PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

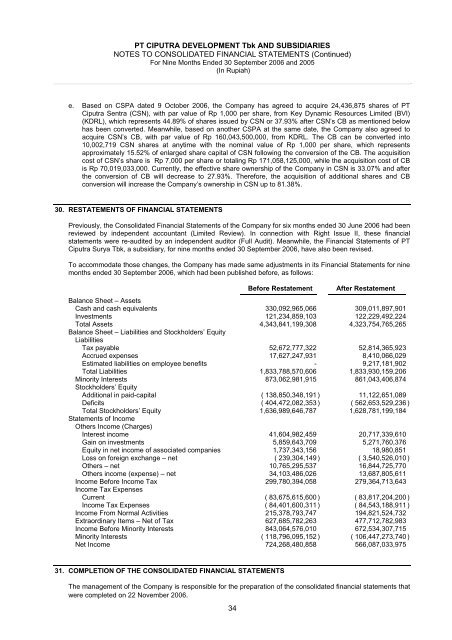

<strong>PT</strong> CIPUTRA DEVELOPMENT <strong>Tbk</strong> AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)e. Based on CSPA dated 9 October 2006, the Company has agreed to acquire 24,436,875 shares of <strong>PT</strong><strong>Ciputra</strong> Sentra (CSN), with par value of Rp 1,000 per share, from Key Dynamic Resources Limited (BVI)(KDRL), which represents 44.89% of shares issued by CSN or 37.93% after CSN’s CB as mentioned belowhas been converted. Meanwhile, based on another CSPA at the same date, the Company also agreed toacquire CSN’s CB, with par value of Rp 160,043,500,000, from KDRL. The CB can be converted into10,002,719 CSN shares at anytime with the nominal value of Rp 1,000 per share, which representsapproximately 15.52% of enlarged share capital of CSN following the conversion of the CB. The acquisitioncost of CSN’s share is Rp 7,000 per share or totaling Rp 171,058,125,000, while the acquisition cost of CBis Rp 70,019,033,000. Currently, the effective share ownership of the Company in CSN is 33.07% and afterthe conversion of CB will decrease to 27.93%. Therefore, the acquisition of additional shares and CBconversion will increase the Company’s ownership in CSN up to 81.38%.30. RESTATEMENTS OF FINANCIAL STATEMENTSPreviously, the Consolidated Financial Statements of the Company for six months ended 30 June 2006 had beenreviewed by independent accountant (Limited Review). In connection with Right Issue II, these financialstatements were re-audited by an independent auditor (Full Audit). Meanwhile, the Financial Statements of <strong>PT</strong><strong>Ciputra</strong> Surya <strong>Tbk</strong>, a subsidiary, for nine months ended 30 September 2006, have also been revised.To accommodate those changes, the Company has made same adjustments in its Financial Statements for ninemonths ended 30 September 2006, which had been published before, as follows:Before RestatementAfter RestatementBalance Sheet – AssetsCash and cash equivalents 330,092,965,066 309,011,897,901Investments 121,234,859,103 122,229,492,224Total Assets 4,343,841,199,308 4,323,754,765,265Balance Sheet – Liabilities and Stockholders’ EquityLiabilitiesTax payable 52,672,777,322 52,814,365,923Accrued expenses 17,627,247,931 8,410,066,029Estimated liabilities on employee benefits - 9,217,181,902Total Liabilities 1,833,788,570,606 1,833,930,159,206Minority Interests 873,062,981,915 861,043,406,874Stockholders’ EquityAdditional in paid-capital ( 138,850,348,191 ) 11,122,651,089Deficits ( 404,472,082,353 ) ( 562,653,529,236 )Total Stockholders’ Equity 1,636,989,646,787 1,628,781,199,184Statements of IncomeOthers Income (Charges)Interest income 41,604,982,459 20,717,339,610Gain on investments 5,859,643,709 5,271,760,376Equity in net income of associated companies 1,737,343,156 18,980,851Loss on foreign exchange – net ( 239,304,149 ) ( 3,540,526,010 )Others – net 10,765,295,537 16,844,725,770Others income (expense) – net 34,103,486,026 13,687,805,611Income Before Income Tax 299,780,394,058 279,364,713,643Income Tax ExpensesCurrent ( 83,675,615,600 ) ( 83,817,204,200 )Income Tax Expenses ( 84,401,600,311 ) ( 84,543,188,911 )Income From Normal Activities 215,378,793,747 194,821,524,732Extraordinary Items – Net of Tax 627,685,782,263 477,712,782,983Income Before Minority Interests 843,064,576,010 672,534,307,715Minority Interests ( 118,796,095,152 ) ( 106,447,273,740 )Net Income 724,268,480,858 566,087,033,97531. COMPLETION OF THE CONSOLIDATED FINANCIAL STATEMENTSThe management of the Company is responsible for the preparation of the consolidated financial statements thatwere completed on 22 November 2006.34