Contents - Tung Lok Restaurants 2000 Ltd

Contents - Tung Lok Restaurants 2000 Ltd

Contents - Tung Lok Restaurants 2000 Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

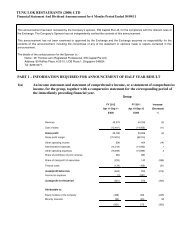

Notes to Financial Statements16 DEFERRED INCOME TAXThe following are the major deferred tax liabilities recognised by the group and the movement thereon during theyear:UnabsorbedAccelerated tax capitaldepreciation allowances Total$ $ $GroupAt beginning of year 590,679 (475,956) 114,723Charge to profit and loss 190,428 159,546 349,974Effect of change in tax rate (75,823) 95,849 20,026At end of year 705,284 (220,561) 484,72317 ISSUED CAPITALGroup and Company2002 2001 2002 2001Number of shares $ $Authorised:Ordinaryshares of $0.025 each 400,000,000 400,000,000 10,000,000 10,000,000Issued and fully paid:Balance at beginning of year 100,000,000 2 2,500,000 2Issue of shares before subdivisionof shares - 1,586,714 - 1,586,714Subdivision of shares - 78,413,284 - -Issue of shares 20,000,000 20,000,000 500,000 913,284Balance at end of year 120,000,000 100,000,000 3,000,000 2,500,000During the financial year, the company issued an additional 20,000,000 ordinary shares of $0.025 each at a premiumof $0.087 per share for cash pursuant to the Placement Agreement with Chip Lian Investments Pte <strong>Ltd</strong>.18 SHARE PREMIUMGroup and Company2002 2001$ $Balance at beginning of year 2,926,581 -Arising from public offering - 4,100,000Arising from Placement Agreement 1,740,000 -Share issue expenses (71,240) (1,173,419)Balance at end of year 4,595,341 2,926,581Included in the share issue expenses written off during the year is professional fee of $9,800(2001 : $233,000) paid to the auditors of the company. 56