Corporate Governance

Corporate Governance

Corporate Governance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2. Capital structure<br />

<strong>Corporate</strong> <strong>Governance</strong><br />

2.1 Capital and changes to the capital during the last three years, and other financial instruments — Since the Annual<br />

General Meeting voted to reduce the company’s share capital by 40 % from CHF 12,600,420 in 2003, it has remained<br />

unchanged at CHF 7,560,252. There has been no change in the proportion of registered shares and bearer shares.<br />

There is neither authorised nor conditional capital. The company has issued neither participation nor profit-sharing cer-<br />

tificates. No convertible bonds or warrants issued by AFG Arbonia-Forster-Holding AG are outstanding. AFG Arbonia-<br />

Forster-Holding AG issued a bond (term 2004–10) with an interest rate of 3.375 % and a total nominal value of CHF 150<br />

million on 3 June 2004. The debt must be repaid on 3 June 2010. Interest is paid annually on 3 June. AFG Arbonia-<br />

Forster-Holding AG concluded a private placement of USD 160 million with a group of US investors on 2 December 2004.<br />

The placement is hedged against interest and exchange rate risks, and is composed of different tranches in USD and EUR<br />

with terms of between four and ten years.<br />

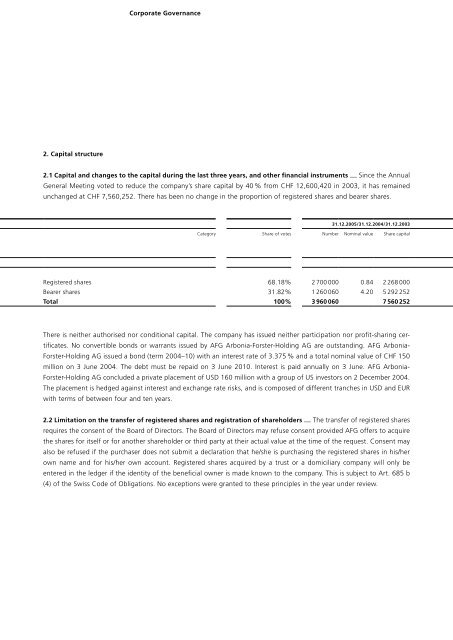

31.12.2005/31.12.2004/31.12.2003<br />

Category Share of votes Number Nominal value Share capital<br />

Registered shares 68.18% 2 700 000 0.84 2 268 000<br />

Bearer shares 31.82% 1 260 060 4.20 5 292 252<br />

Total 100% 3 60 060 7 560 252<br />

2.2 Limitation on the transfer of registered shares and registration of shareholders — The transfer of registered shares<br />

requires the consent of the Board of Directors. The Board of Directors may refuse consent provided AFG offers to acquire<br />

the shares for itself or for another shareholder or third party at their actual value at the time of the request. Consent may<br />

also be refused if the purchaser does not submit a declaration that he/she is purchasing the registered shares in his/her<br />

own name and for his/her own account. Registered shares acquired by a trust or a domiciliary company will only be<br />

entered in the ledger if the identity of the beneficial owner is made known to the company. This is subject to Art. 685 b<br />

(4) of the Swiss Code of Obligations. No exceptions were granted to these principles in the year under review.