COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

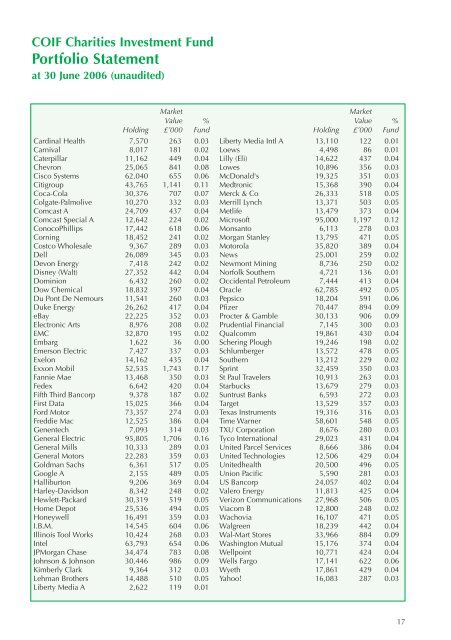

<strong>COIF</strong> Charities Investment FundPortfolio Statementat 30 June 2006 (unaudited)MarketValue %Holding £’000 FundCardinal Health 7,570 263 0.03Carnival 8,017 181 0.02Caterpillar 11,162 449 0.04Chevron 25,065 841 0.08Cisco Systems 62,040 655 0.06Citigroup 43,765 1,141 0.11Coca-Cola 30,376 707 0.07Colgate-Palmolive 10,270 332 0.03Comcast A 24,709 437 0.04Comcast Special A 12,642 224 0.02ConocoPhillips 17,442 618 0.06Corning 18,452 241 0.02Costco Wholesale 9,367 289 0.03Dell 26,089 345 0.03Devon Energy 7,418 242 0.02Disney (Walt) 27,352 442 0.04Dominion 6,432 260 0.02Dow Chemical 18,832 397 0.04Du Pont De Nemours 11,541 260 0.03Duke Energy 26,262 417 0.04eBay 22,225 352 0.03Electronic Arts 8,976 208 0.02EMC 32,870 195 0.02Embarg 1,622 36 0.00Emerson Electric 7,427 337 0.03Exelon 14,162 435 0.04Exxon Mobil 52,535 1,743 0.17Fannie Mae 13,468 350 0.03Fedex 6,642 420 0.04Fifth Third Bancorp 9,378 187 0.02First Data 15,025 366 0.04Ford Motor 73,357 274 0.03Freddie Mac 12,525 386 0.04Genentech 7,093 314 0.03General Electric 95,805 1,706 0.16General Mills 10,333 289 0.03General Motors 22,283 359 0.03Goldman Sachs 6,361 517 0.05Google A 2,155 489 0.05Halliburton 9,206 369 0.04Harley-Davidson 8,342 248 0.02Hewlett-Packard 30,319 519 0.05Home Depot 25,536 494 0.05Honeywell 16,491 359 0.03I.B.M. 14,545 604 0.06Illinois Tool Works 10,424 268 0.03Intel 63,793 654 0.06JPMorgan Chase 34,474 783 0.08Johnson & Johnson 30,446 986 0.09Kimberly Clark 9,364 312 0.03Lehman Brothers 14,488 510 0.05Liberty Media A 2,622 119 0.01MarketValue %Holding £’000 FundLiberty Media Intl A 13,110 122 0.01Loews 4,498 86 0.01Lilly (Eli) 14,622 437 0.04Lowes 10,896 356 0.03McDonald's 19,325 351 0.03Medtronic 15,368 390 0.04Merck & Co 26,333 518 0.05Merrill Lynch 13,371 503 0.05Metlife 13,479 373 0.04Microsoft 95,000 1,197 0.12Monsanto 6,113 278 0.03Morgan Stanley 13,795 471 0.05Motorola 35,820 389 0.04News 25,001 259 0.02Newmont Mining 8,736 250 0.02Norfolk Southern 4,721 136 0.01Occidental Petroleum 7,444 413 0.04Oracle 62,785 492 0.05Pepsico 18,204 591 0.06Pfizer 70,447 894 0.09Procter & Gamble 30,133 906 0.09Prudential Financial 7,145 300 0.03Qualcomm 19,861 430 0.04Schering Plough 19,246 198 0.02Schlumberger 13,572 478 0.05Southern 13,212 229 0.02Sprint 32,459 350 0.03St Paul Travelers 10,913 263 0.03Starbucks 13,679 279 0.03Suntrust Banks 6,593 272 0.03Target 13,529 357 0.03Texas Instruments 19,316 316 0.03Time Warner 58,601 548 0.05TXU Corporation 8,676 280 0.03Tyco International 29,023 431 0.04United Parcel Services 8,666 386 0.04United Technologies 12,506 429 0.04Unitedhealth 20,500 496 0.05Union Pacific 5,590 281 0.03US Bancorp 24,057 402 0.04Valero Energy 11,813 425 0.04Verizon Communications 27,968 506 0.05Viacom B 12,800 248 0.02Wachovia 16,107 471 0.05Walgreen 18,239 442 0.04Wal-Mart Stores 33,966 884 0.09Washington Mutual 15,176 374 0.04Wellpoint 10,771 424 0.04Wells Fargo 17,141 622 0.06Wyeth 17,861 429 0.04Yahoo! 16,083 287 0.0317