong> is one of the key players. As part offurther collaboration this utility is now trying to benchmark its operations along the lines of<strong>Umgeni</strong> <strong>Water</strong> and has requested specific support for: Design of a new laboratory; Design ofa monitoring programme; and Review of their bulk water supply planning.• The organisation has made further progress with implementation of its organisation-wide ISOmanagement system and is preparing for external audit.• The Employment Equity Plan was submitted to the Department of Labour in October 2010, whilst theWorkplace Skills Plan is being completed for submission to ESETA by June 2011. The organisation hasincreased its partnership in learnerships, with twelve additional learnerships approved by ESETA forcommencement in April 2011.• The Board approved the Succession, Mentoring and Coaching Policy in September 2010 for which theorganisation is finalising the implementation framework.• A succession plan has not yet been developed for Executives but a recruitment plan has been developedfor the filling of the posts of the Chief Executive and General Manager Operations. The contract of theGeneral Manager Finance has been extended by two years.• <strong>Umgeni</strong> <strong>Water</strong> is participating in the Best Company to Work for Survey and has also commenced work onits Annual Salary Survey.<strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016 Page 25

Chapter| Self-AppraisalPage 26 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

| Participation inCompaniesChapterChapter 6.Participationinn Coompanies6.1<strong>Umgeni</strong>WatWer Services(Pty)) Ltd<strong>Umgeni</strong><strong>Water</strong>has a 100% shareholdingin <strong>Umgeni</strong> <strong>Water</strong> Services(UWS)) (Pty) Ltd. . This subsidiaryholds an 18.5%investmentin DurbanWateWer Recycling.<strong>Umgeni</strong><strong>Water</strong>issueda letter of supportto UWS, as at 300 June2009, duedto thefact thatits liabilities exceeded itsassets by R1.8m.Initiatives undertaken by b Durban<strong>Water</strong>r Recyclingg (Pty)Ltdd (throughh <strong>Umgeni</strong> <strong>Water</strong> Services (Pty)) LtdDurban<strong>Water</strong>Recyclingg was set up as <strong>Umgeni</strong> WateWer’s contributionto waterdemand management,specificallyfocussing on recycling.Thecompanyhasalwaysbeen suststainable, andis noww startingto pay dividendstoshareholders.Durban<strong>Water</strong> Recycling contributes to <strong>Umgeni</strong> <strong>Water</strong>’ss ‘Customerandd GrowthPerspective’’ and strategicobjective ‘Grow/ increase customerbase’ for which theoutcomeandd key performance indicator are as indicatedbelow.CustomerandGrowthPerspectiveeStrategic ObjectiveeGrow/ Increasecustomerbase<strong>Umgeni</strong> <strong>Water</strong>Outcome<strong>Water</strong>ResourcesAdequacyDescription of Outcome<strong>Umgeni</strong><strong>Water</strong> hashWateer ResourcesAdequacy,when itassessess thee scarcityof freshwaterresources, investigates sustainable alternatives,manages waterabstractionsassiduously andhasaccess to stableraw w water resources to meet currentandfuture customerr needs.Keyy Performance Indicator:The extent towhichthere iswaterr resources assurance /supplyy security.6.2Msinsii Holddings(Pty)Ltd<strong>Umgeni</strong><strong>Water</strong>has a 100% shareholdingin Msinsi Holdings (Pty)) Ltd.The Boardof <strong>Umgeni</strong> <strong>Water</strong>hass takenn a decision to sell s its shareholdingg in MsinsHoldings subjectto DWAgrantinga lease on the landd betweenthee purchaselinee and floodd line for f Inanda,Albertt Falls and a Hazelmere dams.<strong>Umgeni</strong><strong>Water</strong>has provvided a letterof supportt too MsinsHoldingsass its goingconcern status is dependentupon<strong>Umgeni</strong><strong>Water</strong>’scontinuedd supportin terms of contracting/engaging Msinsi to undertakee the <strong>Water</strong> ResourceManagement Function for f thedams.Msinsi’ss loan account ass att 30 June 2009 was R0. .3m due by b <strong>Umgeni</strong>i <strong>Water</strong> toMsinsi. Thee operations of Msinsibreak-evenas illustratedd in thefinancialplanoff this businesss plan.<strong>Umgeni</strong><strong>Water</strong>signed ann agreementfor theO& &M of dams withh DWAA in 2011. Theese dams are a to be managed byMsinsi, andtherelationshipp between<strong>Umgeni</strong> <strong>Water</strong> andMsinsiwill thus continue for the duration off the contract.<strong>Umgeni</strong> <strong>Water</strong> Five-YearBusinessPlan | 2011/20122 too 2015/201627Page 2

