Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

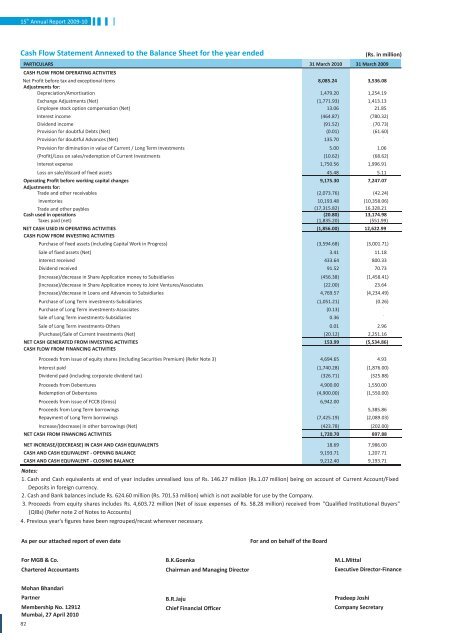

th15 <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong>-<strong>10</strong>Cash Flow Statement Annexed to the Balance Sheet for the year endedPARTICULARSCASH FLOW FROM OPERATING ACTIVITIESNet Profit before tax and exceptional itemsAdjustments for:Depreciation/AmortisationExchange Adjustments (Net)Employee stock option compensation (Net)Interest incomeDividend incomeProvision for doubtful Debts (Net)Provision for doubtful Advances (Net)Provision for diminution in value of Current / Long Term Investments(Profit)/Loss on sales/redemption of Current InvestmentsInterest expenseLoss on sale/discard of fixed assetsOperating Profit before working capital changesAdjustments for:Trade and other receivablesInventoriesTrade and other payblesCash used in operationsTaxes paid (net)NET CASH USED IN OPERATING ACTIVITIESCASH FLOW FROM INVESTING ACTIVITIESPurchase of fixed assets (including Capital Work in Progress)Sale of fixed assets (Net)Interest receivedDividend received(Increase)/decrease in Share Application money to Subsidiaries(Increase)/decrease in Share Application money to Joint Ventures/Associates(Increase)/decrease in Loans and Advances to SubsidiariesPurchase of Long Term investments-SubsidiariesPurchase of Long Term investments-AssociatesSale of Long Term investments-SubsidiariesSale of Long Term investments-Others(Purchase)/Sale of Current Investments (Net)NET CASH GENERATED FROM INVESTING ACTIVITIESCASH FLOW FROM FINANCING ACTIVITIESProceeds from issue of equity shares (Including Securities Premium) (Refer Note 3)Interest paidDividend paid (including corporate dividend tax)Proceeds from DebenturesRedemption of DebenturesProceeds from issue of FCCB (Gross)Proceeds from Long Term borrowingsRepayment of Long Term borrowingsIncrease/(decrease) in other borrowings (Net)NET CASH FROM FINANCING ACTIVITIES31 March 20<strong>10</strong> 31 March <strong>2009</strong>8,085.241,479.20(1,771.93)13.06(464.87)(91.52)(0.01)135.705.00(<strong>10</strong>.62)1,750.5645.489,175.30(2,073.76)<strong>10</strong>,193.48(17,315.82)(20.80)(1,835.20)(1,856.00)(3,594.68)3.41433.6491.52(456.38)(22.00)4,769.57(1,051.21)(0.13)0.360.01(20.12)153.994,694.65(1,740.28)(326.71)4,900.00(4,900.00)6,942.00-(7,425.19)(423.78)1,720.70(Rs. in million)3,536.081,254.191,413.1321.85(780.32)(70.73)(61.60)-1.06(68.62)1,996.915.117,247.07(42.24)(<strong>10</strong>,358.06)16,328.2113,174.98(551.99)12,622.99(3,001.71)11.18800.3370.73(1,458.41)23.64(4,234.49)(0.26)--2.962,251.16(5,534.86)4.93(1,876.00)(325.88)1,550.00(1,550.00)-5,385.86(2,089.03)(202.00)897.88NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTSCASH AND CASH EQUIVALENT - OPENING BALANCECASH AND CASH EQUIVALENT - CLOSING BALANCENotes:1. Cash and Cash equivalents at end of year includes unrealised loss of Rs. 146.27 million (Rs.1.07 million) being on account of Current Account/FixedDeposits in foreign currency.2. Cash and Bank balances include Rs. 624.60 million (Rs. 701.53 million) which is not available for use by the Company.3. Proceeds from equity shares includes Rs. 4,603.72 million (Net of issue expenses of Rs. 58.28 million) received from "Qualified Institutional Buyers"(QIBs) (Refer note 2 of Notes to Accounts)4. Previous year's figures have been regrouped/recast wherever necessary.18.699,193.719,212.407,986.001,207.719,193.71As per our attached report of even dateFor and on behalf of the BoardFor MGB & Co.Chartered AccountantsB.K.GoenkaChairman and Managing DirectorM.L.MittalExecutive Director-FinanceMohan BhandariPartnerMembership No. 12912Mumbai, 27 April 20<strong>10</strong>82B.R.JajuChief Financial OfficerPradeep JoshiCompany Secretary