IBRC annual report for 2011 - Irish Bank Resolution Corporation ...

IBRC annual report for 2011 - Irish Bank Resolution Corporation ...

IBRC annual report for 2011 - Irish Bank Resolution Corporation ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

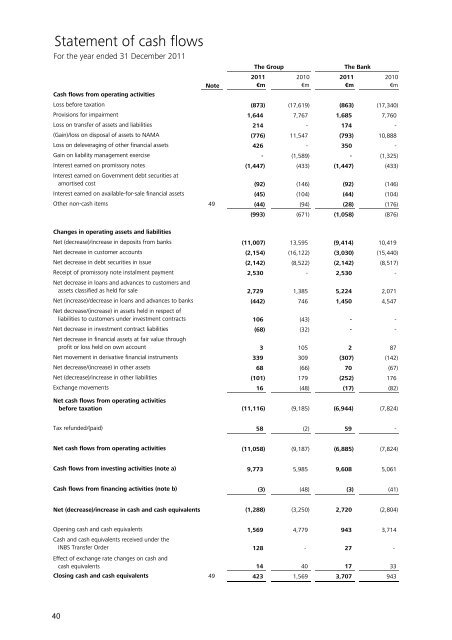

Statement of cash flowsFor the year ended 31 December <strong>2011</strong>Cash flows from operating activitiesThe GroupThe <strong>Bank</strong><strong>2011</strong> 2010 <strong>2011</strong> 2010Note €m €m €m €mLoss be<strong>for</strong>e taxation (873) (17,619) (863) (17,340)Provisions <strong>for</strong> impairment 1,644 7,767 1,685 7,760Loss on transfer of assets and liabilities 214 - 174 -(Gain)/loss on disposal of assets to NAMA (776) 11,547 (793) 10,888Loss on deleveraging of other financial assets 426 - 350 -Gain on liability management exercise - (1,589) - (1,325)Interest earned on promissory notes (1,447) (433) (1,447) (433)Interest earned on Government debt securities atamortised cost (92) (146) (92) (146)Interest earned on available-<strong>for</strong>-sale financial assets (45) (104) (44) (104)Other non-cash items 49 (44) (94) (28) (176)(993) (671) (1,058) (876)Changes in operating assets and liabilitiesNet (decrease)/increase in deposits from banks (11,007) 13,595 (9,414) 10,419Net decrease in customer accounts (2,154) (16,122) (3,030) (15,440)Net decrease in debt securities in issue (2,142) (8,522) (2,142) (8,517)Receipt of promissory note instalment payment 2,530 - 2,530 -Net decrease in loans and advances to customers andassets classified as held <strong>for</strong> sale 2,729 1,385 5,224 2,071Net (increase)/decrease in loans and advances to banks (442) 746 1,450 4,547Net decrease/(increase) in assets held in respect ofliabilities to customers under investment contracts 106 (43) - -Net decrease in investment contract liabilities (68) (32) - -Net decrease in financial assets at fair value throughprofit or loss held on own account 3 105 2 87Net movement in derivative financial instruments 339 309 (307) (142)Net decrease/(increase) in other assets 68 (66) 70 (67)Net (decrease)/increase in other liabilities (101) 179 (252) 176Exchange movements 16 (48) (17) (82)Net cash flows from operating activitiesbe<strong>for</strong>e taxation(11,116) (9,185) (6,944) (7,824)Tax refunded/(paid) 58 (2) 59 -Net cash flows from operating activities (11,058) (9,187) (6,885) (7,824)Cash flows from investing activities (note a) 9,773 5,985 9,608 5,061Cash flows from financing activities (note b) (3) (48) (3) (41)Net (decrease)/increase in cash and cash equivalents(1,288) (3,250) 2,720 (2,804)Opening cash and cash equivalents 1,569 4,779 943 3,714Cash and cash equivalents received under theINBS Transfer Order 128 - 27 -Effect of exchange rate changes on cash andcash equivalents14 40 17 33Closing cash and cash equivalents 49 423 1,569 3,707 94340