Chapter| Participation in CompaniesStrategic Initiatives to be undertaken by Msinsi HoldingsMsinsi Holdings contributes to <strong>Umgeni</strong> <strong>Water</strong>’s ‘Developmental and Environmental Perspective’ and strategicobjective ‘Conserve limited natural resources’ for which the outcome and key performance indicator are asindicated below.Developmental and Environmental PerspectiveStrategic Objective <strong>Umgeni</strong> <strong>Water</strong> Outcome Description of Outcome Key Performance Indicator:Conserve limitednatural resourcesCommunity andEnvironmentalSustainability<strong>Umgeni</strong> <strong>Water</strong> achieves Community andEnvironmental Sustainability when it isexplicitly cognisant of and attentive to theimpacts it has on current and future communitysustainability, supports socio-economicdevelopment, and manages its operations,infrastructure, and investments to protect,restore, and enhance the natural environment,whilst using energy and other natural resourcesefficiently.Number of environmentalsustainability initiatives.The following initiatives are to be undertaken by Msinsi in respect of the above strategy of <strong>Umgeni</strong><strong>Water</strong>:1. The maintenance and enhancement of the natural environment around <strong>Umgeni</strong> <strong>Water</strong> managed dams.i. Control of alien invasive plants.ii. Management of game species according to the carrying capacity of each reserve.iii. Grassland management.2. The control of pollution inside of the purchase area surrounding <strong>Umgeni</strong> <strong>Water</strong> managed dams.i. Ensuring that infrastructure developments takes place with minimum impacts on theenvironment.ii. Controlling visitor activities on the water surface and within the purchase line.iii. Ensuring that there is no illegal dumping by industries within the purchase line.Page 28 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

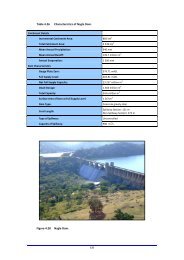

| <strong>Water</strong> ResourcesChapterChapter 7.<strong>Water</strong>Resources7.1<strong>Water</strong>r Availabilityy<strong>Umgeni</strong><strong>Water</strong>sources water primarily fromten impoundments on three major water resourcee systemsnamely,the MgeniSystemm (Mooi andMgenirivers), the North Coasst System(Mdloti River) andthee Southh Coastt System(Nungwane, Mzimmayi and Mzintorivers). Twofurtherr impoundmentsaree owned and managedby <strong>Umgeni</strong> <strong>Water</strong>,which are no longer usedd for water supply purposes. Table 7.1 shows the t capacitiesof these resorources.Table 7.1: Capacity of WateWer Resource SystemssSystemMgeniCatchmentMooiMgeniImpoundmentMearnsWeirMidmar DamMgeniAlbertFallss DamMgeniNagle DammMgeniInandaDammMlaziShongweni Dam Msunduzi, MgeniHenleyDam Total forCentral SystemNorthCoastMdlotiHazelmeree DamTotal forNorthCoast SysttemmSouthCoastNungwane,LovuMzimayiNungwanee DamE J Smith DammMzintoUmzinto DamTotal forSouthCoast SysttemmOtherIxopo, MkommaziIxopo DammTotal for<strong>Umgeni</strong> <strong>Water</strong> Systems# notutilisedforwater suppplyOwnerDWADWADWAUWWDWAUWWUWWDWAUWWUguu DMUguu DMUWWManagerUWUWUWUWUWUWUWUWUWUWUWUWGross CapaCacityy (million m 3 )5.1235.4290.124.6251.63.81.5812.117.917.92.20.90.43.50.6834.17.1.11Mgeni SystemThe MgeniSystemm comprises of fourdams on theMgeniRiver,namelyy MidmarDam, Albert FallsFs Dam,NagleDamandInandaDam.It is augmented by the Mooi-Mgeni TranTnsfer Schemee (Phase 1) whichwh consistsof thee MearnsWeironthe Mooi River,, the MearnsPumpingStation witha maximumtransfer capacityy off 3.22 cubicmetres persecondanda raww water transferpipeline thatt discharges intoo the MpoMfana Stream,whichh flowsinto theLionsRiver and theninto the MgeniRiver upstream of Midmarr Dam.The system currently hasa yield(att a 99 % levelofassurance)of 334. .5 millioon cubic metrmres perannumm att Inandaa Dam.7.1.2NorthCoastSystemThe NorthCoast Systemm comprises the Hazelmeree Damon thee Mdloti River, whichh serves ass a dual-purposedam,providing water for bothh potable and a irrigationrequirements. Thedamm has a yield(at a 988 % level of assurance)of19.0millioncubicmetres per annumavailable fortreatmentt and potablee usage, providedd the reserveallocationisnotimposed.SinceJuly 2007<strong>Umgeni</strong><strong>Water</strong>has alsobeen abstractingg water fromm the MvoMti River ass partofmanaging the Mvoti<strong>Water</strong>Worksandd the supply of bulkpotable water too thee townof KwaDukuza on behalf of theiLembeDistrict Municipality.7.1.3SouthCoast SystemThe SouthCoast Systemm comprises a number of interlinkedoperational entities. <strong>Water</strong> resources for this area areobtained fromthe NunngwaneDamonn the Nungwanee Riverr (a tributaryto thee Lovuu River)), theMzintoo andEJ Smithdamsonn the MzinMnto andd Mzimayiriversrespectively,, and a sand abstraction systemon theMtwalumeRiver. This systemm issubstantiallyy augmentedby thee Mgeni systemvia thee Southh Coastt AugmentationPipelineand the SouthCoastPipeline.<strong>Umgeni</strong> <strong>Water</strong> Five-YearBusinessPlan | 2011/20122 too 2015/201629Page 2

