You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

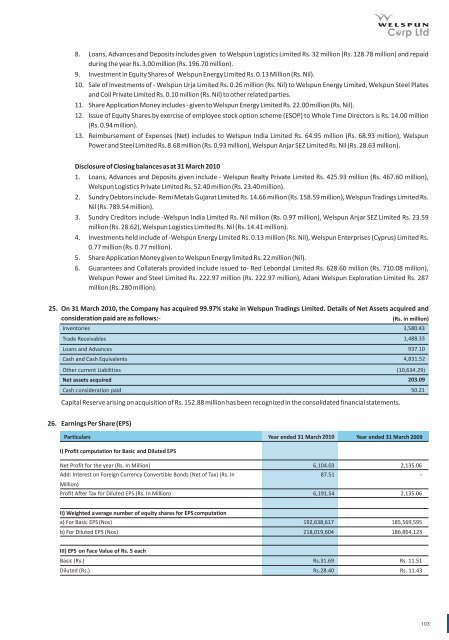

8. Loans, Advances and Deposits includes given to <strong>Welspun</strong> Logistics Limited Rs. 32 million (Rs. 128.78 million) and repaidduring the year Rs. 3.00 million (Rs. 196.70 million).9. Investment in Equity Shares of <strong>Welspun</strong> Energy Limited Rs. 0.13 Million (Rs. Nil).<strong>10</strong>. Sale of Investments of - <strong>Welspun</strong> Urja Limited Rs. 0.26 million (Rs. Nil) to <strong>Welspun</strong> Energy Limited, <strong>Welspun</strong> Steel Platesand Coil Private Limited Rs. 0.<strong>10</strong> million (Rs. Nil) to other related parties.11. Share Application Money includes - given to <strong>Welspun</strong> Energy Limited Rs. 22.00 million (Rs. Nil).C rp Ltd12. Issue of Equity Shares by exercise of employee stock option scheme (ESOP) to Whole Time Directors is Rs. 14.00 million(Rs. 0.94 million).13. Reimbursement of Expenses (Net) includes to <strong>Welspun</strong> India Limited Rs. 64.95 million (Rs. 68.93 million), <strong>Welspun</strong>Power and Steel Limited Rs. 8.68 million (Rs. 0.93 million), <strong>Welspun</strong> Anjar SEZ Limited Rs. Nil (Rs. 28.63 million).Disclosure of Closing balances as at 31 March 20<strong>10</strong>1. Loans, Advances and Deposits given include - <strong>Welspun</strong> Realty Private Limited Rs. 425.93 million (Rs. 467.60 million),<strong>Welspun</strong> Logistics Private Limited Rs. 52.40 million (Rs. 23.40 million).2. Sundry Debtors include- Remi Metals Gujarat Limited Rs. 14.66 million (Rs. 158.59 million), <strong>Welspun</strong> Tradings Limited Rs.Nil (Rs. 789.54 million).3. Sundry Creditors include -<strong>Welspun</strong> India Limited Rs. Nil million (Rs. 0.97 million), <strong>Welspun</strong> Anjar SEZ Limited Rs. 23.59million (Rs. 28.62), <strong>Welspun</strong> Logistics Limited Rs. Nil (Rs. 14.41 million).4. Investments held include of -<strong>Welspun</strong> Energy Limited Rs. 0.13 million (Rs. Nil), <strong>Welspun</strong> Enterprises (Cyprus) Limited Rs.0.77 million (Rs. 0.77 million).5. Share Application Money given to <strong>Welspun</strong> Energy limited Rs. 22 million (Nil).6. Guarantees and Collaterals provided include issued to- Red Lebondal Limited Rs. 628.60 million (Rs. 7<strong>10</strong>.08 million),<strong>Welspun</strong> Power and Steel Limited Rs. 222.97 million (Rs. 222.97 million), Adani <strong>Welspun</strong> Exploration Limited Rs. 287million (Rs. 280 million).25. On 31 March 20<strong>10</strong>, the Company has acquired 99.97% stake in <strong>Welspun</strong> Tradings Limited. Details of Net Assets acquired andconsideration paid are as follows:-Inventories(Rs. in million)3,580.43Trade Receivables1,488.33Loans and Advances937.<strong>10</strong>Cash and Cash Equivalents4,831.52Other current Liabilities(<strong>10</strong>,634.29)Net assets acquired203.09Cash consideration paid50.21Capital Reserve arising on acquisition of Rs. 152.88 million has been recognized in the consolidated financial statements.26. Earnings Per Share (EPS)ParticularsI) Profit computation for Basic and Diluted EPSNet Profit for the year (Rs. In Million)Add: Interest on Foreign Currency Convertible Bonds (Net of Tax) (Rs. InMillion)Profit After Tax for Diluted EPS (Rs. In Million)Year ended 31 March 20<strong>10</strong>6,<strong>10</strong>4.0387.516,191.54Year ended 31 March <strong>2009</strong>2,135.06-2,135.06II) Weighted average number of equity shares for EPS computationa) For Basic EPS (Nos)b) For Diluted EPS (Nos)192,638,617218,019,604185,569,595186,864,123III) EPS on Face Value of Rs. 5 eachBasic (Rs.)Diluted (Rs.)Rs.31.69Rs.28.40Rs. 11.51Rs. 11.43<strong>10</strong>3