Annual Report 2012 - The Australian Property Institute

Annual Report 2012 - The Australian Property Institute

Annual Report 2012 - The Australian Property Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

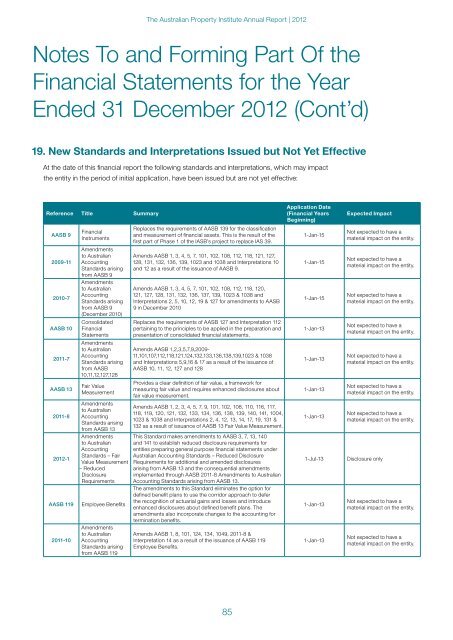

<strong>The</strong> <strong>Australian</strong> <strong>Property</strong> <strong>Institute</strong> <strong>Annual</strong> <strong>Report</strong> | <strong>2012</strong>Notes To and Forming Part Of theFinancial Statements for the YearEnded 31 December <strong>2012</strong> (Cont’d)19. New Standards and Interpretations Issued but Not Yet EffectiveAt the date of this financial report the following standards and interpretations, which may impactthe entity in the period of initial application, have been issued but are not yet effective:Reference Title SummaryAASB 92009-112010-7AASB 102011-7AASB 132011-8<strong>2012</strong>-1AASB 1192011-10FinancialInstrumentsAmendmentsto <strong>Australian</strong>AccountingStandards arisingfrom AASB 9Amendmentsto <strong>Australian</strong>AccountingStandards arisingfrom AASB 9(December 2010)ConsolidatedFinancialStatementsAmendmentsto <strong>Australian</strong>AccountingStandards arisingfrom AASB10,11,12,127,128Fair ValueMeasurementAmendmentsto <strong>Australian</strong>AccountingStandards arisingfrom AASB 13Amendmentsto <strong>Australian</strong>AccountingStandards – FairValue Measurement– ReducedDisclosureRequirementsEmployee BenefitsAmendmentsto <strong>Australian</strong>AccountingStandards arisingfrom AASB 119Replaces the requirements of AASB 139 for the classificationand measurement of financial assets. This is the result of thefirst part of Phase 1 of the IASB’s project to replace IAS 39.Amends AASB 1, 3, 4, 5, 7, 101, 102, 108, 112, 118, 121, 127,128, 131, 132, 136, 139, 1023 and 1038 and Interpretations 10and 12 as a result of the issuance of AASB 9.Amends AASB 1, 3, 4, 5, 7, 101, 102, 108, 112, 118, 120,121, 127, 128, 131, 132, 136, 137, 139, 1023 & 1038 andInterpretations 2, 5, 10, 12, 19 & 127 for amendments to AASB9 in December 2010Replaces the requirements of AASB 127 and Interpretation 112pertaining to the principles to be applied in the preparation andpresentation of consolidated financial statements.Amends AASB 1,2,3,5,7,9,2009-11,101,107,112,118,121,124,132,133,136,138,139,1023 & 1038and Interpretations 5,9,16 & 17 as a result of the issuance ofAASB 10, 11, 12, 127 and 128Provides a clear definition of fair value, a framework formeasuring fair value and requires enhanced disclosures aboutfair value measurement.Amends AASB 1, 2, 3, 4, 5, 7, 9, 101, 102, 108, 110, 116, 117,118, 119, 120, 121, 132, 133, 134, 136, 138, 139, 140, 141, 1004,1023 & 1038 and Interpretations 2, 4, 12, 13, 14, 17, 19, 131 &132 as a result of issuance of AASB 13 Fair Value Measurement.This Standard makes amendments to AASB 3, 7, 13, 140and 141 to establish reduced disclosure requirements forentities preparing general purpose financial statements under<strong>Australian</strong> Accounting Standards – Reduced DisclosureRequirements for additional and amended disclosuresarising from AASB 13 and the consequential amendmentsimplemented through AASB 2011-8 Amendments to <strong>Australian</strong>Accounting Standards arising from AASB 13.<strong>The</strong> amendments to this Standard eliminates the option fordefined benefit plans to use the corridor approach to deferthe recognition of actuarial gains and losses and introduceenhanced disclosures about defined benefit plans. <strong>The</strong>amendments also incorporate changes to the accounting fortermination benefits.Amends AASB 1, 8, 101, 124, 134, 1049, 2011-8 &Interpretation 14 as a result of the issuance of AASB 119Employee Benefits.Application Date(Financial YearsBeginning)1-Jan-151-Jan-151-Jan-151-Jan-131-Jan-131-Jan-131-Jan-131-Jul-131-Jan-131-Jan-13Expected ImpactNot expected to have amaterial impact on the entity.Not expected to have amaterial impact on the entity.Not expected to have amaterial impact on the entity.Not expected to have amaterial impact on the entity.Not expected to have amaterial impact on the entity.Not expected to have amaterial impact on the entity.Not expected to have amaterial impact on the entity.Disclosure onlyNot expected to have amaterial impact on the entity.Not expected to have amaterial impact on the entity.85