PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

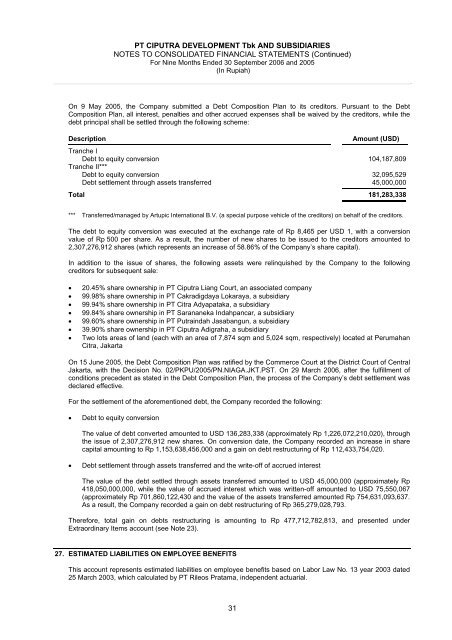

<strong>PT</strong> CIPUTRA DEVELOPMENT <strong>Tbk</strong> AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)On 9 May 2005, the Company submitted a Debt Composition Plan to its creditors. Pursuant to the DebtComposition Plan, all interest, penalties and other accrued expenses shall be waived by the creditors, while thedebt principal shall be settled through the following scheme:DescriptionAmount (USD)Tranche IDebt to equity conversion 104,187,809Tranche II***Debt to equity conversion 32,095,529Debt settlement through assets transferred 45,000,000Total 181,283,338*** Transferred/managed by Artupic International B.V. (a special purpose vehicle of the creditors) on behalf of the creditors.The debt to equity conversion was executed at the exchange rate of Rp 8,465 per USD 1, with a conversionvalue of Rp 500 per share. As a result, the number of new shares to be issued to the creditors amounted to2,307,276,912 shares (which represents an increase of 58.86% of the Company’s share capital).In addition to the issue of shares, the following assets were relinquished by the Company to the followingcreditors for subsequent sale:• 20.45% share ownership in <strong>PT</strong> <strong>Ciputra</strong> Liang Court, an associated company• 99.98% share ownership in <strong>PT</strong> Cakradigdaya Lokaraya, a subsidiary• 99.94% share ownership in <strong>PT</strong> Citra Adyapataka, a subsidiary• 99.84% share ownership in <strong>PT</strong> Sarananeka Indahpancar, a subsidiary• 99.60% share ownership in <strong>PT</strong> Putraindah Jasabangun, a subsidiary• 39.90% share ownership in <strong>PT</strong> <strong>Ciputra</strong> Adigraha, a subsidiary• Two lots areas of land (each with an area of 7,874 sqm and 5,024 sqm, respectively) located at PerumahanCitra, JakartaOn 15 June 2005, the Debt Composition Plan was ratified by the Commerce Court at the District Court of CentralJakarta, with the Decision No. 02/PKPU/2005/PN.NIAGA.JKT.PST. On 29 March 2006, after the fulfillment ofconditions precedent as stated in the Debt Composition Plan, the process of the Company’s debt settlement wasdeclared effective.For the settlement of the aforementioned debt, the Company recorded the following:• Debt to equity conversionThe value of debt converted amounted to USD 136,283,338 (approximately Rp 1,226,072,210,020), throughthe issue of 2,307,276,912 new shares. On conversion date, the Company recorded an increase in sharecapital amounting to Rp 1,153,638,456,000 and a gain on debt restructuring of Rp 112,433,754,020.• Debt settlement through assets transferred and the write-off of accrued interestThe value of the debt settled through assets transferred amounted to USD 45,000,000 (approximately Rp418,050,000,000, while the value of accrued interest which was written-off amounted to USD 75,550,067(approximately Rp 701,860,122,430 and the value of the assets transferred amounted Rp 754,631,093,637.As a result, the Company recorded a gain on debt restructuring of Rp 365,279,028,793.Therefore, total gain on debts restructuring is amounting to Rp 477,712,782,813, and presented underExtraordinary Items account (see Note 23).27. ESTIMATED LIABILITIES ON EMPLOYEE BENEFITSThis account represents estimated liabilities on employee benefits based on Labor Law No. 13 year 2003 dated25 March 2003, which calculated by <strong>PT</strong> Rileos Pratama, independent actuarial.31