A Dynamic Model of Housing Supply

A Dynamic Model of Housing Supply

A Dynamic Model of Housing Supply

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

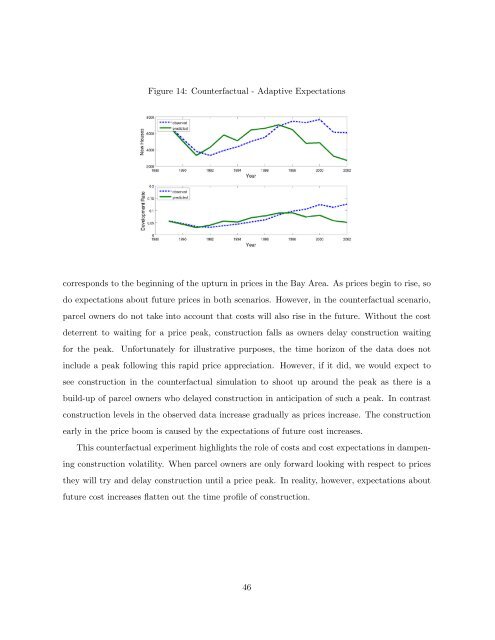

Figure 14: Counterfactual - Adaptive Expectationscorresponds to the beginning <strong>of</strong> the upturn in prices in the Bay Area. As prices begin to rise, sodo expectations about future prices in both scenarios. However, in the counterfactual scenario,parcel owners do not take into account that costs will also rise in the future. Without the costdeterrent to waiting for a price peak, construction falls as owners delay construction waitingfor the peak. Unfortunately for illustrative purposes, the time horizon <strong>of</strong> the data does notinclude a peak following this rapid price appreciation. However, if it did, we would expect tosee construction in the counterfactual simulation to shoot up around the peak as there is abuild-up <strong>of</strong> parcel owners who delayed construction in anticipation <strong>of</strong> such a peak. In contrastconstruction levels in the observed data increase gradually as prices increase. The constructionearly in the price boom is caused by the expectations <strong>of</strong> future cost increases.This counterfactual experiment highlights the role <strong>of</strong> costs and cost expectations in dampeningconstruction volatility. When parcel owners are only forward looking with respect to pricesthey will try and delay construction until a price peak. In reality, however, expectations aboutfuture cost increases flatten out the time pr<strong>of</strong>ile <strong>of</strong> construction.46