Contents - Tung Lok Restaurants 2000 Ltd

Contents - Tung Lok Restaurants 2000 Ltd

Contents - Tung Lok Restaurants 2000 Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

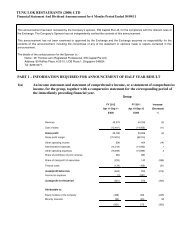

Group’s equityShare of net Before AfterName of company Consideration liabilities acquired acquisition acquisition$ $ % %Club Asiana Pte <strong>Ltd</strong> 80,000 745,865 55 100Club Asiana Pte <strong>Ltd</strong> became a wholly owned subsidiary of the Group after the acquisition of additionalshares.ii)Other than the above, there were no acquisitions or disposals of subsidiaries during the financial year.5 RESULTS FOR THE FINANCIAL YEARGroup Company$ $Loss after income tax (4,284,504) (3,714,633)Minority interests (192,152) -Net loss attributable to shareholders (4,476,656) (3,714,633)Accumulated losses at beginning of year (84,316) (371,969)Accumulated losses at end of year (4,560,972) (4,086,602)6 MATERIAL TRANSFERS TO/FROM RESERVES AND PROVISIONSThere were no material transfers to or from reserves and provisions during the financial year other than thosedisclosed in the financial statements.7 ISSUE OF SHARES AND DEBENTURESDuring the financial year, the company issued 20,000,000 new shares of $0.025 each at a premium of $0.087 pershare for cash pursuant to the Placement Agreement with Chip Lian Investments Pte <strong>Ltd</strong> to subscribe for ordinaryshares in the company. The ordinary shares issued in connection with the Placement Agreement, ranked paripassu in all respects with the existing issued and fully paid-up shares. The proceeds were used for working capital.None of the subsidiaries issued any shares during the financial year.No debentures were issued by the company or subsidiaries during the financial year.8 ARRANGEMENTS TO ENABLE DIRECTORS TO ACQUIRE BENEFITSBY MEANS OF ACQUISITION OF SHARES AND DEBENTURESNeither at the end of the financial year nor at any time during the financial year did there subsist any arrangementwhose object is to enable the directors of the company to acquire benefits by means of the acquisition of shares ordebentures in the company or any other body corporate. 33