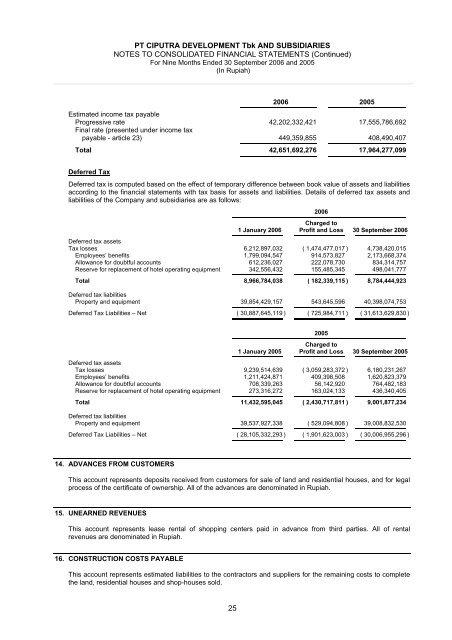

<strong>PT</strong> CIPUTRA DEVELOPMENT <strong>Tbk</strong> AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)2006 2005Estimated income tax payableProgressive rate 42,202,332,421 17,555,786,692Final rate (presented under income taxpayable - article 23) 449,359,855 408,490,407Total 42,651,692,276 17,964,277,099Deferred TaxDeferred tax is computed based on the effect of temporary difference between book value of assets and liabilitiesaccording to the financial statements with tax basis for assets and liabilities. Details of deferred tax assets andliabilities of the Company and subsidiaries are as follows:2006Charged to1 January 2006 Profit and Loss 30 September 2006Deferred tax assetsTax losses 6,212,897,032 ( 1,474,477,017 ) 4,738,420,015Employees’ benefits 1,799,094,547 914,573,827 2,173,668,374Allowance for doubtful accounts 612,236,027 222,078,730 834,314,757Reserve for replacement of hotel operating equipment 342,556,432 155,485,345 498,041,777Total 8,966,784,038 ( 182,339,115 ) 8,784,444,923Deferred tax liabilitiesProperty and equipment 39,854,429,157 543,645,596 40,398,074,753Deferred Tax Liabilities – Net ( 30,887,645,119 ) ( 725,984,711 ) ( 31,613,629,830 )2005Charged to1 January 2005 Profit and Loss 30 September 2005Deferred tax assetsTax losses 9,239,514,639 ( 3,059,283,372 ) 6,180,231,267Employees’ benefits 1,211,424,871 409,398,508 1,620,823,379Allowance for doubtful accounts 708,339,263 56,142,920 764,482,183Reserve for replacement of hotel operating equipment 273,316,272 163,024,133 436,340,405Total 11,432,595,045 ( 2,430,717,811 ) 9,001,877,234Deferred tax liabilitiesProperty and equipment 39,537,927,338 ( 529,094,808 ) 39,008,832,530Deferred Tax Liabilities – Net ( 28,105,332,293 ) ( 1,901,623,003 ) ( 30,006,955,296 )14. ADVANCES FROM CUSTOMERSThis account represents deposits received from customers for sale of land and residential houses, and for legalprocess of the certificate of ownership. All of the advances are denominated in Rupiah.15. UNEARNED REVENUESThis account represents lease rental of shopping centers paid in advance from third parties. All of rentalrevenues are denominated in Rupiah.16. CONSTRUCTION COSTS PAYABLEThis account represents estimated liabilities to the contractors and suppliers for the remaining costs to completethe land, residential houses and shop-houses sold.25

<strong>PT</strong> CIPUTRA DEVELOPMENT <strong>Tbk</strong> AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)17. BONDS PAYABLEThe detail of this account in 2006 and 2005 is as follows:2006 2005<strong>Ciputra</strong> Residence bonds (CR bonds) 350,129,500,000 350,129,500,000<strong>Ciputra</strong> Sentra bonds (CSN bonds) 160,043,500,000 160,043,500,000Total 510,173,000,000 510,173,000,000a. CR BondsOn 30 June 2003, CR, a subsidiary, entered into an agreement with Kerrisdale International Ltd.,(Kerrisdale) to issued Zero Coupon Bonds of Rp 350,129,500,000, which will be due in 8 years fromissuance date.The bondholders have an option to convert the bonds into CR’s shares during the period of bonds withconversion value of Rp 1,085 per share and CR has the option to redeem partly or entire bonds after thesettlement of its obligation to <strong>PT</strong> Bank Tabungan Negara (Persero), until the due date of bonds. The bondsare covered by land for development with area approximately 351 hectares owned by CR (see Note 9).Based on Sale and Purchase Agreement dated 19 December 2005, Kerrisdale has transferred all of thebonds, without any conditions, to Grovedale Capital Ltd., BVI.CR shall accomplish several restrictions according to the bonds agreement, among others, pertaining todividend distribution, changing of its article of association, changing the composition of managementand stockholders, and to deliver/acquire other indebtedness. In addition, CR is liable to maintain its debts toequity ratio not more than 100%.CR has fulfilled the requirements.b. CSN BondsIn 2002, CSN entered into an agreement with Morgan Stanley Emerging Markets, Inc. (MSEM) to issued 2bonds, which would be bought by MSEM as follows:• Zero Coupon Convertible Bonds and with nominal value of Rp 260,043,500,000, which will be due in 8years from issuance date. The bondholders have an option to convert the bonds into shares during theperiod of bonds, and CSN has the option to redeem partly or entire bonds after the settlement of itsobligation to <strong>PT</strong> Bank Mandiri (Persero) <strong>Tbk</strong>, until the due date of bonds. The bonds are guaranteed withSecond Ranked Collateral Right of SHGB No. 3227, together with building and infrastructure which arelocated in Grogol, West Jakarta, covering 41,365 sqm under CSN name, inventories and accountsreceivable of shopping center and hotel owned by CSN (see Notes 5 and 10).• Zero Coupon Mandatory Convertible Bond with nominal value of Rp 290,990,000,000, which would bedue in 1 year from issuance date. These bonds would be automatically converted into 18,186,875 sharesnot later than 30 days before due date of the bonds, after received an approval from the stockholders.On the same date, MSEM transferred these Convertible Bonds and Mandatory Convertible Bonds to KeyDynamic Resources Ltd. (KDRL).CSN shall accomplish several restrictions according to bonds agreement, among others, pertaining todividend distribution, changing of its article of association, changing the composition of management andstockholders, and to deliver/acquire other indebtedness to others parties. In addition, CSN is liable tomaintain its debts to equity ratio not more than 100%.CSN has fulfilled the requirements.On 2 February 2003, the CSN’s stockholders agreed to convert the Mandatory Convertible Bond to paid-incapital of KDRL for 18,186,875 shares.Based on Extraordinary Stockholders’ General Meeting of CSN, held on 24 March 2005, a part ofConvertible Bonds amounting to Rp 100 billion had been approved to be converted as paid-in capital ofKDRL for 6,250,000 shares with par value of Rp 1,000. Subsequently, the Company direct and indirectownership in CSN has been diluted from 37.35% to 33.07% (see Note 1c).26