Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

Advanced Computer Software Group plc Annual report 2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

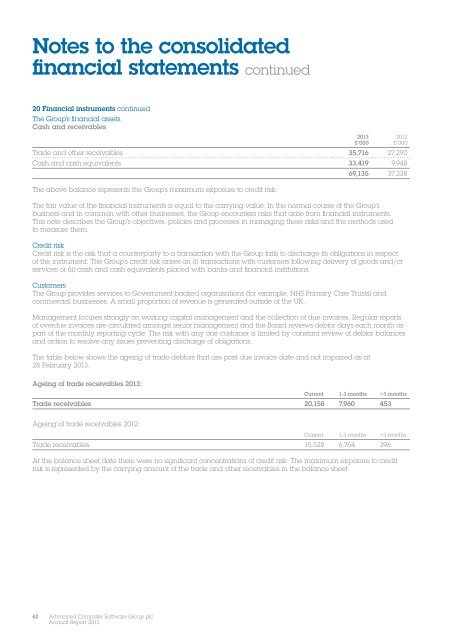

Notes to the consolidatedfinancial statements continued20 Financial instruments continuedThe <strong>Group</strong>'s financial assetsCash and receivablesTrade and other receivables 35,716 27,290Cash and cash equivalents 33,419 9,94869,135 37,238The above balance represents the <strong>Group</strong>’s maximum exposure to credit risk.The fair value of the financial instruments is equal to the carrying value. In the normal course of the <strong>Group</strong>’sbusiness and in common with other businesses, the <strong>Group</strong> encounters risks that arise from financial instruments.This note describes the <strong>Group</strong>’s objectives, policies and processes in managing these risks and the methods usedto measure them.Credit riskCredit risk is the risk that a counterparty to a transaction with the <strong>Group</strong> fails to discharge its obligations in respectof the instrument. The <strong>Group</strong>’s credit risk arises on (i) transactions with customers following delivery of goods and/orservices or (ii) cash and cash equivalents placed with banks and financial institutions.CustomersThe <strong>Group</strong> provides services to Government-backed organisations (for example, NHS Primary Care Trusts) andcommercial businesses. A small proportion of revenue is generated outside of the UK.Management focuses strongly on working capital management and the collection of due invoices. Regular <strong>report</strong>sof overdue invoices are circulated amongst senior management and the Board reviews debtor days each month aspart of the monthly <strong>report</strong>ing cycle. The risk with any one customer is limited by constant review of debtor balancesand action to resolve any issues preventing discharge of obligations.<strong>2013</strong>£’000The table below shows the ageing of trade debtors that are past due invoice date and not impaired as at28 February <strong>2013</strong>.2012£’000Ageing of trade receivables <strong>2013</strong>:Current 1-3 months >3 monthsTrade receivables 20,158 7,960 453Ageing of trade receivables 2012:Current 1-3 months >3 monthsTrade receivables 15,528 6,764 396At the balance sheet date there were no significant concentrations of credit risk. The maximum exposure to creditrisk is represented by the carrying amount of the trade and other receivables in the balance sheet.62<strong>Advanced</strong> <strong>Computer</strong> <strong>Software</strong> <strong>Group</strong> <strong>plc</strong><strong>Annual</strong> Report <strong>2013</strong>