Contents - Tung Lok Restaurants 2000 Ltd

Contents - Tung Lok Restaurants 2000 Ltd

Contents - Tung Lok Restaurants 2000 Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

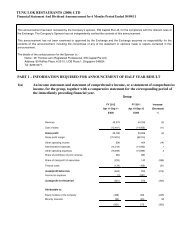

At December 31, 2002, the group’s total bank overdraft, finance lease obligations and long-term loansamounted to $4.8 million (2001 : $3.6 million). The profile of the finance lease obligations and long-termloans are shown in Notes 14 and 15 to the financial statements.e) Commodity price riskCertain commodities, principally shark’s fins, dried foodstuff, meat, fish and other seafood delicacies, aregenerally purchased based on market prices established with the suppliers. Although many of the productspurchased are subject to changes in commodity prices, certain purchasing contracts or pricing arrangementscontain risk management techniques designed to minimise price volatility. Typically, the group uses thesetypes of purchasing techniques to control costs as an alternative to directly using financial instruments tohedge commodity prices. Where commodity cost increases significantly and appears to be long-term innature, the management addresses the risk by adjusting the menu pricing or change the product deliverystrategy.f) Net fair valueThe carrying amounts of financial assets and financial liabilities recorded in the financial statementsapproximate their respective net fair values, determined in accordance with the accounting policies disclosedin Note 2 to the financial statements.4 RELATED PARTY TRANSACTIONSParties are considered to be related if one party has the ability to control the other party or exercises significantinfluence over the other party in making financial and operating decision. Related parties are entities with commondirect or indirect shareholders and or directors.Some of the group’s and the company’s transactions and arrangements are with related parties and the effects ofthese on the basis determined between the parties are reflected in these financial statements. The balances areunsecured, interest-free and without fixed repayment terms unless stated otherwise.Significant related party transactions other than those disclosed elsewhere in the notes to the profit and lossstatement:GroupCompany2002 2001 2002 2001$ $ $ $Sales of food and beverages (252,357) (84,977) - -Management fee income (348,000) (224,000) - -Purchases of food and beverages 14,948 6,976 - -Interest income (28,953) (11,910) - - 49