Annual Report 2012 - The Australian Property Institute

Annual Report 2012 - The Australian Property Institute

Annual Report 2012 - The Australian Property Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

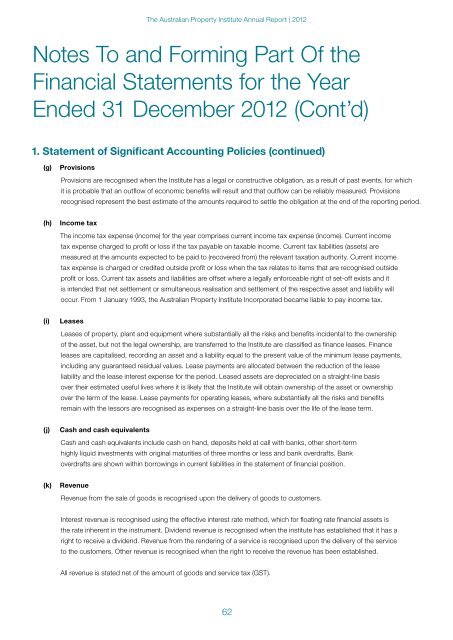

<strong>The</strong> <strong>Australian</strong> <strong>Property</strong> <strong>Institute</strong> <strong>Annual</strong> <strong>Report</strong> | <strong>2012</strong>Notes To and Forming Part Of theFinancial Statements for the YearEnded 31 December <strong>2012</strong> (Cont’d)1. Statement of Significant Accounting Policies (continued)(g)ProvisionsProvisions are recognised when the <strong>Institute</strong> has a legal or constructive obligation, as a result of past events, for whichit is probable that an outflow of economic benefits will result and that outflow can be reliably measured. Provisionsrecognised represent the best estimate of the amounts required to settle the obligation at the end of the reporting period.(h)Income tax<strong>The</strong> income tax expense (income) for the year comprises current income tax expense (income). Current incometax expense charged to profit or loss if the tax payable on taxable income. Current tax liabilities (assets) aremeasured at the amounts expected to be paid to (recovered from) the relevant taxation authority. Current incometax expense is charged or credited outside profit or loss when the tax relates to items that are recognised outsideprofit or loss. Current tax assets and liabilities are offset where a legally enforceable right of set-off exists and itis intended that net settlement or simultaneous realisation and settlement of the respective asset and liability willoccur. From 1 January 1993, the <strong>Australian</strong> <strong>Property</strong> <strong>Institute</strong> Incorporated became liable to pay income tax.(i)LeasesLeases of property, plant and equipment where substantially all the risks and benefits incidental to the ownershipof the asset, but not the legal ownership, are transferred to the <strong>Institute</strong> are classified as finance leases. Financeleases are capitalised, recording an asset and a liability equal to the present value of the minimum lease payments,including any guaranteed residual values. Lease payments are allocated between the reduction of the leaseliability and the lease interest expense for the period. Leased assets are depreciated on a straight-line basisover their estimated useful lives where it is likely that the <strong>Institute</strong> will obtain ownership of the asset or ownershipover the term of the lease. Lease payments for operating leases, where substantially all the risks and benefitsremain with the lessors are recognised as expenses on a straight-line basis over the life of the lease term.(j)Cash and cash equivalentsCash and cash equivalents include cash on hand, deposits held at call with banks, other short-termhighly liquid investments with original maturities of three months or less and bank overdrafts. Bankoverdrafts are shown within borrowings in current liabilities in the statement of financial position.(k)RevenueRevenue from the sale of goods is recognised upon the delivery of goods to customers.Interest revenue is recognised using the effective interest rate method, which for floating rate financial assets isthe rate inherent in the instrument. Dividend revenue is recognised when the institute has established that it has aright to receive a dividend. Revenue from the rendering of a service is recognised upon the delivery of the serviceto the customers. Other revenue is recognised when the right to receive the revenue has been established.All revenue is stated net of the amount of goods and service tax (GST).62