annual report 2007 - the Admiral Group plc

annual report 2007 - the Admiral Group plc

annual report 2007 - the Admiral Group plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

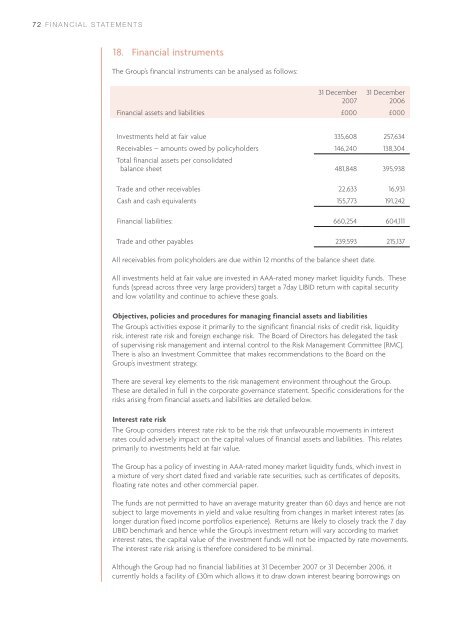

72 FINANCIAL STATEMENTS18. Financial instrumentsThe <strong>Group</strong>’s financial instruments can be analysed as follows:31 December<strong>2007</strong>31 December2006Financial assets and liabilities £000 £000Investments held at fair value 335,608 257,634Receivables – amounts owed by policyholders 146,240 138,304Total financial assets per consolidatedbalance sheet 481,848 395,938Trade and o<strong>the</strong>r receivables 22,633 16,931Cash and cash equivalents 155,773 191,242Financial liabilities: 660,254 604,111Trade and o<strong>the</strong>r payables 239,593 215,137All receivables from policyholders are due within 12 months of <strong>the</strong> balance sheet date.All investments held at fair value are invested in AAA-rated money market liquidity funds. Thesefunds (spread across three very large providers) target a 7day LIBID return with capital securityand low volatility and continue to achieve <strong>the</strong>se goals.Objectives, policies and procedures for managing financial assets and liabilitiesThe <strong>Group</strong>’s activities expose it primarily to <strong>the</strong> significant financial risks of credit risk, liquidityrisk, interest rate risk and foreign exchange risk. The Board of Directors has delegated <strong>the</strong> taskof supervising risk management and internal control to <strong>the</strong> Risk Management Committee (RMC).There is also an Investment Committee that makes recommendations to <strong>the</strong> Board on <strong>the</strong><strong>Group</strong>’s investment strategy.There are several key elements to <strong>the</strong> risk management environment throughout <strong>the</strong> <strong>Group</strong>.These are detailed in full in <strong>the</strong> corporate governance statement. Specific considerations for <strong>the</strong>risks arising from financial assets and liabilities are detailed below.Interest rate riskThe <strong>Group</strong> considers interest rate risk to be <strong>the</strong> risk that unfavourable movements in interestrates could adversely impact on <strong>the</strong> capital values of financial assets and liabilities. This relatesprimarily to investments held at fair value.The <strong>Group</strong> has a policy of investing in AAA-rated money market liquidity funds, which invest ina mixture of very short dated fixed and variable rate securities, such as certificates of deposits,floating rate notes and o<strong>the</strong>r commercial paper.The funds are not permitted to have an average maturity greater than 60 days and hence are notsubject to large movements in yield and value resulting from changes in market interest rates (aslonger duration fixed income portfolios experience). Returns are likely to closely track <strong>the</strong> 7 dayLIBID benchmark and hence while <strong>the</strong> <strong>Group</strong>’s investment return will vary according to marketinterest rates, <strong>the</strong> capital value of <strong>the</strong> investment funds will not be impacted by rate movements.The interest rate risk arising is <strong>the</strong>refore considered to be minimal.Although <strong>the</strong> <strong>Group</strong> had no financial liabilities at 31 December <strong>2007</strong> or 31 December 2006, itcurrently holds a facility of £30m which allows it to draw down interest bearing borrowings on