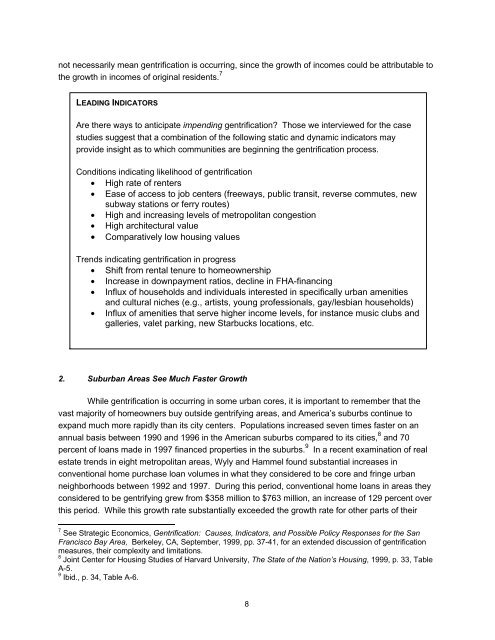

not necessarily mean <strong>gentrification</strong> is occurring, since the growth of incomes could be attributable tothe growth in incomes of original residents. 7LEADING INDICATORSAre there ways to anticipate impending <strong>gentrification</strong>? Those we interviewed for the casestudies suggest that a combination of the following static and dynamic indicators mayprovide insight as to which communities are beginning the <strong>gentrification</strong> process.Conditions indicating likelihood of <strong>gentrification</strong>• High rate of renters• Ease of access to job centers (freeways, public transit, reverse commutes, newsubway stations or ferry routes)• High and increasing levels of metropolitan congestion• High architectural value• Comparatively low housing valuesTrends indicating <strong>gentrification</strong> in progress• Shift from rental tenure to homeownership• Increase in downpayment ratios, decline in FHA-financing• Influx of households and individuals interested in specifically urban amenitiesand cultural niches (e.g., artists, young professionals, gay/lesbian households)• Influx of amenities that serve higher income levels, for instance music clubs andgalleries, valet parking, new Starbucks locations, etc.2. Suburban Areas See Much Faster GrowthWhile <strong>gentrification</strong> is occurring in some urban cores, it is important to remember that thevast majority of homeowners buy outside gentrifying areas, and America’s suburbs continue toexpand much more rapidly than its city centers. Populations increased seven times faster on anannual basis between 1990 and 1996 in the American suburbs compared to its cities, 8 and 70percent of loans made in 1997 financed properties in the suburbs. 9 In a recent examination of realestate trends in eight metropolitan areas, Wyly and Hammel found substantial increases inconventional home purchase loan volumes in what they considered to be core and fringe urbanneighborhoods between 1992 and 1997. During this period, conventional home loans in areas theyconsidered to be gentrifying grew from $358 million to $763 million, an increase of 129 percent overthis period. While this growth rate substantially exceeded the growth rate for other parts of their7 See Strategic Economics, Gentrification: Causes, Indicators, and Possible Policy Responses for the SanFrancisco Bay Area, Berkeley, CA, September, 1999, pp. 37-41, for an extended discussion of <strong>gentrification</strong>measures, their complexity and limitations.8 Joint Center for Housing Studies of Harvard University, The State of the Nation’s Housing, 1999, p. 33, TableA-5.9 Ibid., p. 34, Table A-6.8

