COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

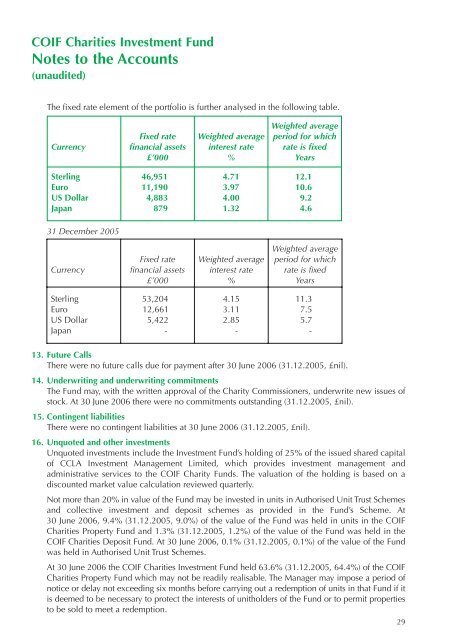

<strong>COIF</strong> Charities Investment FundNotes to the Accounts(unaudited)The fixed rate element of the portfolio is further analysed in the following table.CurrencyFixed ratefinancial assets£’000Weighted averageinterest rate%Weighted averageperiod for whichrate is fixedYearsSterlingEuroUS DollarJapan46,95111,1904,8838794.713.974.001.3212.110.69.24.631 December 2005CurrencyFixed ratefinancial assets£’000Weighted averageinterest rate%Weighted averageperiod for whichrate is fixedYearsSterlingEuroUS DollarJapan53,20412,6615,422-4.153.112.85-11.37.55.7-13. Future CallsThere were no future calls due for payment after 30 June 2006 (31.12.2005, £nil).14. Underwriting and underwriting commitmentsThe Fund may, with the written approval of the <strong>Charity</strong> Commissioners, underwrite new issues ofstock. At 30 June 2006 there were no commitments outstanding (31.12.2005, £nil).15. Contingent liabilitiesThere were no contingent liabilities at 30 June 2006 (31.12.2005, £nil).16. Unquoted and other investmentsUnquoted investments include the Investment Fund’s holding of 25% of the issued shared capitalof <strong>CCLA</strong> Investment Management Limited, which provides investment management andadministrative services to the <strong>COIF</strong> <strong>Charity</strong> <strong>Funds</strong>. The valuation of the holding is based on adiscounted market value calculation reviewed quarterly.Not more than 20% in value of the Fund may be invested in units in Authorised Unit Trust Schemesand collective investment and deposit schemes as provided in the Fund’s Scheme. At30 June 2006, 9.4% (31.12.2005, 9.0%) of the value of the Fund was held in units in the <strong>COIF</strong>Charities Property Fund and 1.3% (31.12.2005, 1.2%) of the value of the Fund was held in the<strong>COIF</strong> Charities Deposit Fund. At 30 June 2006, 0.1% (31.12.2005, 0.1%) of the value of the Fundwas held in Authorised Unit Trust Schemes.At 30 June 2006 the <strong>COIF</strong> Charities Investment Fund held 63.6% (31.12.2005, 64.4%) of the <strong>COIF</strong>Charities Property Fund which may not be readily realisable. The Manager may impose a period ofnotice or delay not exceeding six months before carrying out a redemption of units in that Fund if itis deemed to be necessary to protect the interests of unitholders of the Fund or to permit propertiesto be sold to meet a redemption.29