PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

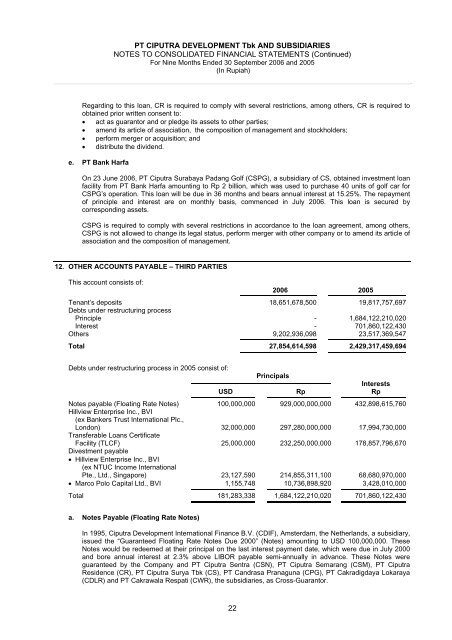

<strong>PT</strong> CIPUTRA DEVELOPMENT <strong>Tbk</strong> AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)Regarding to this loan, CR is required to comply with several restrictions, among others, CR is required toobtained prior written consent to:• act as guarantor and or pledge its assets to other parties;• amend its article of association, the composition of management and stockholders;• perform merger or acquisition; and• distribute the dividend.e. <strong>PT</strong> Bank HarfaOn 23 June 2006, <strong>PT</strong> <strong>Ciputra</strong> Surabaya Padang Golf (CSPG), a subsidiary of CS, obtained investment loanfacility from <strong>PT</strong> Bank Harfa amounting to Rp 2 billion, which was used to purchase 40 units of golf car forCSPG’s operation. This loan will be due in 36 months and bears annual interest at 15.25%. The repaymentof principle and interest are on monthly basis, commenced in July 2006. This loan is secured bycorresponding assets.CSPG is required to comply with several restrictions in accordance to the loan agreement, among others,CSPG is not allowed to change its legal status, perform merger with other company or to amend its article ofassociation and the composition of management.12. OTHER ACCOUNTS PAYABLE – THIRD PARTIESThis account consists of:2006 2005Tenant’s deposits 18,651,678,500 19,817,757,697Debts under restructuring processPrinciple - 1,684,122,210,020Interest - 701,860,122,430Others 9,202,936,098 23,517,369,547Total 27,854,614,598 2,429,317,459,694Debts under restructuring process in 2005 consist of:PrincipalsInterestsUSD Rp RpNotes payable (Floating Rate Notes) 100,000,000 929,000,000,000 432,898,615,760Hillview Enterprise Inc., BVI(ex Bankers Trust International Plc.,London) 32,000,000 297,280,000,000 17,994,730,000Transferable Loans CertificateFacility (TLCF) 25,000,000 232,250,000,000 178,857,796,670Divestment payable• Hillview Enterprise Inc., BVI(ex NTUC Income InternationalPte., Ltd., Singapore) 23,127,590 214,855,311,100 68,680,970,000• Marco Polo Capital Ltd., BVI 1,155,748 10,736,898,920 3,428,010,000Total 181,283,338 1,684,122,210,020 701,860,122,430a. Notes Payable (Floating Rate Notes)In 1995, <strong>Ciputra</strong> <strong>Development</strong> International Finance B.V. (CDIF), Amsterdam, the Netherlands, a subsidiary,issued the “Guaranteed Floating Rate Notes Due 2000” (Notes) amounting to USD 100,000,000. TheseNotes would be redeemed at their principal on the last interest payment date, which were due in July 2000and bore annual interest at 2.3% above LIBOR payable semi-annually in advance. These Notes wereguaranteed by the Company and <strong>PT</strong> <strong>Ciputra</strong> Sentra (CSN), <strong>PT</strong> <strong>Ciputra</strong> Semarang (CSM), <strong>PT</strong> <strong>Ciputra</strong>Residence (CR), <strong>PT</strong> <strong>Ciputra</strong> Surya <strong>Tbk</strong> (CS), <strong>PT</strong> Candrasa Pranaguna (CPG), <strong>PT</strong> Cakradigdaya Lokaraya(CDLR) and <strong>PT</strong> Cakrawala Respati (CWR), the subsidiaries, as Cross-Guarantor.22