Chapter| <strong>Water</strong> Resources7.1.4 <strong>Water</strong> Resource Assurance and Supply Security per <strong>Water</strong> Services AuthorityeThekwini Metropolitan MunicipalityThe Mgeni system is the primary resource for this municipality. <strong>Water</strong> in the municipality’s northern areas is alsosecured from the Hazelmere Dam on the Mdloti River, as well as from the Tongati River. The Nungwane Dam onthe Nungwane River provides a small portion of the municipality’s water requirements in its southern areas.Groundwater is also used to a limited extent. <strong>Water</strong> transfers from the Mkomazi River, wastewater reuse andseawater desalination are potential future sources of water for this area. <strong>Water</strong> from the uThukela River could alsobe utilised to a limited extent.Msunduzi Local MunicipalityThe Midmar Dam on the Mgeni River is the only source of surface water for this municipality. <strong>Water</strong> transfers fromthe Mooi River are used to augment this resource. Groundwater is used to a limited extent.uMgungundlovu District MunicipalityThe Midmar Dam on the Mgeni River is the primary source of water for this municipality. A number of minorabstractions on other rivers and tributaries are also undertaken and groundwater is used extensively for many ofthe rural and outlying peri-urban areas. The Mkomazi and Mooi rivers are potential future sources of water for thisarea.iLembe District MunicipalityThe Hazelmere Dam on the Mdloti River is the primary source of water for this municipality. To a far lesser extent,water is also abstracted from the Mvoti and uThukela rivers, and groundwater is used extensively in the outlyingrural areas. The Mvoti and uThukela rivers and seawater desalination are potential future sources of water for thismunicipality.Ugu District MunicipalityThere are a number of rivers that are utilised in this area. The southern areas (not served by <strong>Umgeni</strong> <strong>Water</strong>) utilisewater from the Mzimkhulu and Mtamvuna rivers, while the central area primarily receives water from the MzintoDam and EJ Smith Dam on the Mzinto and Mzimayi rivers respectively and from the Mtwalume River. Thenorthern area primarily receives water from the Mgeni system via Inanda Dam and the Nungwane Dam on theNungwane River. Groundwater is used extensively within this municipality to supply many of the rural areas. TheMkomazi and Mzimkhulu rivers and seawater desalination are potential future sources of water for thismunicipality.Sisonke District MunicipalityNumerous small abstractions on the Mkomazi, Mzimkhulu and Mzintlava rivers and their tributaries are utilisedwithin this area. Groundwater is also used extensively within this municipality to supply many of the rural areas.The Mkomazi, Mzintlava and Mzimkhulu rivers are potential future sources of water for this municipality.Page 30 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

