COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

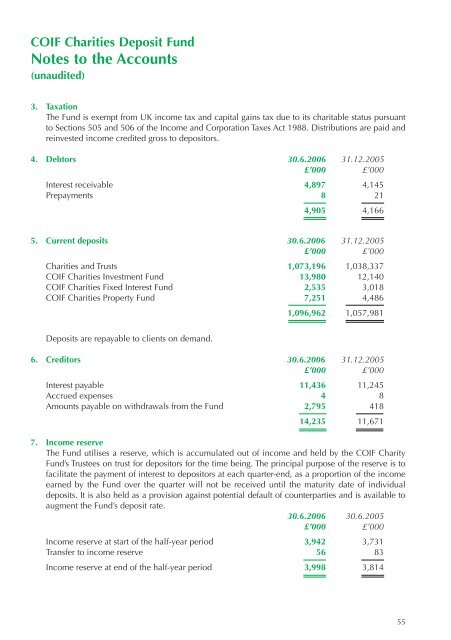

<strong>COIF</strong> Charities Deposit FundNotes to the Accounts(unaudited)3. TaxationThe Fund is exempt from UK income tax and capital gains tax due to its charitable status pursuantto Sections 505 and 506 of the Income and Corporation Taxes Act 1988. Distributions are paid andreinvested income credited gross to depositors.4. Debtors 30.6.2006 31.12.2005£’000 £’000Interest receivable 4,897 4,145Prepayments 8 214,905 4,1665. Current deposits 30.6.2006 31.12.2005£’000 £’000Charities and Trusts 1,073,196 1,038,337<strong>COIF</strong> Charities Investment Fund 13,980 12,140<strong>COIF</strong> Charities Fixed Interest Fund 2,535 3,018<strong>COIF</strong> Charities Property Fund 7,251 4,4861,096,962 1,057,981Deposits are repayable to clients on demand.6. Creditors 30.6.2006 31.12.2005£’000 £’000Interest payable 11,436 11,245Accrued expenses 4 8Amounts payable on withdrawals from the Fund 2,795 41814,235 11,6717. Income reserveThe Fund utilises a reserve, which is accumulated out of income and held by the <strong>COIF</strong> <strong>Charity</strong>Fund’s Trustees on trust for depositors for the time being. The principal purpose of the reserve is tofacilitate the payment of interest to depositors at each quarter-end, as a proportion of the incomeearned by the Fund over the quarter will not be received until the maturity date of individualdeposits. It is also held as a provision against potential default of counterparties and is available toaugment the Fund’s deposit rate.30.6.2006 30.6.2005£’000 £’000Income reserve at start of the half-year period 3,942 3,731Transfer to income reserve 56 83Income reserve at end of the half-year period 3,998 3,81455