COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

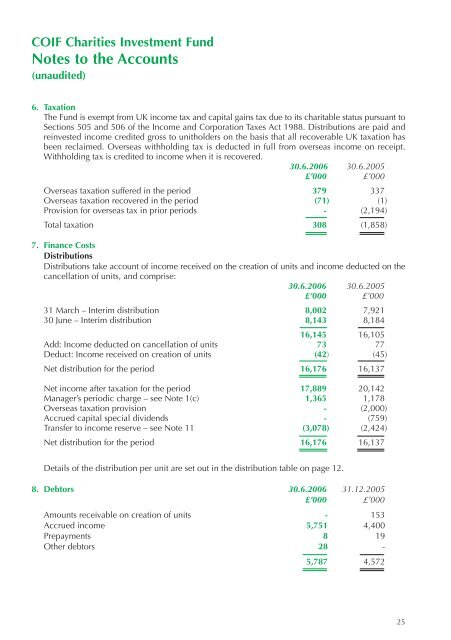

<strong>COIF</strong> Charities Investment FundNotes to the Accounts(unaudited)6. TaxationThe Fund is exempt from UK income tax and capital gains tax due to its charitable status pursuant toSections 505 and 506 of the Income and Corporation Taxes Act 1988. Distributions are paid andreinvested income credited gross to unitholders on the basis that all recoverable UK taxation hasbeen reclaimed. Overseas withholding tax is deducted in full from overseas income on receipt.Withholding tax is credited to income when it is recovered.30.6.2006 30.6.2005£’000 £’000Overseas taxation suffered in the period 379 337Overseas taxation recovered in the period (71) (1)Provision for overseas tax in prior periods - (2,194)Total taxation 308 (1,858)7. Finance CostsDistributionsDistributions take account of income received on the creation of units and income deducted on thecancellation of units, and comprise:30.6.2006 30.6.2005£’000 £’00031 March – Interim distribution 8,002 7,92130 June – Interim distribution 8,143 8,18416,145 16,105Add: Income deducted on cancellation of units 73 77Deduct: Income received on creation of units (42) (45)Net distribution for the period 16,176 16,137Net income after taxation for the period 17,889 20,142Manager’s periodic charge – see Note 1(c) 1,365 1,178Overseas taxation provision - (2,000)Accrued capital special dividends - (759)Transfer to income reserve – see Note 11 (3,078) (2,424)Net distribution for the period 16,176 16,137Details of the distribution per unit are set out in the distribution table on page 12.8. Debtors 30.6.2006 31.12.2005£’000 £’000Amounts receivable on creation of units - 153Accrued income 5,751 4,400Prepayments 8 19Other debtors 28 -5,787 4,57225