| <strong>Water</strong> Resources Chapter7.2 <strong>Water</strong> Quality of Raw <strong>Water</strong>The status of raw water quality and problem per supply source/catchment are presented in Table 7.2. The rawwater quality status of each source/catchment is determined by comparing key determinands against <strong>Water</strong>Resource Quality Objectives developed for each water supply catchment.Potential water quality risks associated with <strong>Umgeni</strong> <strong>Water</strong> raw water supplies include: eutrophication (nutrientenrichment and its associated threats including algal blooms, taste and odour problems and aquatic weedinfestation), faecal contamination and associated pathogen risks, suspended solids, and chemical constituents(including iron and manganese). This in turn has the potential to impact on treatability, chemical usage andassociated treatment cost.DWA is kept continuously apprised of the quality and risks associated with the source water and needs to morevigorously regulate catchment practices and waste discharges, to continue to ensure the long-term sustainabilityof these water resources.Table 7.2: <strong>Water</strong> Quality of Raw <strong>Water</strong>System Catchment Impoundment <strong>Water</strong> Quality status Description of Raw <strong>Water</strong> Quality ProblemMar-2009 Mar-2010 Mar-2011Mooi, Mgeni Mearns Weir, Good Good Good Eutrophication with occasional high algalMidmar Damcount.Occasional high iron concentrations.MgeniAlbert Falls Good Good Good Eutrophication with occasional high algalDam, Naglecount.DamMgeni Inanda Dam Moderate Moderate Moderate Eutrophication with very high algal count.Microcystis is the dominant algal species withlarge amounts of the toxin microcystin presentat all abstraction levels and in the raw waterinflow to the Wiggins <strong>Water</strong> Treatment Works,when the algal count was very high.MdlotiHazelmere Moderate Moderate Moderate Eutrophication at the dam.DamHigh turbidity and elevated iron concentrationsat all water treatment abstraction levels.MgeniNorth CoastSouth CoastOtherNungwane,LovuNungwaneDamModerate Moderate Moderate Increased iron and manganese in the raw watersupply system.Mzimayi E J Smith Dam Poor Poor Poor High algal count and high organic carbonconcentrations.High manganese concentrations.High E. coli counts.Mzinto Umzinto Dam Poor Poor Poor High algal count and high organic carbonconcentrations, andHigh manganese concentrations in the rawwater supply system.Mthwalume RiverAbstractionModerate Moderate Moderate High E.coli.High algal count.Elevated iron and manganese concentrations.Ixopo,Ixopo Dam Moderate Moderate Poor High turbidity.MkomaziHigh iron and manganese concentrations.High conductivity.High organic carbon, exacerbated by the lowdam water levels in 2010.<strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016 Page 31

Chapter| <strong>Water</strong> Resources7.3 <strong>Water</strong> Use Rights, Licences by Resource<strong>Umgeni</strong> <strong>Water</strong>’s most recently registered abstractions and licence applications are shown in Table 7.3.Table 7.3: Registered Abstractions for 2010/11 and Status of Licence Applications.MgeniSystem Abstraction Point Registered Abstractionfor 2010/2011(10 3 m 3 /day)Midmar DamNagle Dam (Albert Falls Dam)Inanda DamCurrent Licence(10 3 m 3 /day)and date issued1,099 1,096May 1985Licence Application(10 3 m 3 /day) and datesubmitted to DWA1,287November 2005North CoastSouth CoastOtherHazelmere Dam 45 311985/8892April 2010Mvoti River 16 11 18April 2008Sikoto Dam N/A N/A 6.3Still to besubmittedMvutshane Dam N/A N/A 10Still to besubmittedLower Thukela N/A N/A 110January 2010Nungwane Dam 26.5 - -E J Smith DamMzinto Dam12 - -Mtwalume River Well points 8.5 3 5May 2006Mhlabatshane Dam N/A 4.1N/AJune 2010Ixopo Dam 2.3 - -Page 32 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

