IBRC annual report for 2011 - Irish Bank Resolution Corporation ...

IBRC annual report for 2011 - Irish Bank Resolution Corporation ...

IBRC annual report for 2011 - Irish Bank Resolution Corporation ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

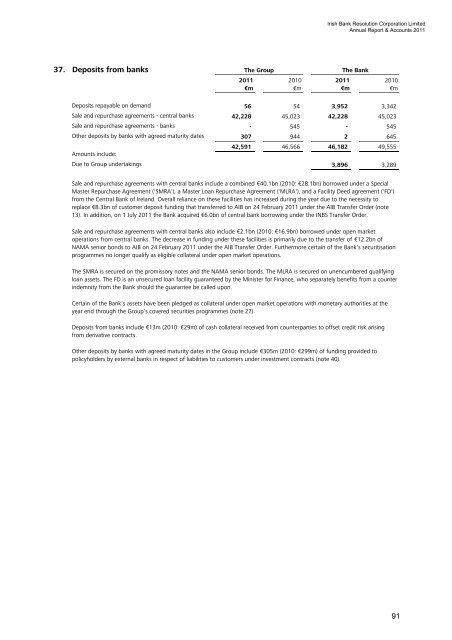

<strong>Irish</strong> <strong>Bank</strong> <strong>Resolution</strong> <strong>Corporation</strong> LimitedAnnual Report & Accounts <strong>2011</strong>37. Deposits from banksThe GroupThe <strong>Bank</strong><strong>2011</strong> 2010 <strong>2011</strong> 2010€m €m €m €mDeposits repayable on demand 56 54 3,952 3,342Sale and repurchase agreements - central banks 42,228 45,023 42,228 45,023Sale and repurchase agreements - banks - 545 - 545Other deposits by banks with agreed maturity dates 307 944 2 64542,591 46,566 46,182 49,555Amounts include:Due to Group undertakings 3,896 3,289Sale and repurchase agreements with central banks include a combined €40.1bn (2010: €28.1bn) borrowed under a SpecialMaster Repurchase Agreement ('SMRA'), a Master Loan Repurchase Agreement ('MLRA'), and a Facility Deed agreement ('FD')from the Central <strong>Bank</strong> of Ireland. Overall reliance on these facilities has increased during the year due to the necessity toreplace €8.3bn of customer deposit funding that transferred to AIB on 24 February <strong>2011</strong> under the AIB Transfer Order (note13). In addition, on 1 July <strong>2011</strong> the <strong>Bank</strong> acquired €6.0bn of central bank borrowing under the INBS Transfer Order.Sale and repurchase agreements with central banks also include €2.1bn (2010: €16.9bn) borrowed under open marketoperations from central banks. The decrease in funding under these facilities is primarily due to the transfer of €12.2bn ofNAMA senior bonds to AIB on 24 February <strong>2011</strong> under the AIB Transfer Order. Furthermore certain of the <strong>Bank</strong>'s securitisationprogrammes no longer qualify as eligible collateral under open market operations.The SMRA is secured on the promissory notes and the NAMA senior bonds. The MLRA is secured on unencumbered qualifyingloan assets. The FD is an unsecured loan facility guaranteed by the Minister <strong>for</strong> Finance, who separately benefits from a counterindemnity from the <strong>Bank</strong> should the guarantee be called upon.Certain of the <strong>Bank</strong>'s assets have been pledged as collateral under open market operations with monetary authorities at theyear end through the Group's covered securities programmes (note 27).Deposits from banks include €13m (2010: €29m) of cash collateral received from counterparties to offset credit risk arisingfrom derivative contracts.Other deposits by banks with agreed maturity dates in the Group include €305m (2010: €299m) of funding provided topolicyholders by external banks in respect of liabilities to customers under investment contracts (note 40).91