PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

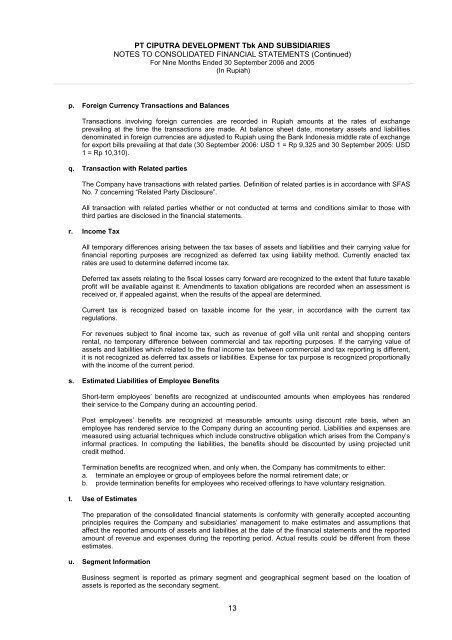

<strong>PT</strong> CIPUTRA DEVELOPMENT <strong>Tbk</strong> AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)p. Foreign Currency Transactions and BalancesTransactions involving foreign currencies are recorded in Rupiah amounts at the rates of exchangeprevailing at the time the transactions are made. At balance sheet date, monetary assets and liabilitiesdenominated in foreign currencies are adjusted to Rupiah using the Bank Indonesia middle rate of exchangefor export bills prevailing at that date (30 September 2006: USD 1 = Rp 9,325 and 30 September 2005: USD1 = Rp 10,310).q. Transaction with Related partiesThe Company have transactions with related parties. Definition of related parties is in accordance with SFASNo. 7 concerning “Related Party Disclosure”.All transaction with related parties whether or not conducted at terms and conditions similar to those withthird parties are disclosed in the financial statements.r. Income TaxAll temporary differences arising between the tax bases of assets and liabilities and their carrying value forfinancial reporting purposes are recognized as deferred tax using liability method. Currently enacted taxrates are used to determine deferred income tax.Deferred tax assets relating to the fiscal losses carry forward are recognized to the extent that future taxableprofit will be available against it. Amendments to taxation obligations are recorded when an assessment isreceived or, if appealed against, when the results of the appeal are determined.Current tax is recognized based on taxable income for the year, in accordance with the current taxregulations.For revenues subject to final income tax, such as revenue of golf villa unit rental and shopping centersrental, no temporary difference between commercial and tax reporting purposes. If the carrying value ofassets and liabilities which related to the final income tax between commercial and tax reporting is different,it is not recognized as deferred tax assets or liabilities. Expense for tax purpose is recognized proportionallywith the income of the current period.s. Estimated Liabilities of Employee BenefitsShort-term employees’ benefits are recognized at undiscounted amounts when employees has renderedtheir service to the Company during an accounting period.Post employees’ benefits are recognized at measurable amounts using discount rate basis, when anemployee has rendered service to the Company during an accounting period. Liabilities and expenses aremeasured using actuarial techniques which include constructive obligation which arises from the Company’sinformal practices. In computing the liabilities, the benefits should be discounted by using projected unitcredit method.Termination benefits are recognized when, and only when, the Company has commitments to either:a. terminate an employee or group of employees before the normal retirement date; orb. provide termination benefits for employees who received offerings to have voluntary resignation.t. Use of EstimatesThe preparation of the consolidated financial statements is conformity with generally accepted accountingprinciples requires the Company and subsidiaries’ management to make estimates and assumptions thataffect the reported amounts of assets and liabilities at the date of the financial statements and the reportedamount of revenue and expenses during the reporting period. Actual results could be different from theseestimates.u. Segment InformationBusiness segment is reported as primary segment and geographical segment based on the location ofassets is reported as the secondary segment.13