7.4 <strong>Water</strong> Demands, Planned Developments and Shortfalls| <strong>Water</strong> Resources Chapter<strong>Umgeni</strong> <strong>Water</strong>’s bulk water sales have slowed considerably over the past seven months with minimal to zerogrowth expected in the short-term. This can largely be attributed to the impact of the eThekwiniMetropolitan Municipality’s water demand management initiatives coupled with a slower than expectedgrowth in the same region. Growth in water sales is expected to increase in the medium to long-term, as theeconomy continues to recover from the last recession, and with government stimulation to grow theeconomy.<strong>Umgeni</strong> <strong>Water</strong>, as a bulk water services provider, requires sustainable and cost-effective water resources to meetits customer’s demands. In view of the significant lead times required to plan, design, construct and commissionmajor water resource development projects, future medium to long-term water resources from the Department of<strong>Water</strong> Affairs (DWA), as the custodian of the country’s water resources, have to be secured in a timely manner.DWA has to date undertaken regional water resource development investigations within <strong>Umgeni</strong> <strong>Water</strong>’s area ofoperation in close collaboration with <strong>Umgeni</strong> <strong>Water</strong> and its major customers. A number of these studies were cofundedby <strong>Umgeni</strong> <strong>Water</strong>. The status of water demand within <strong>Umgeni</strong> <strong>Water</strong>’s area of supply, however,requires several of these water resource investigations to be completed as a matter of urgency. Failing which,customers could be faced with severe water shortages in coming years. A summary of resource needs is shownin Table 7.4 and described further in the sections that follow.Table 7.4: Summary of <strong>Water</strong> Resource/Supply needs, Timing and Estimated CostScheme Date Needed Timing Estimated Cost ResponsibilityPhase 2 Mooi-Mgeni Transfer Scheme: Spring Grove Dam 2007 Behind Schedule R 1,700 million DWAPhase 1 Mkomazi <strong>Water</strong> Project: Smithfield Dam 2010 Behind Schedule R 4,500 million DWANorth Coast System: Raising of Hazelmere Dam 2013 Behind Schedule R 120 million DWAMvutshane Dam 2012 On Schedule R 136 million UWMhlabatshane Dam 2012 On Schedule R195 million UWSikoto Dam 2013 On Schedule R 95 million UWLower Mvoti Bulk <strong>Water</strong> Supply Scheme: Welverdient Dam 2020 Behind Schedule R 1,000 million DWALower Mkomazi Bulk <strong>Water</strong> Supply Scheme 2019 Behind Schedule R 500 million UWUpper Mvoti Bulk <strong>Water</strong> Supply Scheme: Mvoti-Poort Dam 2025 On Schedule R 500 million DWA<strong>Umgeni</strong> <strong>Water</strong> will continue to manage its existing resource supplies with the utmost diligence. In addition,<strong>Umgeni</strong> <strong>Water</strong> is investigating alternative sources to assist with meeting the long-term water requirements of theregion, including:• A detailed feasibility investigation of two large-scale seawater desalination plants for the eThekwiniregion;• Continuation of the reuse investigation at the Darvill Wastewater Works;• Participation in eThekwini Metropolitan Municipality’s reuse investigation with the intention ofcombining the two reuse projects into one regional initiative.Further initiatives are described in the water conservation and demand management plan later in this businessplan.<strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016 Page 33

