annual report 2007 - the Admiral Group plc

annual report 2007 - the Admiral Group plc

annual report 2007 - the Admiral Group plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

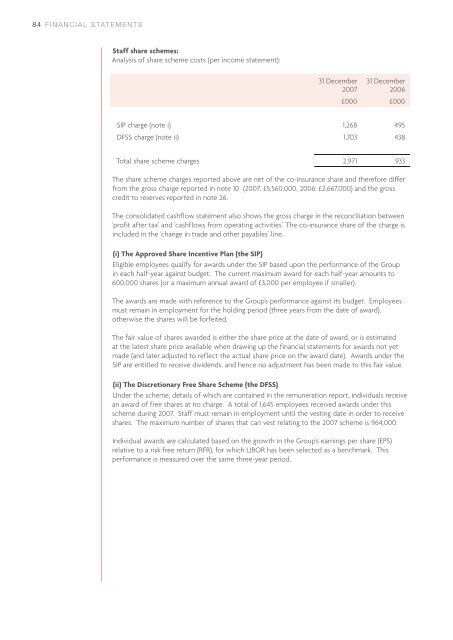

84 FINANCIAL STATEMENTSStaff share schemes:Analysis of share scheme costs (per income statement):31 December<strong>2007</strong>31 December2006£000 £000SIP charge (note i) 1,268 495DFSS charge (note ii) 1,703 438Total share scheme charges 2,971 933The share scheme charges <strong>report</strong>ed above are net of <strong>the</strong> co-insurance share and <strong>the</strong>refore differfrom <strong>the</strong> gross charge <strong>report</strong>ed in note 10 (<strong>2007</strong>: £5,560,000, 2006: £2,667,000) and <strong>the</strong> grosscredit to reserves <strong>report</strong>ed in note 26.The consolidated cashflow statement also shows <strong>the</strong> gross charge in <strong>the</strong> reconciliation between‘profit after tax’ and ‘cashflows from operating activities’. The co-insurance share of <strong>the</strong> charge isincluded in <strong>the</strong> ‘change in trade and o<strong>the</strong>r payables’ line.(i) The Approved Share Incentive Plan (<strong>the</strong> SIP)Eligible employees qualify for awards under <strong>the</strong> SIP based upon <strong>the</strong> performance of <strong>the</strong> <strong>Group</strong>in each half-year against budget. The current maximum award for each half-year amounts to600,000 shares (or a maximum <strong>annual</strong> award of £3,000 per employee if smaller).The awards are made with reference to <strong>the</strong> <strong>Group</strong>’s performance against its budget. Employeesmust remain in employment for <strong>the</strong> holding period (three years from <strong>the</strong> date of award),o<strong>the</strong>rwise <strong>the</strong> shares will be forfeited.The fair value of shares awarded is ei<strong>the</strong>r <strong>the</strong> share price at <strong>the</strong> date of award, or is estimatedat <strong>the</strong> latest share price available when drawing up <strong>the</strong> financial statements for awards not yetmade (and later adjusted to reflect <strong>the</strong> actual share price on <strong>the</strong> award date). Awards under <strong>the</strong>SIP are entitled to receive dividends, and hence no adjustment has been made to this fair value.(ii) The Discretionary Free Share Scheme (<strong>the</strong> DFSS)Under <strong>the</strong> scheme, details of which are contained in <strong>the</strong> remuneration <strong>report</strong>, individuals receivean award of free shares at no charge. A total of 1,645 employees received awards under thisscheme during <strong>2007</strong>. Staff must remain in employment until <strong>the</strong> vesting date in order to receiveshares. The maximum number of shares that can vest relating to <strong>the</strong> <strong>2007</strong> scheme is 964,000.Individual awards are calculated based on <strong>the</strong> growth in <strong>the</strong> <strong>Group</strong>'s earnings per share (EPS)relative to a risk free return (RFR), for which LIBOR has been selected as a benchmark. Thisperformance is measured over <strong>the</strong> same three-year period.