You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

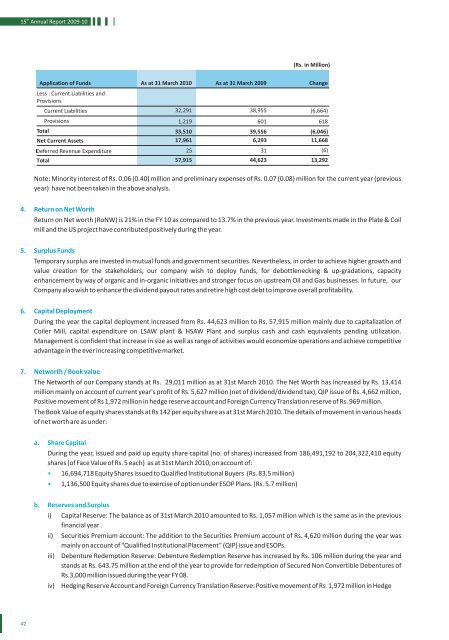

th15 <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong>-<strong>10</strong>(Rs. in Million)Application of Funds As at 31 March 20<strong>10</strong> As at 31 March <strong>2009</strong> ChangeLess : Current Liabilities andProvisionsCurrent LiabilitiesProvisionsTotalNet Current Assets32,291 38,955 (6,664)1,219601 61833,5<strong>10</strong> 39,556 (6,046)17,961 6,293 11,66825 31 (6)57,915 44,623 13,292Note: Minority interest of Rs. 0.06 (0.40) million and preliminary expenses of Rs. 0.07 (0.08) million for the current year (previousyear) have not been taken in the above analysis.4. Return on Net WorthReturn on Net worth (RoNW) is 21% in the <strong>FY</strong> <strong>10</strong> as compared to 13.7% in the previous year. Investments made in the Plate & Coilmill and the US project have contributed positively during the year.5. Surplus FundsTemporary surplus are invested in mutual funds and government securities. Nevertheless, in order to achieve higher growth andvalue creation for the stakeholders, our company wish to deploy funds, for debottlenecking & up-gradations, capacityenhancement by way of organic and in-organic initiatives and stronger focus on upstream Oil and Gas businesses. In future, ourCompany also wish to enhance the dividend payout rates and retire high cost debt to improve overall profitability.6. Capital DeploymentDuring the year the capital deployment increased from Rs. 44,623 million to Rs. 57,915 million mainly due to capitalization ofCoiler Mill, capital expenditure on LSAW plant & HSAW Plant and surplus cash and cash equivalents pending utilization.Management is confident that increase in size as well as range of activities would economize operations and achieve competitiveadvantage in the ever increasing competitive market.7. Networth / Book valueThe Networth of our Company stands at Rs. 29,011 million as at 31st March 20<strong>10</strong>. The Net Worth has increased by Rs. 13,414million mainly on account of current year's profit of Rs. 5,627 million (net of dividend/dividend tax), QIP issue of Rs. 4,662 million,Positive movement of Rs 1,972 million in hedge reserve account and Foreign Currency Translation reserve of Rs. 969 million.The Book Value of equity shares stands at Rs 142 per equity share as at 31st March 20<strong>10</strong>. The details of movement in various headsof net worth are as under:a. Share CapitalDuring the year, issued and paid up equity share capital (no. of shares) increased from 186,491,192 to 204,322,4<strong>10</strong> equityshares (of Face Value of Rs. 5 each) as at 31st March 20<strong>10</strong>, on account of:• 16,694,718 Equity Shares issued to Qualified Institutional Buyers (Rs. 83.5 million)• 1,136,500 Equity shares due to exercise of option under ESOP Plans. (Rs. 5.7 million)b. Reserves and Surplusi) Capital Reserve: The balance as of 31st March 20<strong>10</strong> amounted to Rs. 1,057 million which is the same as in the previousfinancial year .ii)Securities Premium account: The addition to the Securities Premium account of Rs. 4,620 million during the year wasmainly on account of “Qualified Institutional Placement” (QIP) issue and ESOPs.iii) Debenture Redemption Reserve: Debenture Redemption Reserve has increased by Rs. <strong>10</strong>6 million during the year andstands at Rs. 643.75 million at the end of the year to provide for redemption of Secured Non Convertible Debentures ofRs.3,000 million issued during the year <strong>FY</strong> 08.iv)Hedging Reserve Account and Foreign Currency Translation Reserve: Positive movement of Rs 1,972 million in Hedge42