CHAPTER 1: INTRODUCTION 1.0 Chapter Overview - DSpace@UM

CHAPTER 1: INTRODUCTION 1.0 Chapter Overview - DSpace@UM

CHAPTER 1: INTRODUCTION 1.0 Chapter Overview - DSpace@UM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

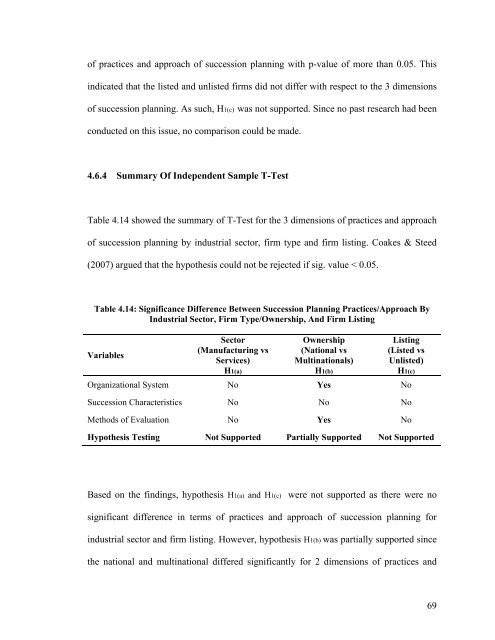

of practices and approach of succession planning with p-value of more than 0.05. Thisindicated that the listed and unlisted firms did not differ with respect to the 3 dimensionsof succession planning. As such, H1(c) was not supported. Since no past research had beenconducted on this issue, no comparison could be made.4.6.4 Summary Of Independent Sample T-TestTable 4.14 showed the summary of T-Test for the 3 dimensions of practices and approachof succession planning by industrial sector, firm type and firm listing. Coakes & Steed(2007) argued that the hypothesis could not be rejected if sig. value < 0.05.Table 4.14: Significance Difference Between Succession Planning Practices/Approach ByIndustrial Sector, Firm Type/Ownership, And Firm ListingVariablesSector(Manufacturing vsServices)H1(a)Ownership(National vsMultinationals)H1(b)Listing(Listed vsUnlisted)Organizational System No Yes NoSuccession Characteristics No No NoMethods of Evaluation No Yes NoHypothesis Testing Not Supported Partially Supported Not SupportedH1(c)Based on the findings, hypothesis H1(a) and H1(c)were not supported as there were nosignificant difference in terms of practices and approach of succession planning forindustrial sector and firm listing. However, hypothesis H1(b) was partially supported sincethe national and multinational differed significantly for 2 dimensions of practices and69