COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

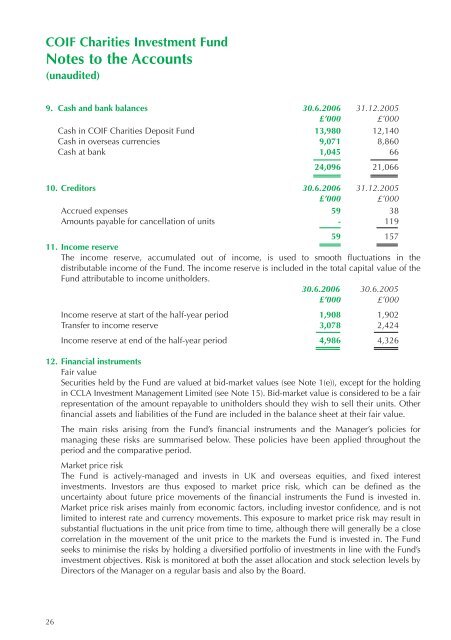

<strong>COIF</strong> Charities Investment FundNotes to the Accounts(unaudited)9. Cash and bank balances 30.6.2006 31.12.2005£’000 £’000Cash in <strong>COIF</strong> Charities Deposit Fund 13,980 12,140Cash in overseas currencies 9,071 8,860Cash at bank 1,045 6624,096 21,06610. Creditors 30.6.2006 31.12.2005£’000 £’000Accrued expenses 59 38Amounts payable for cancellation of units - 11959 15711. Income reserveThe income reserve, accumulated out of income, is used to smooth fluctuations in thedistributable income of the Fund. The income reserve is included in the total capital value of theFund attributable to income unitholders.30.6.2006 30.6.2005£’000 £’000Income reserve at start of the half-year period 1,908 1,902Transfer to income reserve 3,078 2,424Income reserve at end of the half-year period 4,986 4,32612. Financial instrumentsFair valueSecurities held by the Fund are valued at bid-market values (see Note 1(e)), except for the holdingin <strong>CCLA</strong> Investment Management Limited (see Note 15). Bid-market value is considered to be a fairrepresentation of the amount repayable to unitholders should they wish to sell their units. Otherfinancial assets and liabilities of the Fund are included in the balance sheet at their fair value.The main risks arising from the Fund’s financial instruments and the Manager’s policies formanaging these risks are summarised below. These policies have been applied throughout theperiod and the comparative period.Market price riskThe Fund is actively-managed and invests in UK and overseas equities, and fixed interestinvestments. Investors are thus exposed to market price risk, which can be defined as theuncertainty about future price movements of the financial instruments the Fund is invested in.Market price risk arises mainly from economic factors, including investor confidence, and is notlimited to interest rate and currency movements. This exposure to market price risk may result insubstantial fluctuations in the unit price from time to time, although there will generally be a closecorrelation in the movement of the unit price to the markets the Fund is invested in. The <strong>Funds</strong>eeks to minimise the risks by holding a diversified portfolio of investments in line with the Fund’sinvestment objectives. Risk is monitored at both the asset allocation and stock selection levels byDirectors of the Manager on a regular basis and also by the Board.26