A Dynamic Model of Housing Supply

A Dynamic Model of Housing Supply

A Dynamic Model of Housing Supply

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

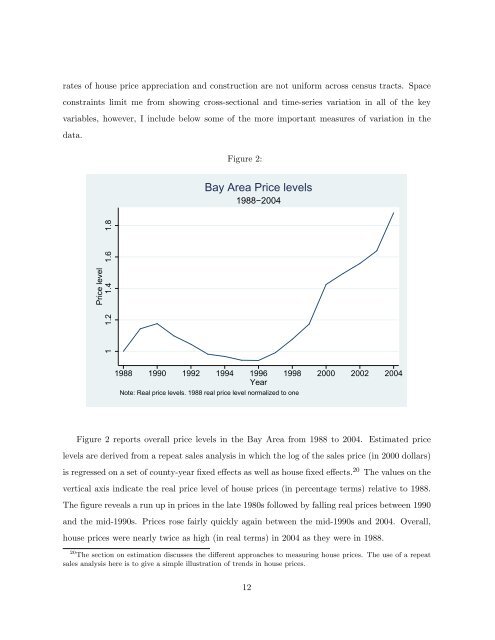

ates <strong>of</strong> house price appreciation and construction are not uniform across census tracts. Spaceconstraints limit me from showing cross-sectional and time-series variation in all <strong>of</strong> the keyvariables, however, I include below some <strong>of</strong> the more important measures <strong>of</strong> variation in thedata.Figure 2:Bay Area Price levels1988−2004Price level1 1.2 1.4 1.6 1.81988 1990 1992 1994 1996 1998 2000 2002 2004YearNote: Real price levels. 1988 real price level normalized to oneFigure 2 reports overall price levels in the Bay Area from 1988 to 2004. Estimated pricelevels are derived from a repeat sales analysis in which the log <strong>of</strong> the sales price (in 2000 dollars)is regressed on a set <strong>of</strong> county-year fixed effects as well as house fixed effects. 20 The values on thevertical axis indicate the real price level <strong>of</strong> house prices (in percentage terms) relative to 1988.The figure reveals a run up in prices in the late 1980s followed by falling real prices between 1990and the mid-1990s. Prices rose fairly quickly again between the mid-1990s and 2004. Overall,house prices were nearly twice as high (in real terms) in 2004 as they were in 1988.20 The section on estimation discusses the different approaches to measuring house prices. The use <strong>of</strong> a repeatsales analysis here is to give a simple illustration <strong>of</strong> trends in house prices.12