espective metropolitan areas, this activity represented only 1.6 percent of all conventional homepurchase activity in these metropolitan areas. 103. National Studies Conflict on ScaleResearch on <strong>gentrification</strong> conducted during the 1970s and 1980s differed in the conclusionsdrawn about the scope of <strong>gentrification</strong> and displacement that was occurring during that period,based perhaps on the definition of <strong>gentrification</strong> used. A comprehensive look at <strong>gentrification</strong> in themid-‘70s found that renovation affected only 0.5 percent of the central city housing stock, 11 and thatonly 100 neighborhoods in the top 30 largest cities experienced any revitalization. 12 This workmeasured the physical dimensions of <strong>gentrification</strong> and explored rehabilitation efforts as a proxy for<strong>gentrification</strong>, in much the same way that Wyly and Hammel more recently used home loansextended to higher-income borrowers in lower-income communities.Other studies in the late ‘70s and early ‘80s measured a social dimension, displacement, asa proxy for <strong>gentrification</strong>, and found much larger effects. One national study estimated that between1.7 and 2.4 million people were displaced by private redevelopment in 1979, consisting primarily oftenants, the poor and female-headed families. 13 Another study estimated that between 10,000 and40,000 households were displaced annually by <strong>gentrification</strong> in New York City in the late 1970s. 14Yet another study of nine revitalizing neighborhoods in five cities found that 23 percent of tenantshad been displaced over a two-year period. 15 These competing conclusions, varying definitions ofdisplacement, and differing definitional frameworks from the ‘70s and ‘80s help us better understandthe complexity of <strong>gentrification</strong>, but do little to answer the question of scale now. While it is hard tomeasure the overall scale of <strong>gentrification</strong>, it is clear that the impacts on the affected neighborhoodsand cities can be quite substantial in both positive and negative ways.B. What Are the Causes of Gentrification?Academic literature features a long-running debate about whether <strong>gentrification</strong> is causedprimarily by social/cultural factors such as changing family structures, by economic factors such asjob/housing imbalances, or by some combination of both. The most recent research attempts tosynthesize these two competing arguments, though there is no definitive resolution to this dispute.One such effort found empirical support for both demand-side and supply-side explanations. 16 Most10 Wyly, Elvin K. and Daniel J. Hammel, “Islands of Decay in Seas of Renewal: Housing Policy and theResurgence of Gentrification,” Housing Policy Debate, Vol. 10 No. 4, pp. 733,734.11 Berry, Brian J. L., “Islands of Renewal in Seas of Decay,” in The New Urban Reality, Paul E. Peterson, ed.Washington: The Brookings Institution, 1985, p. 73, citing Clay.12 Ibid., p. 73, citing National Urban Coalition.13 Residential Displacement, An Update (Washington, D.C.: Department of Housing and Urban Development,Office of Policy Development and Research, 1981) as reported in Ley, Dave, The New Middle Class and theRemaking of the Central City. Oxford: Oxford University Press, 1996, p. 65-66.14 Marcuse, Peter, pp. 216-17.15 Shill, Michael and Richard Nathan, Revitalizing America’s Cities: Neighborhood Reinvestment andDisplacement. Albany: State University of New York Press, 1983, as reported in Ley, p. 66.16 London, Bruce, Barrett Lee and S. Gregory Lipton, “The Determinants of Gentrification in the United States,A City Level Analysis,” Urban Affairs Quarterly, 1986, Vol. 21, No. 3. See also Loretta Lees, “Rethinking9

- Page 1: ___________________________________

- Page 4 and 5: POLICYLINKSUMMARY OF RECENT PUBLICA

- Page 6 and 7: ABSTRACTThis paper serves as a prim

- Page 8 and 9: PREFACEThe Brookings Institution Ce

- Page 11 and 12: DEALING WITH NEIGHBORHOOD CHANGE:A

- Page 13 and 14: owners, and developers—better und

- Page 15 and 16: III. GENTRIFICATION DYNAMICS:DEFINI

- Page 17: A. How Big a Trend Is Gentrificatio

- Page 21 and 22: uilt only 31,000 new homes. 18 The

- Page 23 and 24: created a $5,000 first-time homebuy

- Page 25 and 26: consequences are perceived by varyi

- Page 27 and 28: esidents they should stay in place

- Page 29 and 30: and that these revenues are not era

- Page 31 and 32: sale. 42 The street’s mix of busi

- Page 33 and 34: communities (such as in Cleveland)

- Page 35 and 36: IV. THE POLITICAL DYNAMICS OF GENTR

- Page 37 and 38: the development process made unexpe

- Page 39: 2. increasing regional, city and co

- Page 42 and 43: Atlanta’s future into concrete st

- Page 44 and 45: Affordable Housing Preservation and

- Page 46 and 47: likely unproductive, although San F

- Page 48 and 49: where the entering families with sc

- Page 50 and 51: VI. CONCLUSIONThis paper provides a

- Page 52 and 53: APPENDIX ARESPONSES TO GENTRIFICATI

- Page 54 and 55: taken out of the San Francisco mark

- Page 56 and 57: According to a recent survey, twent

- Page 58 and 59: developed among long-standing Afric

- Page 60 and 61: increased concentrations of minorit

- Page 62 and 63: class to 60-65 percent of the popul

- Page 64 and 65: experience in the Reynoldstown comm

- Page 66 and 67: Hot Housing Market. Perhaps the mos

- Page 68 and 69:

The opening of the new Metro statio

- Page 70 and 71:

3. ConclusionOptimism about the cit

- Page 72 and 73:

just over seven percent of all perm

- Page 74 and 75:

But neighborhood watchers see the c

- Page 76 and 77:

BIBLIOGRAPHYAtkinson, Rowland, “M

- Page 78 and 79:

Mission Economic Development Associ

- Page 80:

Walker, Mary Beth, A Population Pro