Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

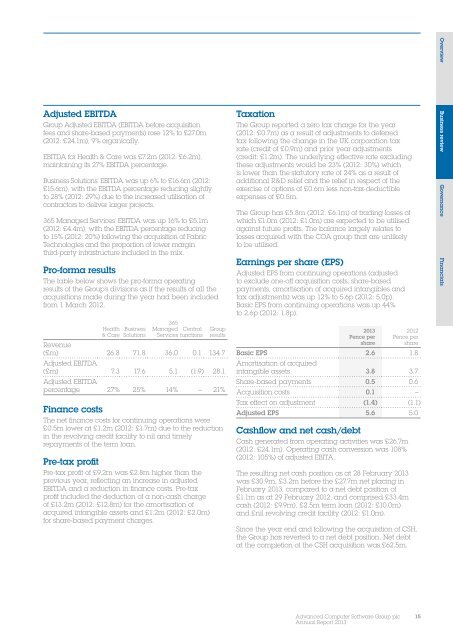

OverviewAdjusted EBITDA<strong>Group</strong> Adjusted EBITDA (EBITDA before acquisitionfees and share-based payments) rose 12% to £27.0m(2012: £24.1m), 9% organically.EBITDA for Health & Care was £7.2m (2012: £6.2m),maintaining its 27% EBITDA percentage.Business Solutions’ EBITDA was up 6% to £16.6m (2012:£15.6m), with the EBITDA percentage reducing slightlyto 28% (2012: 29%) due to the increased utilisation ofcontractors to deliver larger projects.365 Managed Services’ EBITDA was up 16% to £5.1m(2012: £4.4m), with the EBITDA percentage reducingto 15% (2012: 20%) following the acquisition of FabricTechnologies and the proportion of lower marginthird-party infrastructure included in the mix.Pro-forma resultsThe table below shows the pro-forma operatingresults of the <strong>Group</strong>’s divisions as if the results of all theacquisitions made during the year had been includedfrom 1 March 2012.Health& CareBusinessSolutions365Managed CentralServices functions<strong>Group</strong>resultsRevenue(£m) 26.8 71.8 36.0 0.1 134.7Adjusted EBITDA(£m) 7.3 17.6 5.1 (1.9) 28.1Adjusted EBITDApercentage 27% 25% 14% – 21%Finance costsThe net finance costs for continuing operations were£0.5m lower at £1.2m (2012: £1.7m) due to the reductionin the revolving credit facility to nil and timelyrepayments of the term loan.Pre-tax profitPre-tax profit of £9.2m was £2.8m higher than theprevious year, reflecting an increase in adjustedEBITDA and a reduction in finance costs. Pre-taxprofit included the deduction of a non-cash chargeof £13.2m (2012: £12.8m) for the amortisation ofacquired intangible assets and £1.2m (2012: £2.0m)for share-based payment charges.TaxationThe <strong>Group</strong> <strong>report</strong>ed a zero tax charge for the year(2012: £0.7m) as a result of adjustments to deferredtax following the change in the UK corporation taxrate (credit of £0.9m) and prior year adjustments(credit: £1.2m). The underlying effective rate excludingthese adjustments would be 23% (2012: 30%) whichis lower than the statutory rate of 24% as a result ofadditional R&D relief and the relief in respect of theexercise of options of £0.6m less non-tax-deductibleexpenses of £0.5m.The <strong>Group</strong> has £5.8m (2012: £6.1m) of trading losses ofwhich £1.0m (2012: £1.0m) are expected to be utilisedagainst future profits. The balance largely relates tolosses acquired with the COA group that are unlikelyto be utilised.Earnings per share (EPS)Adjusted EPS from continuing operations (adjustedto exclude one-off acquisition costs, share-basedpayments, amortisation of acquired intangibles andtax adjustments) was up 12% to 5.6p (2012: 5.0p).Basic EPS from continuing operations was up 44%to 2.6p (2012: 1.8p).<strong>2013</strong>Pence pershare2012Pence pershareBasic EPS 2.6 1.8Amortisation of acquiredintangible assets 3.8 3.7Share-based payments 0.5 0.6Acquisition costs 0.1 –Tax effect on adjustment (1.4) (1.1)Adjusted EPS 5.6 5.0Cashflow and net cash/debtCash generated from operating activities was £26.7m(2012: £24.1m). Operating cash conversion was 108%(2012: 105%) of adjusted EBITA.The resulting net cash position as at 28 February <strong>2013</strong>was £30.9m, £3.2m before the £27.7m net placing inFebruary <strong>2013</strong>, compared to a net debt position of£1.1m as at 29 February 2012, and comprised £33.4mcash (2012: £9.9m), £2.5m term loan (2012: £10.0m)and £nil revolving credit facility (2012: £1.0m).Since the year end and following the acquisition of CSH,the <strong>Group</strong> has reverted to a net debt position. Net debtat the completion of the CSH acquisition was £62.5m.Business review Governance Financials<strong>Advanced</strong> <strong>Computer</strong> <strong>Software</strong> <strong>Group</strong> <strong>plc</strong><strong>Annual</strong> Report <strong>2013</strong>15