PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

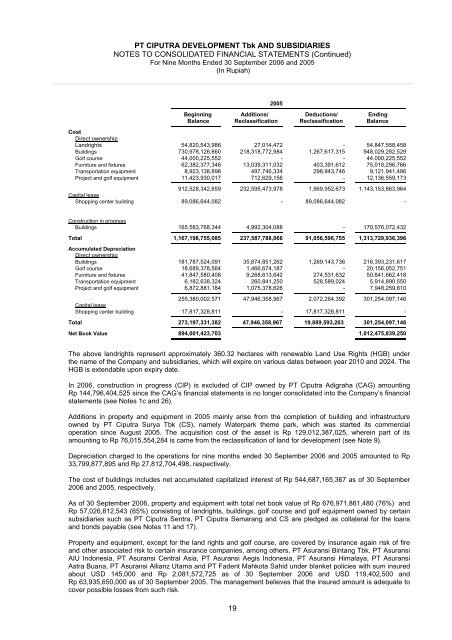

<strong>PT</strong> CIPUTRA DEVELOPMENT <strong>Tbk</strong> AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)2005Beginning Additions/ Deductions/ EndingBalance Reclassification Reclassification BalanceCostDirect ownershipLandrights 54,820,543,986 27,014,472 - 54,847,558,458Buildings 730,978,126,860 218,318,772,984 1,267,617,315 948,029,282,529Golf course 44,000,225,552 - - 44,000,225,552Furniture and fixtures 62,382,377,346 13,039,311,032 403,391,612 75,018,296,766Transportation equipment 8,923,138,898 497,746,334 298,943,746 9,121,941,486Project and golf equipment 11,423,930,017 712,629,156 - 12,136,559,173912,528,342,659 232,595,473,978 1,969,952,673 1,143,153,863,964Capital leaseShopping center building 89,086,644,082 - 89,086,644,082 -Construction in progressBuildings 165,583,768,344 4,992,304,088 - 170,576,072,432Total 1,167,198,755,085 237,587,788,066 91,056,596,755 1,313,729,936,396Accumulated DepreciationDirect ownershipBuildings 181,787,524,091 35,874,851,262 1,269,143,736 216,393,231,617Golf course 18,689,378,564 1,466,674,187 - 20,156,052,751Furniture and fixtures 41,847,580,408 9,268,613,642 274,531,632 50,841,662,418Transportation equipment 6,182,638,324 260,841,250 528,589,024 5,914,890,550Project and golf equipment 6,872,881,184 1,075,378,626 - 7,948,259,810255,380,002,571 47,946,358,967 2,072,264,392 301,254,097,146Capital leaseShopping center building 17,817,328,811 - 17,817,328,811 -Total 273,197,331,382 47,946,358,967 19,889,593,203 301,254,097,146Net Book Value 894,001,423,703 1,012,475,839,250The above landrights represent approximately 360.32 hectares with renewable Land Use Rights (HGB) underthe name of the Company and subsidiaries, which will expire on various dates between year 2010 and 2024. TheHGB is extendable upon expiry date.In 2006, construction in progress (CIP) is excluded of CIP owned by <strong>PT</strong> <strong>Ciputra</strong> Adigraha (CAG) amountingRp 144,796,404,525 since the CAG’s financial statements is no longer consolidated into the Company’s financialstatements (see Notes 1c and 26).Additions in property and equipment in 2005 mainly arise from the completion of building and infrastructureowned by <strong>PT</strong> <strong>Ciputra</strong> Surya <strong>Tbk</strong> (CS), namely Waterpark theme park, which was started its commercialoperation since August 2005. The acquisition cost of the asset is Rp 129,012,387,025, wherein part of itsamounting to Rp 76,015,554,284 is came from the reclassification of land for development (see Note 9).Depreciation charged to the operations for nine months ended 30 September 2006 and 2005 amounted to Rp33,799,877,895 and Rp 27,812,704,498, respectively.The cost of buildings includes net accumulated capitalized interest of Rp 544,687,165,367 as of 30 September2006 and 2005, respectively.As of 30 September 2006, property and equipment with total net book value of Rp 676,971,861,480 (76%) andRp 57,026,812,543 (65%) consisting of landrights, buildings, golf course and golf equipment owned by certainsubsidiaries such as <strong>PT</strong> <strong>Ciputra</strong> Sentra, <strong>PT</strong> <strong>Ciputra</strong> Semarang and CS are pledged as collateral for the loansand bonds payable (see Notes 11 and 17).Property and equipment, except for the land rights and golf course, are covered by insurance again risk of fireand other associated risk to certain insurance companies, among others, <strong>PT</strong> Asuransi Bintang <strong>Tbk</strong>, <strong>PT</strong> AsuransiAIU Indonesia, <strong>PT</strong> Asuransi Central Asia, <strong>PT</strong> Asuransi Aegis Indonesia, <strong>PT</strong> Asuransi Himalaya, <strong>PT</strong> AsuransiAstra Buana, <strong>PT</strong> Asuransi Allianz Utama and <strong>PT</strong> Fadent Mahkota Sahid under blanket policies with sum insuredabout USD 145,000 and Rp 2,081,572,725 as of 30 September 2006 and USD 119,402,500 andRp 63,935,650,000 as of 30 September 2005. The management believes that the insured amount is adequate tocover possible losses from such risk.19