OVERWEIGHT

OVERWEIGHT

OVERWEIGHT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

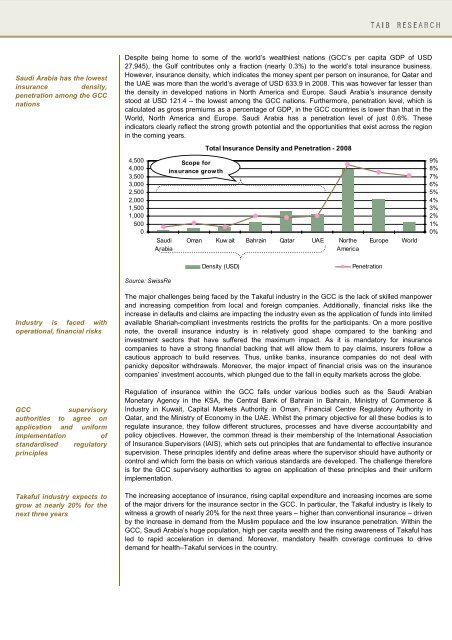

Saudi Arabia has the lowestinsurance density,penetration among the GCCnationsDespite being home to some of the world’s wealthiest nations (GCC’s per capita GDP of USD27,945), the Gulf contributes only a fraction (nearly 0.3%) to the world’s total insurance business.However, insurance density, which indicates the money spent per person on insurance, for Qatar andthe UAE was more than the world’s average of USD 633.9 in 2008. This was however far lesser thanthe density in developed nations in North America and Europe. Saudi Arabia’s insurance densitystood at USD 121.4 – the lowest among the GCC nations. Furthermore, penetration level, which iscalculated as gross premiums as a percentage of GDP, in the GCC countries is lower than that in theWorld, North America and Europe. Saudi Arabia has a penetration level of just 0.6%. Theseindicators clearly reflect the strong growth potential and the opportunities that exist across the regionin the coming years.Total Insurance Density and Penetration - 20084,5004,0003,5003,0002,5002,0001,5001,0005000SaudiArabiaScope forinsurance growthOman Kuw ait Bahrain Qatar UAE NortheAmericaEuropeWorld9%8%7%6%5%4%3%2%1%0%Density (USD)PenetrationSource: SwissReIndustry is faced withoperational, financial risksGCCsupervisoryauthorities to agree onapplication and uniformimplementationofstandardised regulatoryprinciplesTakaful industry expects togrow at nearly 20% for thenext three yearsThe major challenges being faced by the Takaful industry in the GCC is the lack of skilled manpowerand increasing competition from local and foreign companies. Additionally, financial risks like theincrease in defaults and claims are impacting the industry even as the application of funds into limitedavailable Shariah-compliant investments restricts the profits for the participants. On a more positivenote, the overall insurance industry is in relatively good shape compared to the banking andinvestment sectors that have suffered the maximum impact. As it is mandatory for insurancecompanies to have a strong financial backing that will allow them to pay claims, insurers follow acautious approach to build reserves. Thus, unlike banks, insurance companies do not deal withpanicky depositor withdrawals. Moreover, the major impact of financial crisis was on the insurancecompanies’ investment accounts, which plunged due to the fall in equity markets across the globe.Regulation of insurance within the GCC falls under various bodies such as the Saudi ArabianMonetary Agency in the KSA, the Central Bank of Bahrain in Bahrain, Ministry of Commerce &Industry in Kuwait, Capital Markets Authority in Oman, Financial Centre Regulatory Authority inQatar, and the Ministry of Economy in the UAE. Whilst the primary objective for all these bodies is toregulate insurance, they follow different structures, processes and have diverse accountability andpolicy objectives. However, the common thread is their membership of the International Associationof Insurance Supervisors (IAIS), which sets out principles that are fundamental to effective insurancesupervision. These principles identify and define areas where the supervisor should have authority orcontrol and which form the basis on which various standards are developed. The challenge thereforeis for the GCC supervisory authorities to agree on application of these principles and their uniformimplementation.The increasing acceptance of insurance, rising capital expenditure and increasing incomes are someof the major drivers for the insurance sector in the GCC. In particular, the Takaful industry is likely towitness a growth of nearly 20% for the next three years – higher than conventional insurance – drivenby the increase in demand from the Muslim populace and the low insurance penetration. Within theGCC, Saudi Arabia’s huge population, high per capita wealth and the rising awareness of Takaful hasled to rapid acceleration in demand. Moreover, mandatory health coverage continues to drivedemand for health–Takaful services in the country.