OVERWEIGHT

OVERWEIGHT

OVERWEIGHT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

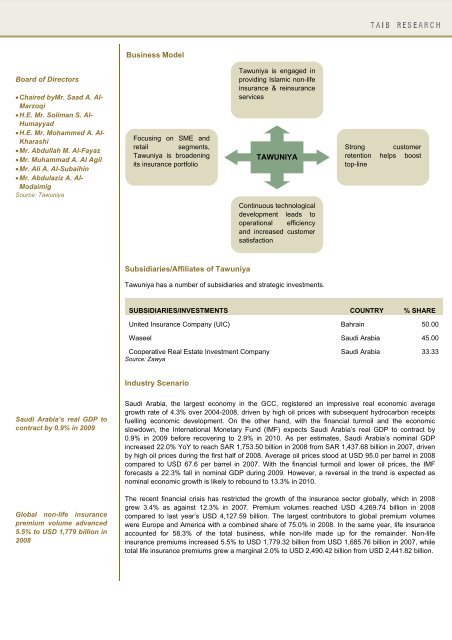

Business ModelBoard of Directors• Chaired byMr. Saad A. Al-Marzoqi• H.E. Mr. Soliman S. Al-Humayyad• H.E. Mr. Mohammed A. Al-Kharashi• Mr. Abdullah M. Al-Fayaz• Mr. Muhammad A. Al Agil• Mr. Ali A. Al-Subaihin• Mr. Abdulaziz A. Al-ModaimigSource: TawuniyaFocusing on SME andretail segments,Tawuniya is broadeningits insurance portfolioTawuniya is engaged inproviding Islamic non-lifeinsurance & reinsuranceservicesTAWUNIYAStrong customerretention helps boosttop-lineContinuous technologicaldevelopment leads tooperational efficiencyand increased customersatisfactionSubsidiaries/Affiliates of TawuniyaTawuniya has a number of subsidiaries and strategic investments.SUBSIDIARIES/INVESTMENTS COUNTRY % SHAREUnited Insurance Company (UIC) Bahrain 50.00Waseel Saudi Arabia 45.00Cooperative Real Estate Investment Company Saudi Arabia 33.33Source: ZawyaIndustry ScenarioSaudi Arabia’s real GDP tocontract by 0.9% in 2009Global non-life insurancepremium volume advanced5.5% to USD 1,779 billion in2008Saudi Arabia, the largest economy in the GCC, registered an impressive real economic averagegrowth rate of 4.3% over 2004-2008, driven by high oil prices with subsequent hydrocarbon receiptsfuelling economic development. On the other hand, with the financial turmoil and the economicslowdown, the International Monetary Fund (IMF) expects Saudi Arabia’s real GDP to contract by0.9% in 2009 before recovering to 2.9% in 2010. As per estimates, Saudi Arabia’s nominal GDPincreased 22.0% YoY to reach SAR 1,753.50 billion in 2008 from SAR 1,437.68 billion in 2007, drivenby high oil prices during the first half of 2008. Average oil prices stood at USD 95.0 per barrel in 2008compared to USD 67.6 per barrel in 2007. With the financial turmoil and lower oil prices, the IMFforecasts a 22.3% fall in nominal GDP during 2009. However, a reversal in the trend is expected asnominal economic growth is likely to rebound to 13.3% in 2010.The recent financial crisis has restricted the growth of the insurance sector globally, which in 2008grew 3.4% as against 12.3% in 2007. Premium volumes reached USD 4,269.74 billion in 2008compared to last year’s USD 4,127.59 billion. The largest contributors to global premium volumeswere Europe and America with a combined share of 75.0% in 2008. In the same year, life insuranceaccounted for 58.3% of the total business, while non-life made up for the remainder. Non-lifeinsurance premiums increased 5.5% to USD 1,779.32 billion from USD 1,685.76 billion in 2007, whiletotal life insurance premiums grew a marginal 2.0% to USD 2,490.42 billion from USD 2,441.82 billion.