COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

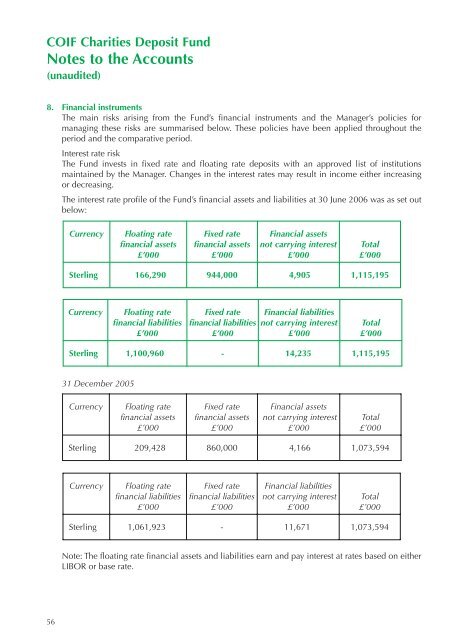

<strong>COIF</strong> Charities Deposit FundNotes to the Accounts(unaudited)8. Financial instrumentsThe main risks arising from the Fund’s financial instruments and the Manager’s policies formanaging these risks are summarised below. These policies have been applied throughout theperiod and the comparative period.Interest rate riskThe Fund invests in fixed rate and floating rate deposits with an approved list of institutionsmaintained by the Manager. Changes in the interest rates may result in income either increasingor decreasing.The interest rate profile of the Fund’s financial assets and liabilities at 30 June 2006 was as set outbelow:CurrencyFloating ratefinancial assets£’000Fixed ratefinancial assets£’000Financial assetsnot carrying interest£’000Total£’000Sterling 166,290 944,000 4,905 1,115,195CurrencyFloating ratefinancial liabilities£’000Fixed ratefinancial liabilities£’000Financial liabilitiesnot carrying interest£’000Total£’000Sterling 1,100,960 - 14,235 1,115,19531 December 2005CurrencyFloating ratefinancial assets£’000Fixed ratefinancial assets£’000Financial assetsnot carrying interest£’000Total£’000Sterling 209,428 860,000 4,166 1,073,594CurrencyFloating ratefinancial liabilities£’000Fixed ratefinancial liabilities£’000Financial liabilitiesnot carrying interest£’000Total£’000Sterling 1,061,923 - 11,671 1,073,594Note: The floating rate financial assets and liabilities earn and pay interest at rates based on eitherLIBOR or base rate.56