annual report 2007 - the Admiral Group plc

annual report 2007 - the Admiral Group plc

annual report 2007 - the Admiral Group plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

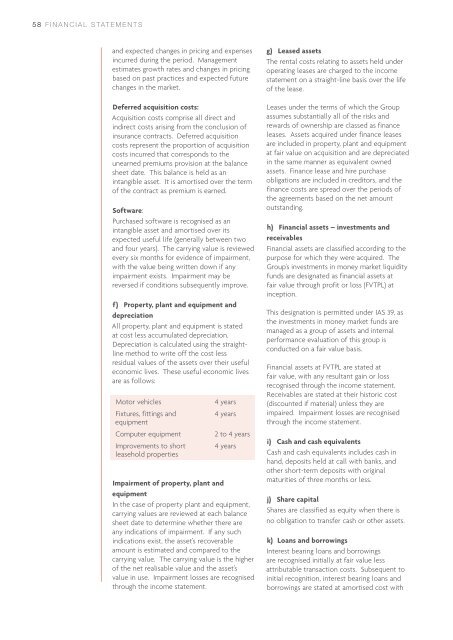

58 FINANCIAL STATEMENTSand expected changes in pricing and expensesincurred during <strong>the</strong> period. Managementestimates growth rates and changes in pricingbased on past practices and expected futurechanges in <strong>the</strong> market.Deferred acquisition costs:Acquisition costs comprise all direct andindirect costs arising from <strong>the</strong> conclusion ofinsurance contracts. Deferred acquisitioncosts represent <strong>the</strong> proportion of acquisitioncosts incurred that corresponds to <strong>the</strong>unearned premiums provision at <strong>the</strong> balancesheet date. This balance is held as anintangible asset. It is amortised over <strong>the</strong> termof <strong>the</strong> contract as premium is earned.Software:Purchased software is recognised as anintangible asset and amortised over itsexpected useful life (generally between twoand four years). The carrying value is reviewedevery six months for evidence of impairment,with <strong>the</strong> value being written down if anyimpairment exists. Impairment may bereversed if conditions subsequently improve.f) Property, plant and equipment anddepreciationAll property, plant and equipment is statedat cost less accumulated depreciation.Depreciation is calculated using <strong>the</strong> straightlinemethod to write off <strong>the</strong> cost lessresidual values of <strong>the</strong> assets over <strong>the</strong>ir usefuleconomic lives. These useful economic livesare as follows:Motor vehiclesFixtures, fittings andequipmentComputer equipmentImprovements to shortleasehold properties4 years4 years2 to 4 years4 yearsImpairment of property, plant andequipmentIn <strong>the</strong> case of property plant and equipment,carrying values are reviewed at each balancesheet date to determine whe<strong>the</strong>r <strong>the</strong>re areany indications of impairment. If any suchindications exist, <strong>the</strong> asset’s recoverableamount is estimated and compared to <strong>the</strong>carrying value. The carrying value is <strong>the</strong> higherof <strong>the</strong> net realisable value and <strong>the</strong> asset’svalue in use. Impairment losses are recognisedthrough <strong>the</strong> income statement.g) Leased assetsThe rental costs relating to assets held underoperating leases are charged to <strong>the</strong> incomestatement on a straight-line basis over <strong>the</strong> lifeof <strong>the</strong> lease.Leases under <strong>the</strong> terms of which <strong>the</strong> <strong>Group</strong>assumes substantially all of <strong>the</strong> risks andrewards of ownership are classed as financeleases. Assets acquired under finance leasesare included in property, plant and equipmentat fair value on acquisition and are depreciatedin <strong>the</strong> same manner as equivalent ownedassets. Finance lease and hire purchaseobligations are included in creditors, and <strong>the</strong>finance costs are spread over <strong>the</strong> periods of<strong>the</strong> agreements based on <strong>the</strong> net amountoutstanding.h) Financial assets – investments andreceivablesFinancial assets are classified according to <strong>the</strong>purpose for which <strong>the</strong>y were acquired. The<strong>Group</strong>'s investments in money market liquidityfunds are designated as financial assets atfair value through profit or loss (FVTPL) atinception.This designation is permitted under IAS 39, as<strong>the</strong> investments in money market funds aremanaged as a group of assets and internalperformance evaluation of this group isconducted on a fair value basis.Financial assets at FVTPL are stated atfair value, with any resultant gain or lossrecognised through <strong>the</strong> income statement.Receivables are stated at <strong>the</strong>ir historic cost(discounted if material) unless <strong>the</strong>y areimpaired. Impairment losses are recognisedthrough <strong>the</strong> income statement.i) Cash and cash equivalentsCash and cash equivalents includes cash inhand, deposits held at call with banks, ando<strong>the</strong>r short-term deposits with originalmaturities of three months or less.j) Share capitalShares are classified as equity when <strong>the</strong>re isno obligation to transfer cash or o<strong>the</strong>r assets.k) Loans and borrowingsInterest bearing loans and borrowingsare recognised initially at fair value lessattributable transaction costs. Subsequent toinitial recognition, interest bearing loans andborrowings are stated at amortised cost with