Contents - Tung Lok Restaurants 2000 Ltd

Contents - Tung Lok Restaurants 2000 Ltd

Contents - Tung Lok Restaurants 2000 Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

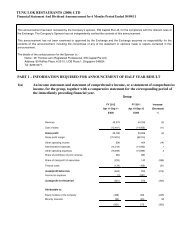

The number of directors of the company in remuneration bands for the year ended December 31, 2002 are asfollows:Number of Number of non- Total numberexecutive directors executive directors of directors2002 2001 2002 2001 2002 2001$500,000 and above - - - - - -$250,000 to $499,999 - 1 - - - 1Below $250,000 2 1 4 3 6 4Total 2 2 4 3 6 524 INCOME TAX EXPENSEThis comprises:GroupCompany2002 2001 2002 2001$ $ $ $Current tax expense 40,398 71,101 134,100 7,064Deferred tax 370,000 (99,000) - -Total/Net 410,398 (27,899) 134,100 7,064The income tax expense varied from the amount of income tax expense determined by applying the Singapore taxrate of 22.0% (2001 : 24.5%) to the profit before tax as a result of the following differences:GroupCompany2002 2001 2002 2001$ $ $ $Income tax expense (benefit) atstatutory rate (852,303) (344,688) (787,717) (85,727)Non-allowable items 1,190,207 70,845 1,011,437 92,791Group relief - - (110,000) -Effect of changes in tax rates 20,026 - - -Unrecorded deferred tax benefits 713,475 386,801 - -Utilisation of prior year’s tax losses (505,878) (122,763) - -Tax exempt (23,100) (12,863) - -Others (132,029) (5,231) 20,380 -Net 410,398 (27,899) 134,100 7,064Group reliefDuring the year the company utilises $500,000 of the current year tax losses and capital allowances of a subsidiarypursuant to the group relief scheme which was announced this year. The benefit from group relief amounted toapproximately $110,000. The subsidiary which transferred the tax losses and capital allowances to the companyhas agreed to transfer the tax losses and capital allowances without any charge to the company. 59