annual report 2007 - the Admiral Group plc

annual report 2007 - the Admiral Group plc

annual report 2007 - the Admiral Group plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

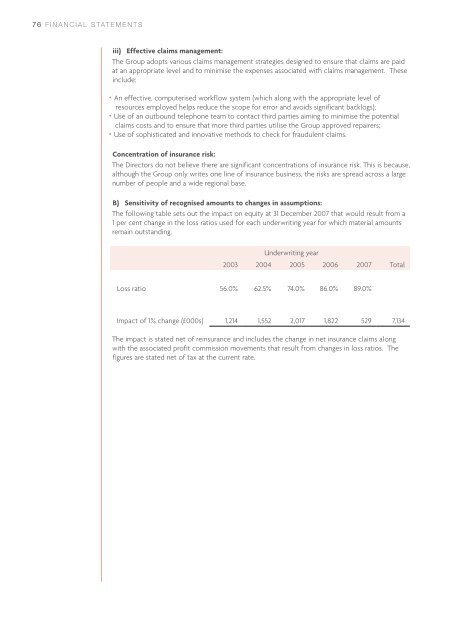

76 FINANCIAL STATEMENTSiii) Effective claims management:The <strong>Group</strong> adopts various claims management strategies designed to ensure that claims are paidat an appropriate level and to minimise <strong>the</strong> expenses associated with claims management. Theseinclude:· An effective, computerised workflow system (which along with <strong>the</strong> appropriate level ofresources employed helps reduce <strong>the</strong> scope for error and avoids significant backlogs);· Use of an outbound telephone team to contact third parties aiming to minimise <strong>the</strong> potentialclaims costs and to ensure that more third parties utilise <strong>the</strong> <strong>Group</strong> approved repairers;· Use of sophisticated and innovative methods to check for fraudulent claims.Concentration of insurance risk:The Directors do not believe <strong>the</strong>re are significant concentrations of insurance risk. This is because,although <strong>the</strong> <strong>Group</strong> only writes one line of insurance business, <strong>the</strong> risks are spread across a largenumber of people and a wide regional base.B) Sensitivity of recognised amounts to changes in assumptions:The following table sets out <strong>the</strong> impact on equity at 31 December <strong>2007</strong> that would result from a1 per cent change in <strong>the</strong> loss ratios used for each underwriting year for which material amountsremain outstanding.Underwriting year2003 2004 2005 2006 <strong>2007</strong> TotalLoss ratio 56.0% 62.5% 74.0% 86.0% 89.0%Impact of 1% change (£000s) 1,214 1,552 2,017 1,822 529 7,134The impact is stated net of reinsurance and includes <strong>the</strong> change in net insurance claims alongwith <strong>the</strong> associated profit commission movements that result from changes in loss ratios. Thefigures are stated net of tax at <strong>the</strong> current rate.