Chapter| <strong>Water</strong> Resources7.4.1 Mgeni System: Planned Developments and ShortfallsPhase 2 of the Mooi-Mgeni Transfer Scheme: Spring Grove DamThe Mooi-Mgeni River Transfer Scheme (MMTS) was intended for phased implementation in accordance withgrowth needs. Phase 1 of this scheme (MMTS-1) was commissioned in 2003 and comprised the new Mearns Weiron the Mooi River, the raising of Midmar Dam, the provision of a standby pump for the existing Mearn’s PumpingStation and the registration of a servitude of aqueduct along sections of the Mpofana, Lions and Mgeni rivers.Phase 2 of this scheme (MMTS-2) comprises the proposed Spring Grove Dam (full supply capacity of 141.6 millioncubic metres) on the Mooi River, a new pumping station at Spring Grove Dam and a new pipeline to transfer waterdirectly into the Mpofana River, which is within the Mgeni catchment. The overall transfer capacity of the MMTSwill then be increased to its ultimate rate of 4.5 cubic metres per second.Over the past few years water demands from the Mgeni System have continued to grow, with this past financialyear showing a decreased growth rate from the previous year (refer to Figure 7.1). The current financial year isexpected to show a further decline in growth rate with an increase in the years thereafter. Figure 7.1 indicates thatdemands have already exceeded the 99% assurance of supply level that will be achieved with the commissioningof MMTS-2, and even further augmentation of the Mgeni System is already needed.At the end of 2007 the Minister of <strong>Water</strong> and Environmental Affairs instructed the Trans-Caledon-Tunnel-Authority (TCTA) to implement the MMTS-2 project as quickly as possible in order to augment the existing systemand reduce the risk of possible future restrictions. Construction of the dam is scheduled to begin in the first half of2011. At this stage construction is scheduled to be completed in September 2012 with the first water delivered inApril 2013. However, the construction of water supply pipeline from the dam, which will maximise the transfercapacity from the dam, has been delayed due to an appeal against the environmental record of decision. It appearsthat the completion of this pipeline is now likely to only occur a year or two after the dam completion.Phase 1 of the Mkomazi <strong>Water</strong> Project: Smithfield DamIt is evident from current and projected water demand trends (refer to Figure 7.1), that the planning of the nextmajor water resource development, the Mkomazi <strong>Water</strong> Project, to support the Mgeni system urgently needs tobe brought to a stage of implementation. Without this augmentation of the Mgeni system, <strong>Umgeni</strong> <strong>Water</strong> will beunable to ensure that future water demands can be met timeously and at the appropriate level of assurance.Therefore, there is now a need for DWA to move beyond the findings of the 1998 pre-feasibility study of thisscheme and initiate a detailed feasibility level investigation into this augmentation option.It is anticipated that DWA will initiate a detailed feasibility investigation of the raw water component of thisscheme during the first half of 2011. <strong>Umgeni</strong> <strong>Water</strong> has undertaken to complete concurrent detailed feasibilitylevel investigations into the associated potable water component. It is envisaged that these investigations willproceed simultaneously and in an integrated manner, and the environmental impact assessment of the entireproject conducted as a single co-funded investigation.Page 34 <strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016

| <strong>Water</strong> Resources ChapterFigure 7.1: Long-Term <strong>Water</strong> Demand Projection for the Mgeni SystemLong-Term <strong>Water</strong> Demand Projection for the Mgeni System<strong>Water</strong> Demand (million cubic metres per annum)6506005505004504003503002501994/951996/971998/992000/01Current 99% Assurance Level (Mooi-Mgeni Transfer Scheme Phase 1)99% Assurance Level (Mooi-Mgeni Transfer Scheme Phase 2 - Spring Grove Dam)Actual SalesProjected Sales (revised 2011)2002/032004/052006/072008/092010/112012/132014/152016/172018/192020/212022/232024/252026/272028/292030/312032/332034/352036/372038/392040/41Sikoto DamCommunities within the Ozwathini area are currently supplied with water from a number of boreholes that areproving to be unsustainable. The long-term solution that has been proposed by <strong>Umgeni</strong> <strong>Water</strong> for this region is toextend the existing Wartburg pipeline to also serve this region. However, current levels of water demand in thearea do no yet warrant the implementation of this project, and a medium to long-term solution has beendeveloped.The proposed Ozwathini Bulk <strong>Water</strong> Supply Scheme project is located in the uMgungundlovu and iLembe DistrictMunicipalities. The scheme will consist of a 5.5 million cubic metre dam on the Sikoto River (a tributary of theMvoti River), a raw water pump station and rising main to a 6,000 cubic metre per day water treatment works anda further pump station and rising main to supply potable water to the existing Nondobula Reservoir. Potablewater can be reticulated through existing networks to the various communities within Ozwathini.7.4.2 North Coast System: Planned Developments and Shortfalls<strong>Water</strong> demand in the North Coast region - the coastal strip between Veralum, to the north of Durban, and thetown of KwaDukuza - has risen over the past few years and is expected to continue to grow in the future (refer toFigure 7.2). The drop in demand for the 2008/2009 financial year was as a result of a load shift from theHazelmere <strong>Water</strong> Treatment Works onto the Durban Heights <strong>Water</strong> Treatment Works, and not due to a drop indemand in the North Coast area.DWA recently commissioned the KwaZulu-Natal Coastal Metropolitan Areas <strong>Water</strong> Reconciliation StrategyStudy, which amongst other things, considered strategies for augmenting the North Coast water supplies. Theaugmentation options included:• Raising of Hazelmere Dam,• Implementing the Lower Thukela Bulk <strong>Water</strong> Supply Scheme (BWSS), and• Building a new dam on the Mvoti River (either the Welverdient Dam or Isithundu Dam).<strong>Umgeni</strong> <strong>Water</strong> Five-Year Business Plan | 2011/2012 to 2015/2016 Page 35